DIDG, ELEV, PFNI – Pump And Dump Alerts – May 11, 2012

This week were exposing these three popular Pump & Dumps: The Digital Development Group (DIDG), Elevate (ELEV), and The Psychic Friends Network (PFNI).

This week were exposing these three popular Pump & Dumps: The Digital Development Group (DIDG), Elevate (ELEV), and The Psychic Friends Network (PFNI).

That said, welcome to Pump and Dump Friday, where every week we identify a few of the potentially bogus promotions going on in penny stocks today.

If you dont know how these schemes work, be sure to check out this free report that exposes the whole thing.

Without further ado, here are todays disasters waiting to happen:

The Digital Development Group (DIDG)

Theyre back! And this time, they have a fresh, new name and ticker symbol. But the game stays the same

Who am I talking about? Its none other than the awesome pre-exploration mineral mining company, Regency Resources (RSRS).

Remember these guys?

I highlighted them back in April while the stock was still trading under the ticker symbol RSRS. Back then it was trading at $0.97 a share. Now its down near $0.83, a mere 15% drop. It appears the stock touting efforts of The Penny Stock Chief werent enough to lure in unsuspecting fish to buy RSRS shares.

Now that theyre DIDG, pumpers like David Cohen and Research Driven Alerts are getting in on the action. I cant wait to see how much they can tank the stock!

So how does one go from mineral mining to digital TV distribution? Im not quite sure. But it appears that the merger can only help RSRS. Based on their March 2012 quarter financials, Regency has $0 cash, $0 assets, and $90,073 in current liabilities.

So why is DIDG merging with them?

Well, no one will ever know what was truly behind that deal, but my only guess is it gives DIDG access to sell stock in order to raise funds.

Looks like the plan is to simply change the ticker symbol and start looking for investors.

The problem is, with a new company name and ticker symbol, theres no real financial information about the business of DIDG. Who in their right mind invests in a company with no financials?

I guess the sad saps falling for the pumping thats going on thats who.

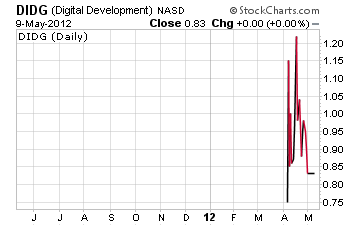

Finally, take a look at the brief but painful chart of DIDG

Yeah, theyve been trading as DIDG for a whopping 42 days. And in that time, it looks like someone already is taking a loss after buying shares north of $1.20.

With no real financial data, and a confusing merger with a pre-exploration mineral company, Id avoid shares of DIDG at any cost!

Elevate (ELEV)

Elevate is one of the very few companies that end up here who actually generate revenue. They do, shocking, I know

This mobile, broadband, and digital focused company pulled in a whopping $299,895 in revenue for the three months ending February 2012. The problem is, ELEV racked up a $734,966 loss in the same quarter!

Of course, the pumpers wont tell you that. Nope, Penny Stock Rumors was paid $7,500 by Actual Investors, LLC to paint the best possible picture. And that they did.

But dont buy it for a second. ELEV has yet to turn an actual profit and they have a nine month net loss of over $3.1 million!

Whats more, Elevate sold over $1.6 million worth of common stock to keep afloat this long. You see, with $0 cash their own accountants are concerned they wont stay in business without further funding.

You read that right, $0 cash. And over $2 million in current liabilities are out there waiting to be paid.

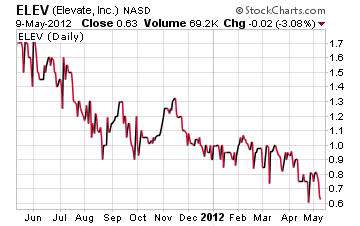

If youre still considering investing in Elevate, let me share a photo with you because pictures are worth a thousand words

Clearly, investors arent happy with how this company is performing. Id say, no matter what the pumpers are saying about ELEV steer clear of this stock.

The Psychic Friends Network (PFNI)

Are you chuckling yet? Lets just say this is a test to see how old some of our readers are

Do you remember the Dionne Warwick infomercials running late night on TV? It was 1991, and I can still picture the lovely Ms. Warwick all dressed up in shiny flowing attire pitching the Psychic Friends Network.

If you didnt know, the company went bankrupt back in 1998 and the remaining assets, PFN Holdings, were recently acquired by a company called Web Wizard, Inc. It was a stock swap deal that went down in January of this year.

Basically, Web Wizard exchanged over 50 million shares of their stock for the PFN Holdings shares. In addition, they changed their name to Psychic Friends Network. At the same time, they secured nearly $750,000 in financing from Right Power Service, LTD.

The bottom line, the whole deal is just one big swap agreement that allows the new company to sell or swap stock so they can fund operations shocking, huh?

And yet Squawk Box Stocks, among other pumpers, were paid $50,000 by Winning Media, LLC to pump shares of PFNI. Whats the line the pumpers are feeding everyone?

Its just the usual over-hyped, over-stretched version of the truth

A market they dominated a short time ago? 1998, is 14 years ago! They went bankrupt because of too much competition. Please

And this is a $40 million per year organization? Maybe back 14 years ago, when they were still solvent. Right now, the most recent earnings report for PFNI show the company has $90 in cash, $0 in revenue, and a loss of $8,008 for the three months ending December 2011.

Where does the $40 million come in again?

Oh, in your dreams. Maybe you can dial up the psychic network and see how you can turn your $40 million dream into a reality! But I wouldnt hold my breath on this one.

A final word (and warning).

These are just a few of the potential pump and dumps we’ve seen lately.

Remember, theres a lot more of this going on each week than we highlight here.

As you know, penny stocks are a great place to invest your money. You just have to do your due diligence to stay away from all the schemes and scams out there these days!

Until next time,

Brian Walker

Category: Pump & Dump Alerts