Buy These 3 Stocks That Insiders Love

When the CEO of a company purchases $6 million worth of stock in short order, investors should take notice. Buys of that magnitude from insiders do not come around often. See the three stocks that have confident insider buying you shouldn’t ignore.

When the CEO of a company purchases $6 million worth of stock in short order, investors should take notice. Buys of that magnitude from insiders do not come around often. See the three stocks that have confident insider buying you shouldn’t ignore.

Normally this column focuses on stocks with insider buying that trade for less than $10. I’ve got a couple of those for you today. However, when a CEO coughs up nearly $6 million in short order to buy his company’s shares, it’s worth mentioning too.

Let’s start with the smaller guys.

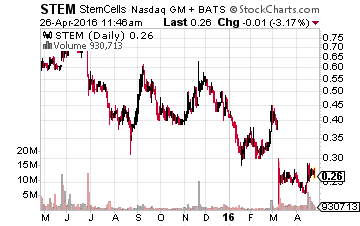

StemCells Inc. (NASDAQ:STEM) – Pending News to Make Up for Lost Ground?

You have to love those stocks that trade for less than fifty cents; they are sort of like options that never expire, sans bankruptcy.

You have to love those stocks that trade for less than fifty cents; they are sort of like options that never expire, sans bankruptcy.

Chief Financial Officer (CFO) and Executive VP of Finance, Gregory T. Schiffman, doesn’t seem to believe belly-up is an issue as he bought 166,000 shares of the micro-cap; a total investment of $49,000. At the risk of sounding redundant, I play favorites when the bean-counters buck up. Nobody understands a company’s bank account better than the chief accountant.

Earlier in 2016, the CFO disposed of shares in the $0.40 range. The two transactions added up to roughly $26,000. Since then, shares of STEM lost about 20% of their value. Twenty percent in a matter of months is the definition of making the right call.

For the record, StemCells is a tiny biopharmaceutical company that engages in the research, development, and commercialization of cell-based therapeutics and related technologies. It develops HuCNS-SC platform technology, a purified human neural stem cells, used as a potential therapeutic to treat diseases and disorders of the central nervous system.

Recently, STEM had good news for shareholders. The company announced positive, interim results for its Phase II Pathway™ Study of HuCNS-SC cells for the treatment of chronic cervical spinal cord injuries.

The study showed muscle strength had improved in five of the six patients with four of these five patients also demonstrating improved performance on functional tasks assessing dexterity and fine motor skills.

Management says to expect full results from Phase II later this quarter. Wanna bet that’s why Schiffman is staying in STEM shares this time around? My guess is that preliminary results mirror full results, which should give the stock a chance to regain lost ground.

RELATED: How to earn 7% a year from a specialty bank in as little as 5 minutes.

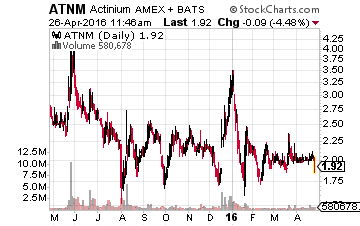

Actinium Pharmaceuticals Inc. (NYSEMKT:ATNM) – A Phase Away from Rocketing

Another favorite insider purchase type of mine is cluster buying. That’s when a bunch of executives and board members break out the debit card in a short time span. In this case, five ATNM decision makers swiped their cards and entered their pins numbers to buy 35,500 shares; a combined debit of $71,165.

Another favorite insider purchase type of mine is cluster buying. That’s when a bunch of executives and board members break out the debit card in a short time span. In this case, five ATNM decision makers swiped their cards and entered their pins numbers to buy 35,500 shares; a combined debit of $71,165.

All five jumped in since April 14, 2016, which seemingly came out of nowhere.

In the last two years, there were only two trades made by management members. Chief Exec. Officer, President, Principal Financial Officer, Principal Accounting Officer and Director (how the heck does he get all that on his business card?), Dave Kaushik, sold $382,000 of Actinium at $2.45.

