Watch The Euro…

What many US investors do not realize is that the Euro has a pretty strong connection to small-cap stocks. There are a handful of reasons why this relationship exists. As we move forward in 2013, smart investors would be wise to keep their eyes on the Euro.

What many US investors do not realize is that the Euro has a pretty strong connection to small-cap stocks. There are a handful of reasons why this relationship exists. As we move forward in 2013, smart investors would be wise to keep their eyes on the Euro.

Heres why

First, the Euro trades in direct opposition with the US Dollar index. So when the Dollar moves lower, the Euro almost always moves higher. While there are many reasons for the greenback to move lower, one of the primary movers is when investors are looking to take on more risk.

So in essence, you can say the Euro is often times seen as a proxy for risk. If it rises, risk is on. If it falls, risk is off. Now this relationship has been on the rocks for quite some time basically the entire time the Euro crisis has been ensuing.

For example, all of the dovish action taken by the Federal Reserve over the past year (QE2, QE3, Operation Twist) should have sent the dollar much lower than it had gone. But due to the Euro crisis (and their falling currency), the greenback caught a break.

Over the past week or so, it seems the EuroZone economy may not be in as much danger of recession as previously thought. At least this is the opinion of ECB President Mario Draghi. In fact, the ECB left interest rates untouched and did not buy anymore bonds as a result.

So now that the Euro debt crisis is pretty much in the rearview mirror, we should see a return of the normalized relationship between the US Dollar and the European currency.

Why does this matter to small-cap stocks?

I said before the Euro is a proxy for risk. And in the stock world, small-cap stocks are often seen as the most risky. In fact, the direction of the Euro has been pretty closely tied to the movement of small caps.

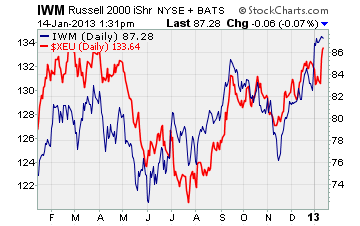

Take a look at the chart below showing the relationship over the past year between the Euro and the iShares Russell 2000 (IWM)

As you can see, both the Russell 2000 and the Euro share an almost identical pattern. No matter how you slice it, that’s a very strong correlation and one not to be ignored.

Now, as I stated earlier, the Euro crisis seems to be behind us. And with a dovish Federal Reserve, continued low interest rates, and more stimulus in the works the US Dollar is set to move lower from here. That’s even further exacerbated by the upcoming increase in the US debt ceiling, which will undoubtedly weaken the US currency.

And as the US Dollar moves lower, the Euro is going to move higher.

Remember, the Euro/US Dollar used to trade near the $1.50 level towards the end of 2009… So there’s lots of room for the currency to move above the $1.34 level it’s trading at right now. As the European economy continues to improve, we can expect to see small-cap stocks continue their rally, even after such a fantastic run.

Until next time,

Brian Walker

Category: Investing in Penny Stocks, Penny Stock Tips