Secure A Rare 60% Yield In This 1 Stock

Although it yields 60%, it is not at risk of going bankrupt and even has the potential to hand investors a whopping 100% or more total return in 2016. Those are numbers that are hard to ignore, and investors would be wise to look into this investment opportunity.

Although it yields 60%, it is not at risk of going bankrupt and even has the potential to hand investors a whopping 100% or more total return in 2016. Those are numbers that are hard to ignore, and investors would be wise to look into this investment opportunity.

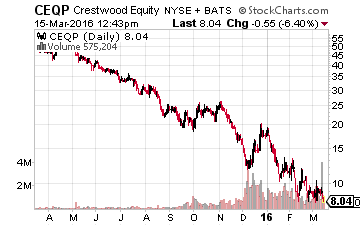

The energy sector crash has resulted in some interesting/intriguing/perplexing/scary yield and valuation stories in the midstream energy infrastructure businesses dominated by publicly traded master limited partnerships (MLPs). Currently, there are a handful of MLPs where management has stated the company can and will maintain current distribution rates while the market is pricing them as if the distributions will be dramatically reduced or eliminated. The result is yields ranging from 25% up to an astounding 60%. That last number belongs to Crestwood Equity Partners LP (NYSE: CEQP) a diversified midstream energy services provider.

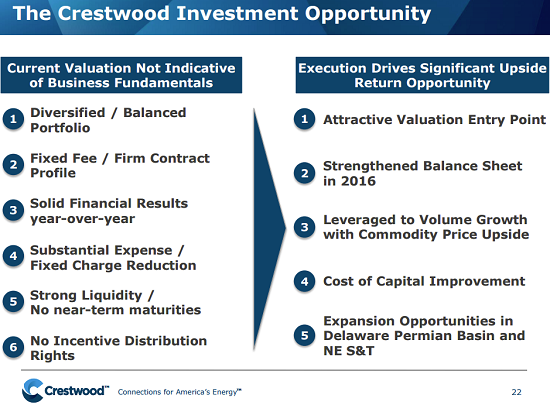

When you dig deeper into the Crestwood Equity Partners story, it is not an obvious conclusion that the company will stop paying distributions or even go out of business, which the current pricing and yield may indicate. Here is the story behind CEQP, the current positives and negatives faced by the company, and why it may be worth consideration in your portfolio.

When you dig deeper into the Crestwood Equity Partners story, it is not an obvious conclusion that the company will stop paying distributions or even go out of business, which the current pricing and yield may indicate. Here is the story behind CEQP, the current positives and negatives faced by the company, and why it may be worth consideration in your portfolio.

In the two to three years leading up to the start of the energy sector crash in the latter months of 2014, Crestwood consisted of two companies: Crestwood Midstream Partners (CMLP) was the traditional midstream MLP and Crestwood Equity Partners was positioned as the publicly traded general partner.

With this arrangement, distribution growth at the midstream partners would generate a mathematical multiple of the growth rate for the general partner. However, in its short life before the crash, Crestwood Midstream Partners was not able to generate very much free cash flow growth, so distribution growth was stagnant at both companies.

The Crestwood assets consist of a combination of storage and distribution pipelines and terminals primarily serving the Northeast and gathering and transport facilities in the North Dakota Bakken and the Delaware-Permian Basin in Texas and New Mexico. The Northeast natural gas storage system is a group of high-value assets providing essential natural gas supply into New York and the region. The production basin located assets are more at risk from a slowdown in crude oil and natural gas production.

Related: How to earn $3,208.80 in extra income by Tax Day (April 18th).

In 2015, the CMLP and CEQP unit values crashed right along with the rest of the sector, driving both values to near penny stock territory. To reduce expenses and shore up the duo’s financials, CMLP was absorbed into CEQP in September 2015, eliminating the stand-alone public general partner. In November, the company completed a 1 for 10 reverse stock split to bring up the unit value. The current $1.375 quarterly distribution is unchanged when adjusted for the reverse split.

2015 Results and 2016 Guidance

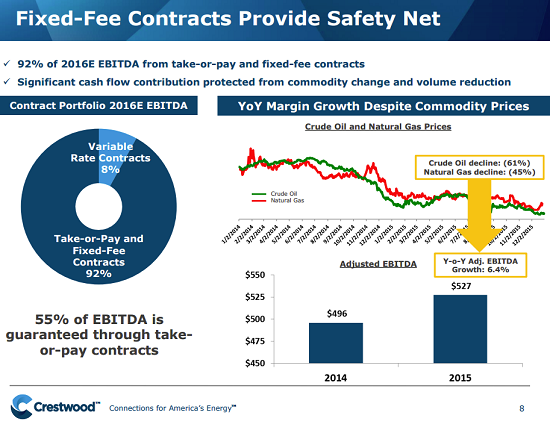

For 2015, the Crestwood group reported adjusted EBITDA of $527 million, up 6% compared to 2014. Distributable cash flow of $361.5 million provided 1.0 times coverage on the distributions paid to both companies. For the fourth quarter, EBITDA of $119 million was down 10% and the resulting DCF provided just 0.80 times coverage.