The CEO was joined by Dragan Cicic, Chief Operating Officer and Chief Medical Officer, who sold just $7,400. Both, by the way, are included in the roster of five buyers. That’s a second favorite purchase type, change of heart, from seller to buyer.

ATNM is another small biotech that engages in developing treatments for cancer. The company develops therapies for life-threatening diseases using its alpha particle immunotherapy platform and other related and similar technologies.

In all likelihood, the group of insiders is jumping in front of a planned April 26, 2016 webinar to discuss the Company’s upcoming pivotal Phase 3 clinical trial for Iomab-B. Iomab-B will be used in preparing patients for hematopoietic stem cell transplantation (HSCT), the fastest growing hospital procedure in the U.S.

If all goes well in Phase 3, ANTM shares could be one of the fastest growing stock prices in the U.S., too.

OK, now it’s on to the Big Buy of the Big Stock.

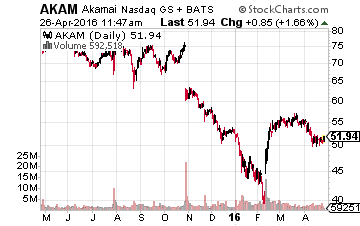

Akamai Technologies, Inc. (NASDAQ:AKAM) – A Bionic Buyer

AKAM covers the final type of insider purchases I favor. Already, we’ve talked about past insider performance, cluster buys, change of heart, and lastly – BIG BUCKS!

AKAM covers the final type of insider purchases I favor. Already, we’ve talked about past insider performance, cluster buys, change of heart, and lastly – BIG BUCKS!

Since the middle of February, Co-Founder, Chief Executive Officer and Director, Thomson Leighton, put $6 million worth of AKAM into indirectly related accounts i.e. a family trust, spouse’s account(s), children… you get the picture.

Aside from acquiring and disposing of the stock at no cost and exercising options (sometimes the same thing) the past two years, this is Leighton’s first “real-money” transaction.

Although Akamai reported earnings on April 26th, it’s doubtful that the CEO bought the stock for the short-run. There are laws prohibiting insiders from buying and selling shares that quickly.

Instead, the transaction is more likely to be a valuation thing. In the last decade, AKAM’s average price-to-earnings ratio (P/E) is 33.52. Today, the stock trades around 28.6 times earnings and with a forward P/E of 16.48 based on next year’s consensus earnings estimate.

Wall Street analysts forecast profits of $3.09 for 2017. At its 10-year average P/E ratio, AKAM would trade at $103. That’s more than a double from recent prices. At current price-to-earnings levels, the Internet Information Provider’s shares would price out at $90ish.

At either price, Thomson Leighton’s $6 million purchase would prove to be a bionic buy, generating a seven-figure return.

Bringing you back to reality, homeruns like that don’t come around often, and the majority of an investors’ portfolio should not be made up of risky positions like the three trades above. And, with the Federal Reserve punishing savers like they are right now, buying a safe CD that pays good interest is no longer an option.

So, what are investors to do with their portfolios?

Recently, Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me just blew me away.

This bank didn’t take TARP money or other taxpayer bailouts–or any other bailouts for that matter–back in 2008 or ever.

This bank didn’t get tangled up in risky mortgage-backed securities, credit default swaps, stress tests, FDIC watch lists… you name it.

The CEO told Tim how his bank has been growing by leaps and bounds since even before the financial crash of 2008 and while impressive it’s not what stopped Tim in my tracks.

This specialty bank in America’s heartland is currently paying 7%.

He then shared with Tim exactly how his bank is able to pay so well and how everyday Americans (and Canadians!) can get in on this. Click here to find out.

Tim jotted down all of his notes and put them in this one report for you.

Click here for the full briefing that tells you exactly how and when to get started.

Note: Rich Bieglmeier is the author of this article. Rich has practiced the art of technical analysis and the science of fundamental analysis since 1991. He draws on a wealth of experience and practical application to help investors find actionable investment opportunities.

Category: Penny Stocks to Buy