Keeping It Real

For a second week in a row, Im inclined to reach into the old mailbag and answer subscriber questions. Thankfully, this weeks subscriber heeded my advice for useful questions.

For a second week in a row, Im inclined to reach into the old mailbag and answer subscriber questions. Thankfully, this weeks subscriber heeded my advice for useful questions.

Heres the latest from Demiregen

I’ve bought tsys at 2.44. It has been constantly going down. ?s there something wrong with tsys? Should I hold it or sell? Thank you very much for your help.

Now, before I answer the question, let me state that Im not really going to tell you what YOU should do. When I answer this, Im going share what I see with the stock, and how I might handle the situation.

But trust me, Im keeping it real.

So were talking about the penny stock TSYS, or Telecommunication Systems. Its a micro-cap tech play focused on turn-by-turn navigation and E9-1-1 call routing.

Lets look at the chart to get a better understanding of what were going to discuss .

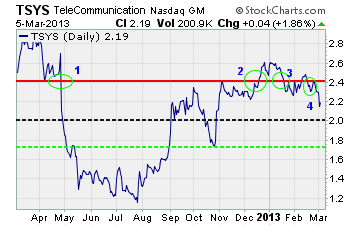

When we look at the 1 year chart on TSYS, the first thing to jump out at me is that the stock has traded at $2.44 (red line) more than 4 times over the past 52 weeks.

And if youve purchased the stock at point 2, 3, or 4 in the chart above, I dont understand why youre panicking yet.

Seriously, you do understand that stocks trade both up AND down right?

No really Im being serious here.

To me, it looks like youre getting worried over a slight variation on this chart. If we were talking about the stock trading down at its first support level (black dotted line) of $2, then I could say we might pay closer attention.

Or, if we were at the next support level of $1.75 (green dotted line) you may want to get worried.

That brings me to my whole point for answering this question

If youre using TSYS as a trade, then youre looking at a whopping 10% drop. I want you to consider that in the context of where the stock has traded in the past 52 weeks- specifically the low back in August of 2012.

From that point, the stock has doubled!

So, if youre trading this stock, you need to stick to your targets regardless of the price movement. Simply put, if youre trading with a 10% stop loss you should have sold it.

But if youre trading using a 20% stop loss, youd still be hanging on to it with no worries.

Wait what what was that? You dont have a trading plan with buy/sell targets?

Well, I suggest you learn a bit more about how to trade stocks before randomly buying them. Its not like buying a pair of shoes youll put on your feet every day- its a bit more complex

Now, if youre investing- its a whole different ball game!

If you really ARE investing in TSYS, just ignore the trade and come back in 3 or 6 months to check on it. A medium- to long-term investment shouldnt be watched over like a pot of boiling water youll go crazy if you do that!

Simply let your investment decision run its course and whatever you do- dont try to time the market with investmentsyoull almost always sell your winners while theyre still losers!

Until next time,

Brian Walker

Category: Investing in Penny Stocks, Penny Stock Tips