This Will Be The Next Bear Market Sector

This industry has become an overhyped story on Wall Street, and retail investors are about to pay the price. None of the top operators look compelling at these prices, and these widely owned stocks should be sold immediately.

This industry has become an overhyped story on Wall Street, and retail investors are about to pay the price. None of the top operators look compelling at these prices, and these widely owned stocks should be sold immediately.

It all started back in 2008 when the industry was hit with ultra-high oil prices and tightening credit markets. This helped keep new players out of the industry and capacity in check — so no oversupply or pressure on pricing.

At the same time, high fuel costs lead to a wave of consolidation in the industry. Delta Airlines (NYSE: DAL) bought out Northwest in 2008, then United Airlines (NYSE: UAL) merged with Continental in 2010, Southwest (NYSE: LUV) purchased AirTran in 2011, and, finally American Airlines (NYSE: AAL) combined with US Airways in 2013. Now, these four airlines control 80% of the U.S. airline market.

Major airlines enjoyed a number of “good” years, with shares of Delta, United, and Southwest up more than triple the S&P 500 over the last five years.

Then, hedge funds and investment banks caught onto the story. Wall Street even created an exchange-traded fund last year to take advantage of the hype, the U.S. Global Jets ETF (NYSE: JETS). Funds have piled into airlines and started pumping the industry hype to retail investors. However, since then, airlines have been relatively dead money.

Shares of United Airlines have tumbled 14% in the last year and American Airlines has fallen 22%. But there’s still a lot of smart money in the names, yet, when investors realize that airline investing is still a fairy tale (just as it was for so many decades), there will be a mass exodus. This will put even more downward pressure on the space.

This comes as the promise of low oil as a tailwind for airlines hasn’t really worked out. Soon, airlines will fall back into their old ways of competing on price, which means lower prices for consumers, as well as lower margins for airlines. So, in a way, the extreme consolidation has taught the remaining players nothing.

What’s more is that consolidation doesn’t always work, case and point is United Airlines. This is the airline whose CEO recently returned to work after suffering a heart attack and getting a subsequent heart transplant.

United is now facing pressure from activist investors, which comes as it has been one of the biggest laggards in the industry. The merger with Continental in 2010 hasn’t gone as smoothly as expected and cost synergies have been nonexistent.

Still, for all this negativity, air travel is a steadily growing business. But, if you’re really looking for that airline-type exposure, try looking at the aircraft parts makers. There are plenty of pure plays in the parts business that will give you exposure to airlines, without the hype and cutthroat competition.

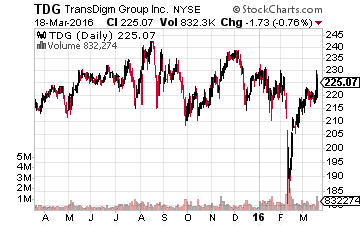

Best Airline Play No. 1: TransDigm Group (NYSE: TDG)

TransDigm makes various airline parts, from engine sensors, lighting systems, overhead bin latches to lavatory faucets. These specialty parts add up quickly. They wear out over time and need to be replaced, which provides TransDigm with a steady stream of cash flows that is not susceptible to oil prices and the broader economy. Plus, it calls the world’s two biggest airline makers major customers — Boeing (NYSE: BA) and Airbus.

TransDigm makes various airline parts, from engine sensors, lighting systems, overhead bin latches to lavatory faucets. These specialty parts add up quickly. They wear out over time and need to be replaced, which provides TransDigm with a steady stream of cash flows that is not susceptible to oil prices and the broader economy. Plus, it calls the world’s two biggest airline makers major customers — Boeing (NYSE: BA) and Airbus.

The unique thing about TransDigm is that it’s been a serial acquirer in the airline parts business, using its strong free cash flow to buy up the smaller parts markets. With that, TransDigm has been resilient against a weak airline and broader market and is up 5% over the last year.

Related: How to earn $4,138.80 of extra income in April.

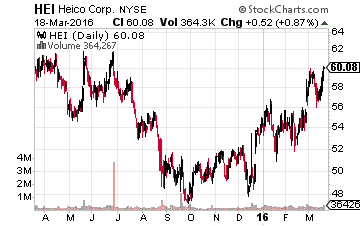

Best Airline Play No. 2: HEICO (NYSE: HEI)

HEICO is another major player worth looking into. It makes and sells FAA-approved replacement airline engine parts. A unique market and one that HEICO owns; it’s the world’s largest maker of FAA-approved airline engine and component parts.

HEICO is another major player worth looking into. It makes and sells FAA-approved replacement airline engine parts. A unique market and one that HEICO owns; it’s the world’s largest maker of FAA-approved airline engine and component parts.

Its advantage lies in its ability to make replacement parts and sell them for lower prices than the original equipment manufacturers can. It has a solid balance sheet, double-digit profit margins and 12% return on invested capital.

In the end, airlines were a great trade for a number of years. It’s too bad that Wall Street and many investors didn’t catch on until too late. There’s virtually no catalysts on the horizon that could push the industry higher — oil prices are already at historical lows, virtually no additional mergers would get approved, there’s no “rebound” in people flying as the economy and employment are already back at robust levels.

However, airlines will continue to run flights, with a slight increase in global air traffic expected for 2016. With that, as long as there are planes in the sky, the airline parts makers are worth a look for investors looking to tap a steady and underrated market.

Finding stable companies that regularly increase their dividends is the strategy my colleague Tim Plaehn uses to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given him the most consistent gains out of any strategy that he has tried over his decades-long investing career.

And, there are currently over twenty of these stocks to choose from in his Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

If you join the calendar by Thursday, March 24th you will have the opportunity to claim an extra $4,138.80 of dividend payouts in April.

The Calendar tells you when you need to own the stock when to expect your next payout, and how much you can make from stable, low-risk stocks paying upwards of 12%, 13%, even 15% in the case of one of them. I’ve done all the research and hard work; you just have to pick the stocks and how much you want to get paid.

The next critical date is Thursday, March 24th (it’s closer than you think!), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $4,138.80 of payouts in April, but only if you’re on the list before the 24th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: Penny Stock Alerts