Don’t Buy Adobe Systems… Get Smart!

Adobe Systems (NASDAQ: ADBE) has been an investor favorite since the dawn of the internet era. And that love affair returned the spotlight yesterday after the software company reported better than expected first quarter earnings.

Adobe Systems (NASDAQ: ADBE) has been an investor favorite since the dawn of the internet era. And that love affair returned the spotlight yesterday after the software company reported better than expected first quarter earnings.

Adobe reported late Tuesday afternoon that it earned 30 cents per share on sales of $1 billion. While profits fell 14% from the prior year quarter, the number handily beat analysts’ estimates of 25 cents.

That’s a solid 20% upside surprise.

The good news from Adobe prompted me to do a little research. I wanted to see if I could find a penny sized software stock that might also beat the street’s forecast. After all, with a share price of $66.80 and a market cap of over $33 billion, Adobe is much too large a company for true penny stock investors.

So, I did a little digging and found an exciting small-cap software stock with a strong possibility of providing an upside surprise.

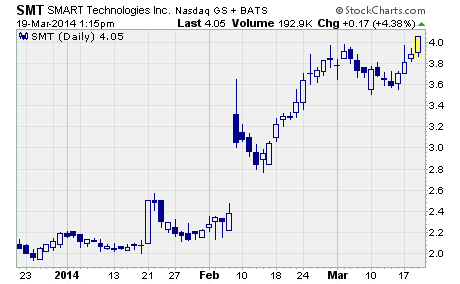

The company is Smart Technologies (NASDAQ: SMT)…

Smart Technologies makes interactive technology products that enhance learning and enable people to collaborate worldwide. Their easy-to-use interactive displays and integrated solutions are crucial to classrooms and meeting rooms around the world.

The company created the first interactive whiteboard in 1991, and it remains the world’s leading provider today. More than 2 million SMART Board interactive whiteboards are used by over 40 million students and their teachers in over 175 countries.

Not only do SMART Boards help students learn better, they’re creating a whole new generation of users. The kids using this technology in the classroom today will be the ones demanding it when they enter the workforce tomorrow.

It reminds me of how my generation got hooked on Microsoft Word in high school and college. And we all know how that turned out for Microsoft (NASDAQ: MSFT).

But the SMART Board isn’t just a fancy new gadget for teachers and students. It’s also becoming a key technology for businesses around the world.

In fact, more than 125 Fortune 500 companies in over 50 countries are using the company’s visual collaboration solutions. Some of these include such household names as Audi, British Telecom, Cisco Systems, General Electric, and Microsoft.

What’s more, the widespread success of the SMART Board prompted the company to develop a host of other related products and solutions. Today the company also provides interactive flat panels, interactive tables, interactive pen displays, and conferencing software.

These products combined with the company’s visual collaboration solutions are helping business teams increase innovation and boost productivity. No longer are they restricted by the limits of traditional tools or distance.

No question about it, Smart Technologies is an innovative company with cutting-edge technology products for the 21st century.

But getting back to the point of this article. Smart Technologies is a good candidate to post a first quarter earnings upside surprise. And if that happens, the stock should jump on the news.

The company has beaten analysts’ estimates in each of the past three quarters. And in the most recent quarter (December 2013), the company posted a profit of $0.04 per share when analysts’ were forecasting a loss of ($0.02).

With Wall Street now expecting a loss of ($0.05) per share for the March 2014 quarter, we just might see history repeat itself.

Furthermore, some analysts have become more bullish on the company in recent weeks. In just the past 60 days, the consensus estimate for fiscal year 2014 has increased from $0.12 per share to $0.21. And the consensus estimate for fiscal year 2015 has jumped from $0.09 per share to $0.16.

Bottom line…

If you’re looking for a small-cap stock with upside earnings surprise potential, you should take a closer look at SMT today. And given the rapid adoption of the company’s products and services by schools, businesses, and governments worldwide, you should bear in mind that the stock offers strong long-term growth potential as well.

Profitably Yours,

Robert Morris

Category: Penny Stocks to Watch