Biotech Is Back: Why The 15% Rally Is For Real

After falling over 40% in six months, the biotech sector has soared 15% in just the last two weeks. The sector remains oversold, creating very appealing entry points. These four companies are Bret Jensen’s favorites to continue the rally.

After falling over 40% in six months, the biotech sector has soared 15% in just the last two weeks. The sector remains oversold, creating very appealing entry points. These four companies are Bret Jensen’s favorites to continue the rally.

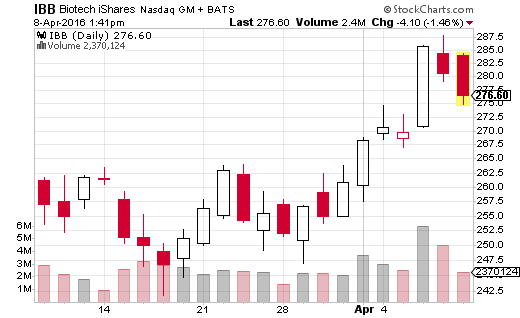

After spending over six months deep in the doldrums, and in the deepest and longest bear market since the financial crisis, the biotech sector has exploded to the upside over the past half-dozen trading sessions. The sector, after falling over 40% from its highs in late July to its trough in the second week of February, has roared back as of late. As of this Thursday, the sector had gained nearly 15% since March 30th. One of the biggest underperformers in the market has become one of the top gaining areas of the market so far early in the second quarter.

Even the Treasury Department’s derailing of the over $150 billion mega-merger between giants Pfizer (NYSE: PFE) and Allergan (NYSE: AGN) could not kill the improved sentiment on this segment of the market. In fact, the sector rallied some six percent Wednesday when the two drug giants officially announced they were ending their proposed tie up. So, why is biotech rallying and why could the rise be sustainable? There are several things suddenly working in the industry’s favor.

First and foremost, the sector broached deeply oversold levels. The large cap portion of biotech was selling at their lowest valuations since 2011 before this recent surge. Most of the larger names sold at a discount to the overall market multiple; traditionally, they sell at a premium. This anomaly could not last as the sector is one of the few in the market that can consistently still deliver earnings and revenue growth right now despite an anemic global demand picture.

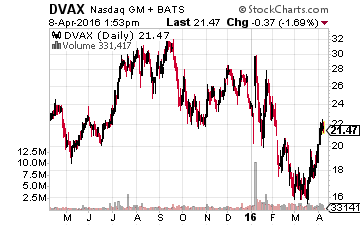

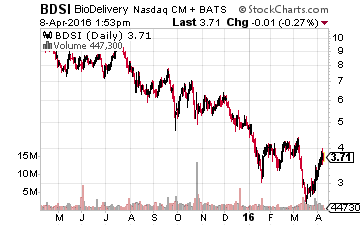

In addition, some of the stocks of smaller cap names I have profiled on these pages before like Dynavax Technologies (NASDAQ: DVAX), BioDelivery Sciences (NASDAQ: BDSI) and Merrimack Pharmaceuticals (NASDAQ: MACK) were so disconnected from their underlying value that something had to give.

In addition, some of the stocks of smaller cap names I have profiled on these pages before like Dynavax Technologies (NASDAQ: DVAX), BioDelivery Sciences (NASDAQ: BDSI) and Merrimack Pharmaceuticals (NASDAQ: MACK) were so disconnected from their underlying value that something had to give. I am not surprised these names have rebounded considerably of late.

I am not surprised these names have rebounded considerably of late.

Some of the recent rise is also due to some of the nuances of Wall Street. The sector was heavily shorted coming into the second quarter. This was a profitable strategy from the fourth quarter of 2015 into the early months of 2016 as the sector was one of the worst performers in the market. That strategy is unraveling in the second quarter and Wednesday’s almost six percent rally in the biotech sector felt like it was powered by a significant short squeeze as fund managers abandoned their short positions. In addition, the high-frequency trading programs that rode the momentum down with biotech are now riding the rise up.

RELATED: The biotech icon with a $10 BILLION a year opportunity curing heart disease

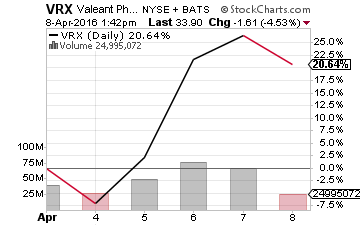

Valeant Pharmaceuticals (NYSE: VRX) the one-time hedge fund hotel that recently has become a pariah, not to mention a huge overhang on the entire pharma and biotech sectors, seems to have stabilized recently as well. The stock had its best two-day gain in some two decades this week as management reached a deal with creditors to extend its annual report filing deadline.

