BZRT, GBEN, GLTV – Pump And Dump Alerts – September 7, 2012

This week were exposing these three popular Pump & Dumps: BizRocket (BZRT), Global Resource Energy (GBEN), and Greenlite Ventures (GLTV).

This week were exposing these three popular Pump & Dumps: BizRocket (BZRT), Global Resource Energy (GBEN), and Greenlite Ventures (GLTV).

That said, welcome to Pump and Dump Friday, where every week we identify a few of the potentially bogus promotions going on in penny stocks today.

If you dont know how these schemes work, be sure to check out this free report that exposes the whole thing.

Without further ado, here are todays disasters waiting to happen:

***Editors Note*** This week Im taking the opportunity to highlight why you never hold onto pump and dump penny stocks once they lose their original pump value. Its pretty ugly stuff but I hope you take away a valuable lesson.

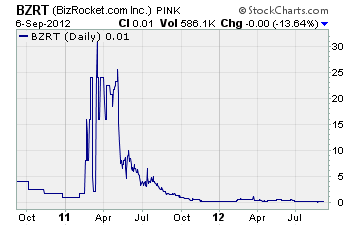

BizRocket (BZRT)

The first is no doubt the worst this week. In addition, BizRocket has to be one of the worst pump and dump jobs weve ever come across here at Penny Stock Research.

Why?

Ill show you the chart first, because it will get your attention. But its not the only problem here

Can you believe this chart? The companys stock was pumped up all the way to $30 before the crash cycle brought it down to virtually zero!

When we caught onto the scam, it was already pretty late in the cycle BZRT was down near $6.15 already. Thats when we sent out our warning to subscribers. Hopefully if they were holding shares, they sold out at anywhere near this price.

Now, if you held this sad stock all the way to the bitter end, your investment has become worthless.

But the real question is why would you bother hanging on? My research on this company hasnt provided any indication a turnaround is in the cards.

And speaking of research, BizRocket doesnt even file with the SEC! That means investors are on their own. The management of this company can tell everyone what they want, when they want, about financial performance.

What they have said is pretty sad since we last visited them (in 2011). For starters, BZRT announced in June theyd completed an 1:80 reverse stock split! And even worse, BizRocket continues to not produce any revenue at all. Thats why they posted a loss of $38,816 in the first quarter of the year.

Lets face it, if the real Facebook stock cant make investors rich then theres no way BZRTs Facebook for kids penny stock has a chance!

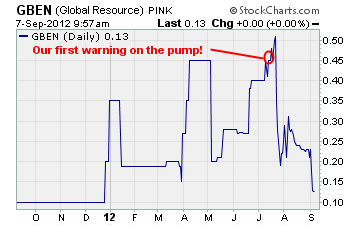

Global Resource Energy (GBEN)

Does this penny stock sound familiar to you? It should we exposed a pump and dump on GBEN back a couple of months ago in July. It was none other than Epic Stock Picks collecting $25,000 from a company called Ti Consulting, Inc. to tout Global Resource shares.

Just yesterday, we caught Penny Stock Market Bulls picking up $30,000 to hype up shares of GBEN.

To follow along with our theme today, shares of this pennergy stock have simply fallen off a cliff in under eight weeks. Take a look at the chart

Talk about a loss. GBEN climbed as high as $.0.50 only to come crashing down to near $0.13. Thats a loss of 75% in just a few weeks!

Theres nothing going on at Global Resource that would keep a sane investor in this stock no matter what the pumpers tell you this time around.

For starters, in their latest reported quarter (which is back in April of 2012), GBEN lost $77,206. Of course, thats because theyre generating no revenue whatsoever.

In addition, they list only prepaid expenses under assets, with no line entry for cash. Thats a major red flag how will they pay for anything to keep them doing business?

Once again, heres proof that you should never buy into these pumped up penny stocks hoping to strike it rich as the pumpers say. At this point, youre buying a pipe dream with GBEN!

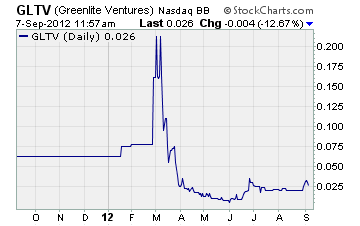

Greenlite Ventures (GLTV)

Last but not least, we have Greenlite Ventures. And brother, do these guys know how to stink it up! Of course, we exposed a pump and dump earlier this year. At the time, Elite Penny Stock was paid $25,000 for their touting services.

And yet somehow, some way the exact same pumper was paid the exact same amount to do the exact same thing! The big difference here is the stock price

Tell me this chart doesnt look exactly like the rest a big huge spike due to pumping, and then a massive crash to virtually zero.

What makes the latest round of pumping crazy is the stock is now worth a fraction of what it was earlier this year. Whos going to pay $25,000 to pump a $0.02 stock?

I mean, its not like the company is having any luck selling their carbon offsets. GLTV had $0 revenue back when they were being pumped, and nothing has changed in that department since.

All thats happened is the company has managed to rack up even more accumulated debt bringing the grand total to $846,645 as of June 30th. And as youd expect, Greenlite has had no choice but to burn up cash and assets, dropping total cash down to a mere $4,999.

Your final takeaway

Just because a penny stock was successfully pumped in the past, doesnt mean the next round of pumping will do any good. Especially once weve exposed the scam!

A final word (and warning).

These are just a few of the potential pump and dumps we’ve seen lately.

Remember, theres a lot more of this going on than we can highlight here.

As you know, penny stocks are a great place to invest your money. You just have to do your due diligence to stay away from all the schemes and scams out there these days!

***Editor’s Note*** If you’re looking for the names of some legitimate penny stocks to invest in, then look no further than Robert Morris’ Penny Stock Breakouts service. he just released the names of 2 gold and silver mining stocks that are set to skyrocket as metal prices continue their upward march. Click here for details.

Until next time,

Brian Walker

Category: Pump & Dump Alerts