Buying Penny Stocks During The Holiday Season

Buying Penny Stocks During The Holiday Season

Buying Penny Stocks During The Holiday Season

You may be fooled by the unseasonably warm weather we’ve been experiencing around the country, but it is in fact November. In less than three weeks, Thanksgiving will occur whether it’s 80 degrees or 30 degrees.

While many think of Thanksgiving as the start of the month-long holiday season, it also serves another purpose. It’s the Friday after Thanksgiving (or even that very night) where holiday shopping shifts into full gear.

At this point, consumers begin to eagerly snap up holiday gifts and take advantage of whatever big deals are going on. This is true both at brick and mortal stores and online as well.

The holiday shopping season is also closely tracked by investors. Many companies are heavily impacted by sales during the fourth quarter. In some cases, fourth quarter revenues comprise 50% or more of a company’s total sales for the year.

So what does this have to with buying penny stocks?

As you may expect, there are numerous penny stock companies with ties to retail. Not every retail chain is a major corporation. Smaller, yet still public, retail chains do exist.

One such company is Joe’s Jeans $JOEZ.

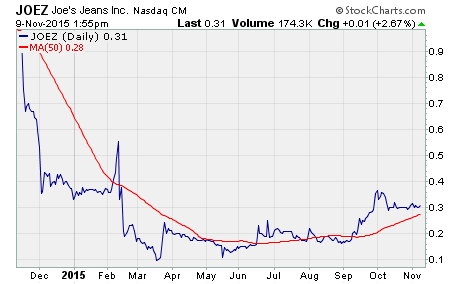

Here’s the chart:

JOEZ is down 9% so far for the year, but you can see it’s turned up over the last couple months. This could be a prelude to holiday sales expectations.

Currently, the stock is trading sideways around $0.30. Investors are likely waiting to see how holiday business is shaping up before buying further. The share price is above the important 50-day moving average line, which will serves as stiff resistance to a drop.

Is $JOEZ worth buying?

Joe’s Jeans develops apparel products under the Hudson name in the US. The company has 10 full-priced retail stores and 11 outlet stores. So, it definitely qualifies as a small retail chain.

Despite being small, the company generated $181 million in revenues over the last year. However, the business is also nowhere near being profitable, losing $44 million over the same period. The company also has a lot of debt and not a lot of cash.

Basically, if you want to focus on sales (which is reasonable for a small company), then $JOEZ could be worth buying. If you want to focus on the rest of the fundamentals, well, not so much.

Here’s the thing…

$JOEZ is just one example of how you can play the retail shopping season using penny stocks. It’s a great example because it’s a pure retail play that should benefit from holiday shopping.

Other companies may not be as directly tied into the retail sector as an apparel company like Joe’s Jeans. But, anything retail related could make a reasonable play given the right price. Shipping companies are a good example.

As always, finding the right penny stock company is about doing your research and having a plan. $JOEZ is an interesting call because the research gives mixed results. However, if you have a plan – and a good reason for buying – it could be a good retail stock to buy for a very cheap price.

Good investing…

Brian Kent

Note: If you’re interested in learning more about Brian Kent’s Penny Stock All-Stars premium service… and learning about the stocks we’re trading for profit… you can get the inside scoop on penny stocks here.

Category: Penny Stock Tips