Why This Election Wont Impact Your Portfolio

This is the first time in my adult life I can honestly say I have no clue as to who Im voting for.

This is the first time in my adult life I can honestly say I have no clue as to who Im voting for.

Im pretty certain that many of you will agree when I say that in the past, the candidates were compelling enough to make a clear choice. They made their case as to why they were better than the other guy.

But now, with muddled messages coming from both the Republican and Democratic candidates, its not apples to oranges but more like oranges to tangerines.

Let me explain

If youve watched the debates, youll hear pretty much the same by-line from both candidates Taxes are too high, and Im going to lower them. Or, We need job growth, and I know how to fix it. Better yet, I know how to deal with China and the Middle East, and he doesnt.

Sure, they do have different approaches to solving the issues. On taxes, President Obama wants a middle class tax cut, and to tax the rich. Mitt Romeny says hell cut everyones taxes, and cap tax breaks to make up the difference.

Promises, promises gentlemen…

My point here is all of their answers are completely hedged. When listening to them speak, everything they say is completely word-smithed, spun, and crafted to appeal to as many in the middle as possible.

Thats why it seems like two different versions of an orange theyre pretty much the same, but have a slightly different flavor.

Why do you think the current polls are tied at 50/50?

Let me get to the point at hand, how the election will impact the stock market

Normally, Wall Street loves the Republican Party. In the past, theyve been all about low taxes and friendly to the big financial institutions. Theyve sold themselves as small government, pro growth, and business friendly.

That means a Republican win should be good for the stock market.

Conversely, many believe the markets arent really in love with Democratic candidates. Their plans to raise taxes on the rich and increase government spending send shivers up and down many traders spines.

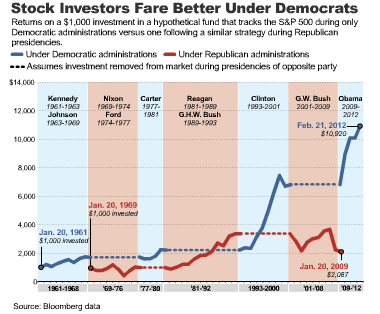

With that said, Id bet youd be surprised to know that statistically markets perform better in a Democratic run White House.

Its true.

Since JFK, investments have risen more than 9 times when a Democrat was in office than when a Republican President was in office. Take a look at the chart below to see for yourself

Now, let me stop you before you say it Oh, thats because Republicans almost always inherit a weaker economy that Democrats messed up.

True or not, none of that matters.

This time around, whoever gets elected in November isnt going to impact the markets in the slightest. I say that because whoever takes office is already staring down $16 trillion in US national debt!

Neither candidate will be able to fix that kind of debt in just four years thats a 100% guaranteed fact.

Whats more, there are major economic issues awaiting the next leader of the United States the day after hes elected. Anyone remember the looming fiscal cliff coming in January?

Thats certainly not going away

The bottom line is, with the muddled and over-crafted messages were getting from the candidates, we cant be sure what each candidate will really do in office over the next four years.

Moreover, theyre going to have their hands full trying to fix the current economic reality instead of implementing their promises.

No matter who wins, the markets will go back to focusing on earnings and other macro issues out there, and you should too.

Best of luck voting!

Until next time,

Brian Walker

Category: Investing in Penny Stocks