Is This Beverage Company The Right Penny Stock To Buy?

Is This Beverage Company The Right Penny Stock To Buy?

Is This Beverage Company The Right Penny Stock To Buy?

Picking the right penny stock to buy can be a tough decision. After all, penny stocks are priced so low for a reason. The key is to determine if the company is just cheap because it’s new or developmental… and not because of some major flaw.

When it comes to picking a good penny stock, it often makes a lot of sense to look at the industry itself. A rapidly growing industry can do wonders for just about any company in it.

And, if you can combine a good company with a growing industry, well let’s just say it’s a very good mix of factors.

That’s why I really like beverage company Castle Brands $ROX. Not only is the company impressively growing revenues, but the industry itself is also quickly gaining popularity.

More specifically, ROX develops and sells alcoholic beverages worldwide. The company’s products include rum, whiskey, ginger beer, vodka, and others. ROX’s biggest sales come from bourbon, Irish whiskey, rum, and ginger beer.

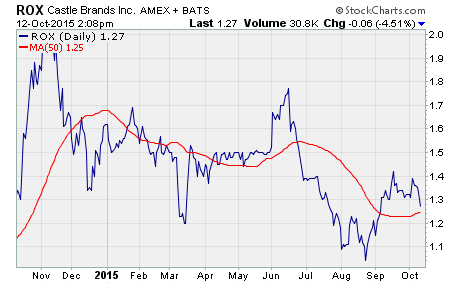

Here’s a look at what $ROX has done over the last year:

ROX was trading in tight range until the August stock market selloff. Since then, the share price has recovered and is now trading above the 50-day moving average. The stock is still about 40% from the 52-week high.

So why is ROX the right penny stock to buy?

As I said earlier, ROX has the advantage of being a strong company in a growing industry.

From a company-specific perspective, Castle has the fastest growing small-batch bourbon in the US. They also have the largest selling premium ginger beer in the US. Plus, ROX’s Irish whiskeys are growing rapidly.

From an industry perspective, small-batch and small label alcohol sales are exploding in the US. All you have to do is look at the alcohol shelf in any grocery store and you can see just how many brands are out there… and how many labels are from some small brewery or distillery.

Let’s look at some company specifics.

First off, in 2013 ROX had revenues of $41.4 million. In fiscal 2015, that number grew to $75.5 million. That’s an impressive 39% increase. At the same time, gross profits rose from $14.3 million to $21.6 million – over a 50% increase.

Basically, even though revenue grew rapidly, costs remained controlled. That’s why profits rose at a faster rate than revenues.

What’s more, in the first quarter of fiscal 2016, revenues increased 38% year over year. More importantly, EBITDA improved to $0.6 million from a loss a year ago. Growth was driven by a 106% increase in whiskey sales, 12% increase in rum sales, and 40% rise in ginger beer sales.

And that’s not all…

ROX management has said for public drink companies, enterprise value to annual revenue ratios usually are about 5-6x. At the current price, ROX is trading at just 3.3x, well below the typical floor for this metric.

So to summarize, we have a rapidly growing industry with a company seeing its own amazing growth. And, that company is trading well below the valuation comparables in its industry.

Sounds like a great opportunity to me!

Good investing…

Brian Kent

Note: If you’re interested in learning more about Brian Kent’s Penny Stock All-Stars premium service… and learning about the stocks we’re trading for profit… you can get the inside scoop on penny stocks here.

Category: Penny Stocks to Buy