CIIX, NOUV, LUDG – Pump And Dump Alerts – July 6, 2012

This week were exposing these three popular Pump & Dumps: ChineseInvestors.com (CIIX), Nouveau Life Pharmaceuticals (NOUV), and Ludwig Enterprises (LUDG).

This week were exposing these three popular Pump & Dumps: ChineseInvestors.com (CIIX), Nouveau Life Pharmaceuticals (NOUV), and Ludwig Enterprises (LUDG).

That said, welcome to Pump and Dump Friday, where every week we identify a few of the potentially bogus promotions going on in penny stocks today.

If you dont know how these schemes work, be sure to check out this free report that exposes the whole thing.

Without further ado, here are todays disasters waiting to happen:

ChineseInvestors.com (CIIX)

Sometimes I feel bad for certain stocks being pumped and then I get a reality check. Someones been paid to pump the stock!

Even as the CEO of this company whines in public about the stock price, pumpers are being paid. Here are comments from the CEO of this company

“Recent CIIX stock weakness is primarily related to specific shareholder profit taking (selling) due to a low basis value in the stock,” Mr. Wang commented. “It is my belief that this particular group of sellers will eventually disappear from our shareholder list and more specifically; I don’t see any other fundamental reasoning behind this selloff.”

He doesnt see any reason for the selloff? Ill tell you what apparently he needs a reality check. Speculating Stocks and Nicks Penny Picks were paid $2,000 to hype CIIX, and Nicks Penny Picks has collected a total of $6,000 to date.

And you might be shocked to know who footed the bill

CIIX paid the pumper directly for an investor relations contract. Call it what you will, but its just paid stock promoting to me. Seriously, who cuts a check to have their stock pumped and then cries publicly about the sellers killing the stock?

Whats more, the company isnt even turning a profit.

For the first quarter ending in February 2012, CIIX lost $425,195. Thats an even bigger loss than the year prior!

With all the stocks out there to invest in, CIIX is one you can take a pass on.

Nouveau Life Pharmaceuticals (NOUV)

Its been a slow week in the pump and dump business and it shows since were seeing NOUV pumped yet again. Apparently, there are not enough new clients coming in to pay for pumping, so the stock promoters are hitting up their old favorites (must be the summer holiday).

Global Market Media, LLC is the owner of 24-7 Stock Alert, Penny Stock Pros, and Penny Stock Club websites. They were each paid anywhere from $5,000 to $35,000 to hype up shares of NOUV.

We exposed the pump and dump scheme a few times in the past first as HRID, and again as NOUV.

The biggest problem we had with the company (besides the paid pumping) was they used to be in the bio-fuels business. They were attempting to convert organic waste into fuel. Obviously, that didnt go as planned.

So they became a pharmaceutical company named Nouveau Life. Their primary product is an ED supplement (a cheap Viagra-like remedy).

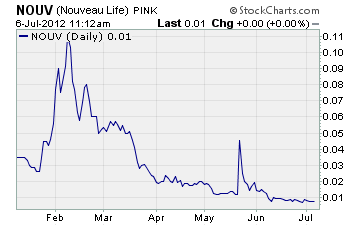

In June, we pointed out the pump dump being run on the new ticker symbol, NOUV. Back then, the stock was trading at $0.02.

So how have they fared over the last month? See for yourself

Clearly, the continued pumping isnt helping one bit as shares have shed over 50% since our last alert.

Id like to think our work exposing these schemes is keeping pumpers from being paid off. As long as investors avoid stocks like NOUV were getting the job done!

Ludwig Enterprises (LUDG)

Ludwig Enterprises first caught my eye because of the name Ludwig. It first brought to mind the great NYC-based piano company which started at the turn of the century. Then I couldnt help but think of the great composer, Ludwig Van Beethoven.

Well, sadly this company is neither!

Ludwig Enterprises is a broadcasting company offering programming aimed at a multi-cultural market. Of course, I stumbled across this company because of an email from Penny Stock Day Trader.

The pumper was telling everyone about an $8 million contract with Haitian American Broadcasting Corporation. While that sounds great for the company, keep in mind the pumper was paid $56,000 to promote LUDG so anything they say has to be questioned.

In fact, the pumper is happy to tell you all about the great stuff at LUDG. But theyre not sharing the dirt I dug up

For starters, Ludwig Enterprises has no SEC filings. Basically, this stock is not registered with the SEC and isnt required to file their financial statements in a timely or organized fashion. Any late filings wont be announced, and investors can do nothing about it.

Red Flag number 1

Second, the company has been paying off debt in exchange for common stock. And theyve done this numerous times in the past. For example, on July 5, 2011 the board of directors authorized an exchange of 62,500,000 shares to pay down $62,500.00 of debt with Worthington Financial Service.

LUDG did it again on June 29th, 2012 for 100,000,000 shares to wipe out $100,000 of debt with the same company.

And its easy to see why Ludwig has just $100,000 in revenue on the books as of June 30th. The problem is, the company has an accumulated deficit over $523,000. Even worse, they have just $4,770 in cash on hand!

While digital radio may someday pay off for LUDG, Im always weary of a stock thats being pumped especially when they keep issuing shares for debt.

Id say you need to turn a deaf ear to what the pumpers are saying about this stock, and avoid buying any shares!

A final word (and warning).

These are just a few of the potential pump and dumps we’ve seen lately. Remember, theres a lot more of this going on than we can highlight here. As you know, penny stocks are a great place to invest your money. You just have to do your due diligence to stay away from all the schemes and scams out there these days!

Until next time,

Brian Walker

Category: Pump & Dump Alerts