Three Penny Stocks The Pros Are Buying Now!

Buying stocks the pros are loading up on can be a prescription for big returns. After all, institutional investors make their living by buying and selling stocks for a profit.

Buying stocks the pros are loading up on can be a prescription for big returns. After all, institutional investors make their living by buying and selling stocks for a profit.

Institutional investors are pension funds, insurance companies, savings institutions, open- and closed-end investment companies, and foundations. They control a major portion of the world’s financial assets and wield extensive influence in all markets.

In fact, the pros account for as much as 70% of all trading activity on any given day.

Due to their size and professional nature, institutional investors have real advantages over individual investors.

Many of these entities employ teams of researchers and investment analysts who scour the universe to find undervalued companies with bright futures. They also tend to get the best information because they have greater access to companies and their management teams.

No question about it, piggy-backing on the trades of institutional investors can lead to outstanding stock market profits. Without further ado, here are three penny stocks the pros are buying right now…

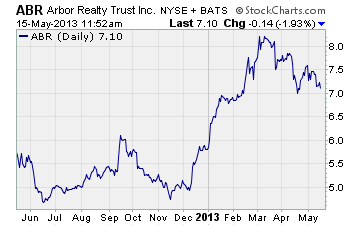

Arbor Realty Trust (NYSE: ABR)

Arbor Realty Trust is a real estate investment trust with a market cap of $18.8 million and a share price of around $7.00.

The company invests in multi-family and commercial real estate-related bridge loans, junior participating interests in first mortgages, mezzanine loans, preferred and direct equity, discounted mortgage notes, and other real estate assets. It also holds investments in mortgage-related securities and real estate property.

Institutional investors have been snapping up shares of this REIT hand over fist. In the past three months, the pros have increased their holdings by a whopping 94%. And they now own just over 25% of the company’s outstanding shares.

And for good reason…

Analysts are expecting revenue to jump 28% this year to $50 million. Earnings estimates are creeping higher. And the stock offers an annual dividend yield of 6.6%.

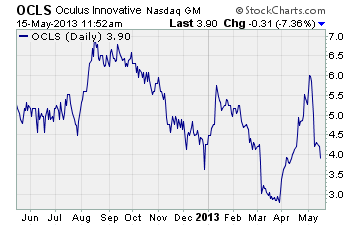

Oculus Innovative Sciences (NASDAQ: OCLS)

Oculus is a medical instrument and supply company with a market cap of $21 million and a share price just under $4.00.

They provide drugs, devices, and nutritional products based on their Microcyn platform technology for the dermatology, surgical, wound care, and animal health markets in the US, Mexico, Europe, and internationally. Their Microcyn platform technology is based on electrically charged oxychlorine small molecules that target a range of disease-causing organisms, such as viruses, fungi, spores, and anti-biotic resistant strains of bacteria.

Over the past three months, institutional investors have boosted their holdings in OCLS by 74%. And these investors now own nearly 16% of the company’s outstanding shares.

It looks like the pros are fond of the company’s improving fundamentals.

Revenue is projected to increase by 25% this year to $16 million and 24% next year to $20 million. And while analysts are forecasting a loss of $0.77 per share for fiscal year 2013 (ends in March), they’re expecting the company to turn a profit of $0.16 per share in fiscal year 2014.

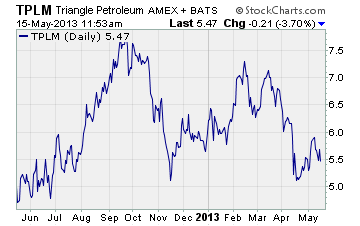

Triangle Petroleum (NYSE: TPLM)

Triangle Petroleum is an independent oil and gas company with a market cap of $307 million and a share price of around $5.50.

They produce unconventional shale oil and natural gas resources in the Bakken Shale and Three Forks formations in the Williston Basin of North Dakota and Montana. The company also provides hydraulic pressure pumping and complementary well completion services.

Triangle has received a lot of interest from the pros of late.

In fact, institutional investors have increased their ownership of TPLM in the past three months by more than 50%. And they now own nearly 60% of the company’s outstanding shares.

Here’s why…

The company’s growing by leaps and bounds!

Analysts are expecting revenue to increase by a jaw-dropping 203% this year to $184 million. And after Triangle posted a loss of $0.31 per share in its last fiscal year (ended January 2013), analysts are expecting the company to turn a profit of $0.61 per share in fiscal year 2014.

Trading penny stocks the investment pros are trading is one strategy that can produce nice gains for your portfolio. Take a closer look at these three penny stocks the pros are buying right now.

Profitably Yours,

Robert Morris

Category: Investing in Penny Stocks, Penny Stock Tips