FINW – Pump And Dump Alert – January 24, 2014

Welcome to Pump and Dump Friday, our weekly feature where we identify potentially “bogus” promotions going on in penny stocks.

Welcome to Pump and Dump Friday, our weekly feature where we identify potentially “bogus” promotions going on in penny stocks.

Today we’re exposing one of the most extensive penny stock pump and dump campaigns of the week: Firstin Wireless Technology (OTCPINK: FINW).

If you don’t know how these schemes work, be sure to check out our free report that exposes the whole thing.

Without further ado, here is today’s disaster waiting to happen:

Firstin Wireless Technology (OTCPINK: FINW)

FINW is one of the most heavily hyped penny stocks of the past week. According to our sources, 25 promoters have been paid over $80,000 this month to pump the stock through more than 45 newsletters.

But so far, the campaign has failed to boost the stock by much.

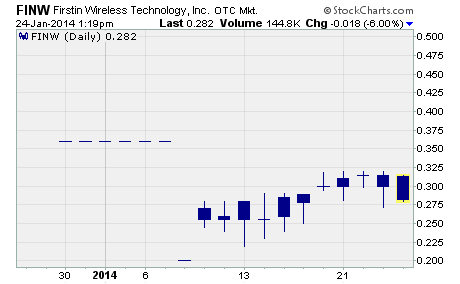

As you can see, FINW has traded up about 40% since the campaign started to a current price of 28 cents per share. While the stock has traded as high as 32 cents during the campaign, it hasn’t been able to get beyond that price.

The reason the campaign hasn’t worked all that well is probably due to the company’s recent change of business and poor financial condition.

According to the most recent annual report (January 2014), the company was formed in September 2010 under the name Passionate Pet, Inc. From inception until January 2013, it operated as a retail pet supply store in Irvine, California.

The company discontinued the pet supply business after it was evicted from its building in January 2012. And it disposed of this business entirely in July 2012 “primarily because it [had] incurred significant operating losses in each of the [prior] two years…”

Then in January 2013, the company entered into a share exchange agreement with Firstin Wireless Technology, Inc. and became a subsidiary of that company.

The company’s now trying to make a go of it as a provider of mobile wireless services. They claim to offer affordable international long distance and roaming calls over their hybrid mobile VoIP technology for the same low price and sound quality of a local call.

But one look at their financials reveals the company has a lot of work to do.

For the fiscal year ending September 30, 2013, the company generated zero revenue while racking up a net loss of nearly $36,000. It ended the year with current assets of $77,726 compared to current liabilities of $938,912. And the company ended the year with a shareholder deficit of $819,805.

Not a pretty picture by any means.

In fact, the annual report states the following…

“In light of operating losses incurred in past years, negative cash flows, a negative working capital and a shareholder’s deficiency, there is significant doubt about the Company’s ability to continue as a going concern.”

Given the company’s shaky financial situation, it’s no wonder investors are staying away from FINW. Not even an $80,000 stock promotion campaign has been able to drum up much interest in the stock.

You would do well to steer clear of FINW at this time. The company is just entering a new business, it hasn’t generated any revenue from that business yet, and it’s not clear the company will be able to continue as a going concern.

Other Penny Stocks Being Pumped This Week

Nuvilex (OTCQB: NVLX) – 12 promoters with 43 newsletters have been paid more than $20,000 so far this month to hype NVLX.

Plandai Biotechnology (OTCQB: PLPL) – 20 promoters with 38 newsletters have been paid over $25,000 in January to plug PLPL.

As you know, penny stocks are a great place to invest your money. You just have to do your due diligence to stay away from all the schemes and scams out there these days!

Profitably Yours,

Robert Morris

Category: Pump & Dump Alerts