Valeant Pharmaceuticals (NYSE: VRX) the one-time hedge fund hotel that recently has become a pariah, not to mention a huge overhang on the entire pharma and biotech sectors, seems to have stabilized recently as well. The stock had its best two-day gain in some two decades this week as management reached a deal with creditors to extend its annual report filing deadline.

The major presidential candidates also seem to be slowly shifting into more of a general election stance and will continue to do so. This should mean less tweets and rhetoric around drug price “gouging” in the coming months. This too is a welcome event given how this populist spiel has impacted the sector every time it has come up since early summer.

Finally, numerous drugs have been recommended for approval by the various Ad Comm panels. Although this does not mean the FDA will automatically follow up and grant approval in short order, it does mean it is highly likely to do so. Several small caps have soared recently after these recommendations which has significantly helped improve sentiment on the sector overall. Few stocks have benefited more than Acadia Pharmaceuticals (NASDAQ: ACAD) from this sort of recommendation.

I told you about this potential catalyst in mid-March in these pages (notation 1). The stock is up more than 60% since then as its Ad Comm panel recommended its drug Nuplazid for approval in a 12-2 vote. The FDA should follow with its own approval before April ends. This compound would be the first approved treatment for the psychosis that often accompanies Parkinson’s Disease. The drug has potential blockbuster status and is also in trials for other indications.

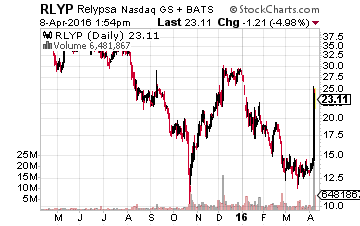

Another of the three stocks mentioned in that article, Relypsa (NASDAQ: RLYP), soared almost 70% on Thursday on a report in Reuters that the company was ready to field buyout offers. That was one of my core reasons for owning the stock and it is one of many small caps that has rallied substantially within the Biotech Gems portfolio.

Another of the three stocks mentioned in that article, Relypsa (NASDAQ: RLYP), soared almost 70% on Thursday on a report in Reuters that the company was ready to field buyout offers. That was one of my core reasons for owning the stock and it is one of many small caps that has rallied substantially within the Biotech Gems portfolio.

This brings up my final point and one I have not had much occasion to re-emphasize recently thanks to the deep bear market in biotech which now seems over. They relate to culling some profits when you see big rallies in small biotech stocks and I have dubbed them the “Jensen Rules”. They work like this.

If you buy 1,000 shares of a small biotech stock. After a 50% gain, you want to sell 100 shares. If the stock doubles you want to cash out of another 200 shares. Finally, if you are lucky enough to get a triple, unload an additional 200 shares. You now have a guaranteed gain even if the stock subsequently goes to zero. You also have half of your original stake riding on the “house’s money”. This allows you to take some gains to redeploy in other opportunities as well as ensuring you don’t completely cash out of what might ultimately turn out to be the next juggernaut in the sector.

After six months in the wilderness, I am sure biotech investors will have no problem dealing with how to take some gains in their small biotech positions in the months ahead.

Some of the biggest biotech gains – or any gains for that matter – I’ve enjoyed have come from small biotechs like RLYP, EGRX, among others, but my next biggest opportunity is interestingly enough from a bigger name in the industry.

Why? Because this firm is on the verge of solving one of the biggest killers in America: heart disease. Almost one hundred million people are affected by heart disease, and this firm’s powerful new drug will be able to help them in ways that prior treatments have not. And, it could push just about every other treatment off the table as patients dump their existing treatment for this new one.

All of this adds up to a $10 billion dollar a year market just for this one drug. An opportunity like this does not come around often, but when it does, like it did with Gilead’s Harvoni from which I made a ton of money, those that got on board early banked massive profits.

his isn’t some high-risk small cap investment either. This company has flourished throughout bear markets, recessions, and worse over the last thirty years and is now tapping into a goldmine that will propel its stock to new highs.

Positions: Long ACAD, BDSI, DVAX, MACK, RLYP

Category: Biotech Stocks