The Most Important Investment Rule Now That QE3 Is Out

Theres no doubt youre reading this article because you too want to know how to invest in a post-stimulus environment. After the rally from QE3, you may be wondering if its still safe to invest.

Theres no doubt youre reading this article because you too want to know how to invest in a post-stimulus environment. After the rally from QE3, you may be wondering if its still safe to invest.

Whats more, judging from yesterdays trading action, the markets seem to have a bit of a stimulus hangover.

So now what?

Ill get to that in a second. But first, if youre one of the many investors who werent positioned for QE3 last week, then you missed out on the rally that resulted from the announcement.

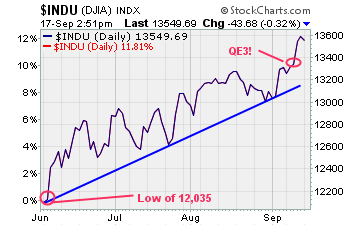

But after the huge rally that led up to QE3, I can understand why. Take a look at the chart of the Dow Jones Industrial Average below

You can see the rally thats been virtually non-stop since June 4th. The market rallied from a low of 12,035 all the way up to 13,333 just prior to the Feds announcement on September 13th.

Many investors were already feeling nervous about a market that had rallied over 11% on mere expectations. And then wham the ECB rolled out a bond buying plan to stabilize European sovereign debt.

And just a week later, double wham – QE3 eternity was announced and the Dow tacked on another few hundred points in just two days.

Listen, I completely understand if youre nervous about getting in the market at these levels. We are sitting just off four-year highs set on Friday so a bit of concern is only natural.

And with the selling we saw yesterday, its understandable why youd be thinking the worst. Too much too fast, you might be saying. Or I cant handle another meltdown like in 2009. Fair enough.

But if youre buying stocks right now, heres the one rule that you need to follow to remain successful in a post QE3 market

Buy on the dips and ride out the volatility.

While it may sound rudimentary, its what will allow you to profit from QE3. You see, one of the intended side effects of the Feds stimulus package is to increase asset prices.

The Fed wants the stock market to move higher. As this happens, wealth is created and people will feel more inclined to both hire and spend. That goes for businesses and individual consumers and investors.

And if everyone continues to spend, grow, expand, hire, and upgrade the economy can heal to the point that it can sustain itself.

But its never an easy ride higher.

With the big headlines (both in the US and Europe) out of the way, investors and traders alike will return their focus to economic data and earnings reports. If weakness is detected at any point, it will be an opportunity to sell and take profits.

The bottom line

If youre investing in the markets for the long haul, QE3 will certainly take this market higher. And seeing the major downside risk in Europe has been put on hold, you should still see this as a buying opportunity.

Certainly there will be down days ahead like yesterday. Just use the down days to add more equities to your portfolio as you get more and more comfortable with the fact QE3 has put a floor under stocks. And judging from what the Fed told us, it could be the case for the next couple of years.

***Editors Note*** If youre looking to buy some penny stocks to help you capitalize on QE3, our in-house guru Gordon Lewis has created a must read guide showing you how to pick winning penny stocks. Click here to check it out.

Until next time,

Brian Walker

Category: Investing in Penny Stocks