For 2016, management has provided adjusted EBITDA guidance of $490 million to $520 million, which at the midpoint is down 4% compared to 2015. Operating, maintenance, and general expenses were reduced by $26 million in 2015 compared to 2014, and management expects to knock another $10 million out of expenses in 2016.

92% of the expected 2016 revenues are from fixed fee or take-or-pay contracts. Just 8% is variable. Crestwood does not have any debt problems and does not plan to tap the capital markets (debt or equity) in 2016. However, management has provided no guidance on what it plans for the distributions this year.

Pro and Con News Events

A private firm, First Reserve, sponsors and controls the general partner of Crestwood. In late 2015 and early 2016, the sponsor has purchased $93 million of the CEQP publicly traded units. First Reserve now owns 23% of Crestwood. This is a strong sign First Reserve believes in the investment value of Crestwood and is a reassuring signal to individual investors.

On the flip side, one of Crestwood’s largest customers, Quicksilver Resources filed for bankruptcy in March 2015. Quicksilver’s gas gathering and processing contract with Crestwood has minimum volume commitments, which means it has to pay a minimum amount to Crestwood even if it does not produce the minimum level of gas.

In the bankruptcy process, Quicksilver has reached an agreement to sell the Barnett Shale assets covered by the Crestwood contract. One of the buyer’s conditions is that the Crestwood contract be voided and Quicksilver has filed suit to void the contract.

A federal court judge is currently considering the request. This potential hit to Crestwood is the biggest piece of news that is holding down the unit value. The bankruptcy judge has not provided an estimated time when her decision will be released.

Investment Potential

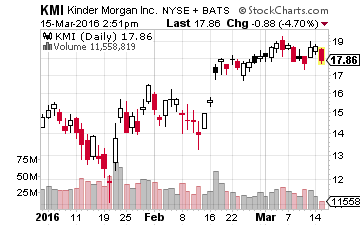

Although Crestwood has not provided DCF and distribution guidance, the 2015 fourth quarter numbers indicate that the projected 2016 cash flow will probably fall 20% to 25% short of the current distribution rate. It is probable that the payout to investors will be cut this year, but even a 50% cut still leaves the units at a 30% yield. If such a reduction does happen, the market will see an excess of cash flow to cover the distributions and should bid the unit value higher. Kinder Morgan Inc. (NYSE: KMI) has climbed 50% from its January lows even after reducing its quarterly dividend by 75%.

On the Quicksilver Resources contract, there are 1,000 wells under contract and hooked up to the Crestwood gathering system. If the contract is voided, whoever ends up with the production assets will need to negotiate in good faith with Crestwood to make sure the gas keeps flowing to generate revenue for the buyer.

On the Quicksilver Resources contract, there are 1,000 wells under contract and hooked up to the Crestwood gathering system. If the contract is voided, whoever ends up with the production assets will need to negotiate in good faith with Crestwood to make sure the gas keeps flowing to generate revenue for the buyer.

While the MLP universe is watching this lawsuit with great interest, Crestwood will still generate some level of reasonable cash flow from its Barnett assets, no matter what the judge decides.

For investors, CEQP offers an interesting high-risk, high-reward investment potential. The company’s situation is not as bad as a 60% yield would indicate. A 30% to 50% distribution cut would be good news and most likely lead to a double or even triple in the unit value and even then still give you a yield of approximately 30%.

So, investors should not count on a 60% yield, but instead should be looking for a 100% total return over the course of 2016, with the caveat that Crestwood needs to see some stability in the energy markets and some moderate future growth expectations coming from the exploration and production end as crude oil and natural gas prices start to recover.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

And, there are currently over twenty of these stocks to choose from in my Monthly Paycheck Dividend Calendar, an income system used by thousands of dividend investors enjoying a steady stream of cash.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks per month and in some months 8, 9, even 12 paychecks per month from stable, reliable stocks with high yields.

If you join my calendar by Tuesday, March 22nd you will have the opportunity to claim an extra $3,208.80 in dividend payouts by Tax Day (April 18th).

The Calendar tells you when you need to own the stock when to expect your next payout, and how much you can make from stable, low-risk stocks paying upwards of 12%, 13%, even 15% in the case of one of them. I’ve done all the research and hard work; you just have to pick the stocks and how much you want to get paid.

The next critical date is Tuesday, March 22nd (it’s closer than you think!), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $3,208.80 in payouts by April 18th, but only if you’re on the list before the 22nd. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: Penny Stock Alerts