Will Rising Interest Rates Impact Penny Stock Investing?

Will Rising Interest Rates Impact Penny Stock Investing?

Will Rising Interest Rates Impact Penny Stock Investing?

Let’s clear something up. Interest rates are important – even for penny stocks. You see, interest rates are a major variable in how well or poorly the economy is doing. That’s why the Fed has a powerful impact on economic performance.

As such, even as penny stock investors, you don’t want to just ignore interest rates. The overall economy certainly impacts penny stock companies, just like everything else.

On the other hand, interest rates direct impact on penny stock performance is going to be less than other, larger companies. I’ll get to that in a minute.

First off, let’s quickly review the current interest rate environment.

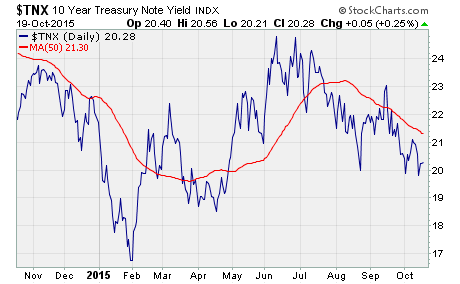

Here’s a look at what 10-year Treasury yields has done over the last year:

As you can see, the yield on 10-year bonds has basically been above 2% since the spring. However, it hasn’t made its way up to 2.5% yet this year. It’s been closer to 2% than 2.5% since August.

So where are interest rates headed next?

Most likely, the minor slowdown in the US economy, along with the issues in emerging markets, will result in the Fed keeping rates at current levels until 2016. That means the Fed Funds rate will remain at around 0%.

That also means the 10-year bond yield will likely stick between 2% to 2.5% for the time being. However, bond yields are related to future expectations of rates, so we could see a higher move in yields before the Fed actually makes any changes.

Still, nothing is likely to happen anytime soon.

When rates do start to rise – probably early to mid 2016 – it’s going to be a slow rise. We’ll mostly likely see rate hikes in increments of 25 basis points every couple months. The Fed will make sure not to raise rates too quickly.

While small rate hikes won’t mean a whole lot to most consumers, they could have a large impact on the business world. Financial companies in particular will see very large impacts from even the smallest changes in rates.

So how do interest rates impact penny stock investing?

As I mentioned earlier, penny stocks can be impacted by rates if a raise in rates slows down the economy. A rising tide lifts all boats, so to speak. But, the Fed should raise rates at a slow enough pace that an economic slowdown should be avoided.

What about a direct impact?

Well, larger companies who have to take on debt (or who have variable rates on their current debt) will certainly feel the sting of higher rates. It will make debt more expensive. That could definitely eat into profits.

Fortunately, many penny stocks don’t have a lot of debt because they’re small enough to get by on organic growth or existing cash holdings. That makes low-debt penny stock companies a good investment in a rising rate environment.

After all, you probably don’t want to be investing in heavily indebted penny stocks anyways. It’s hard enough to grow a business without a major debt burden. Additional interest rate risk is the last thing you need to worry about.

In summary, it’s a good idea to understand the interest rate environment as it pertains to the economy as a whole. However, the direct impact on most penny stocks is minimal. Finally, it’s probably a good idea to avoid penny stock companies with a large amount of debt.

Good investing…

Brian Kent

Note: If you’re interested in learning more about Brian Kent’s Penny Stock All-Stars premium service… and learning about the stocks we’re trading for profit… you can get the inside scoop on penny stocks here.

Category: Penny Stock Tips