3 Stocks Under $10 With Bullish Insider Buying

Stocks with major insiders buying up shares are some of the most attractive investments in the market right now. With mounting uncertainty about what growth the economy can achieve in 2016, trusting in the people that know their businesses best is a safe bet.

Stocks with major insiders buying up shares are some of the most attractive investments in the market right now. With mounting uncertainty about what growth the economy can achieve in 2016, trusting in the people that know their businesses best is a safe bet.

Investors are always interested in low priced stocks. That’s why you get so many “This Low-Priced stock is Set to Explode” emails. They entice buyers. The lure of putting a small amount of money in and possibly getting a fat stack back is tempting to even the most uptight, investor.

Finding gems under $10 can be a sort of treasure hunt; you know, map in hand, Pirates of the Caribbean style, search for gold. More often than not, the hunt comes up empty.

However, savvy investors have some clues to help them find the “X” that marks the spot where spoils are buried. In this case, our map will be stocks under $10 with insider buying. When the folks who understand a company put their own money on the table, it’s a pretty good indication they expect a pot o’ gold at the end of the rainbow. (Mixing up metaphors, but couldn’t think of anything better!)

Although “X” is the final destination, insider buying and price are just the start line here. Following the trail of insiders who have a history of “getting it right” can help investors find the paths with a higher probability of a payoff.

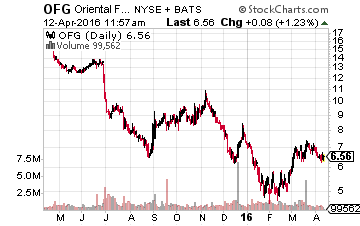

OFG Bancorp (NYSE: OFG) – Booking a Double from Here?

Jose Rafael Fernandez, who happens to be the money center’s Vice Chairman, Chief Exec. Officer, President, and Director of Oriental Bank & Trust, bought 7,000 shares of OFG on April 1st – no joke.

Jose Rafael Fernandez, who happens to be the money center’s Vice Chairman, Chief Exec. Officer, President, and Director of Oriental Bank & Trust, bought 7,000 shares of OFG on April 1st – no joke.

OFG Bancorp, a financial holding company, provides various banking and financial services primarily in Puerto Rico. It operates in three segments: Banking, Wealth Management, and Treasury.

Mr. Fernandez paid $6.99 for his stock for an out-of-pocket investment of $48,930 in the Puerto Rican financial business. Now, this is the 53-year-old CEO’s fourth purchase in the last two years. However, this last purchase and his first were in the 50K range, while the others were closer to 20K.

Back in April of 2014, Fernandez made an even $50,000 bet on his company at $16.85 per share. By June 23, 2014, the price climbed to $19, or a 12.8% return.

Perhaps, the man in charge believes his stock is undervalued on a price-to-book (P/B) basis. Shares trade for roughly 40 cents on the dollar based on OFG’s book value. Over the last half-decade, the low water mark was 29 cents (Feb 11, 2016) with a peak of a $1.25 (Aug 9, 2013.) In fact, shares have only traded below a P/B of .50 for the last 11 of 60 months.

At its 5-year average price-to-book ratio, OFG would trade up to $13.81; doubling from recent levels.

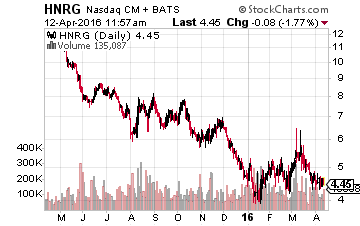

Hallador Energy Co. (NASDAQ: HNRG) – From Bearish to Modestly Bullish

Hallador Energy Co. (NASDAQ: HNRG) – From Bearish to Modestly Bullish

Hallador Energy Company, through its subsidiaries, engages in the mining, production, and sale of steam coal for the electric power generation industry in the United States.

With coal being very unpopular politically, this one gets the spidey sense tingling. Especially when you consider the role a key inside buyer plays at the company and an apparent reversal in opinion.

All-in-all, three people from the management team broke out their debit cards and bought 11,450 shares at the start of April; a total investment of $52,642. Agreed, the dollar amount isn’t that impressive; however, any money in is a departure from past trading habits.

Prior to late December 2015, almost all the insider action was exercise options and sell, sell, sell. To see three management members come to the same conclusion could be a sign that the trio sees brighter days ahead.

Factor in the numbers guy, CFO Martin Lawrence, being a member of the trio and it grabs my attention even more. After all, who knows a company’s finances better than the Chief Financial Officer? Probably nobody.

Lawrence bought some stock in September of 2014, but has done nothing but cash in as shares kept falling, falling, and falling. He began selling at $10.27 a share late in 2014, and you see where the stock is today. Lawrence has been on the right side of the trade for the last 18 months.

RELATED: How to earn 7% a year from a specialty bank in as little as 5 minutes.

Maybe, just maybe, the number cruncher thinks Hallador Energy is undervalued on a price-to-sales (P/S) basis. At the moment, the basic materials company is trading near its 5-year low of 0.35 times sales with a ratio of 0.38.

If HNRG were to trade up to its average P/S of 1.45 dating back to 2011, then Martin Lawrence’s $20,000 investment would be worth more than $75,000. Now that’s uncovering some treasure.

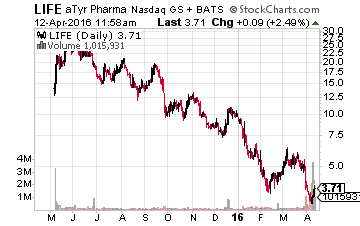

aTyr Pharma Inc. (NASDAQ: LIFE) – 288,000 Reasons to Expect Good News

aTyr is the most speculative play of the insider buying candidates.

aTyr is the most speculative play of the insider buying candidates.

I like it when high-level executives lay down big money for the first time in years. Dr. Paul R. Schimmel Ph.D., the company’s founder, just parted with more than a quarter million. No matter how much money you got, nobody is throwing away $288,000 on a black or red bet.

A lot of folks might feel LIFE is as much a number on a roulette table as it is an upstart biotech. It’s engaged in the discovery and clinical development of innovative medicines for patients suffering from severe and rare diseases using its knowledge of Physiocrine biology, a newly discovered set of physiological modulators.

The Company’s lead candidate, Resolaris™, is a potential first-in-class intravenous protein therapeutic for the treatment of rare myopathies with an immune component. Resolaris is currently in a Phase 1b/2 clinical trial.

Recently, the company got “mixed” Phase Ib/II trial data of Resolaris in adult patients with late-onset facioscapulohumeral muscular dystrophy from the FDA, according to William Blair analyst Y. Katherine Xu.

Although the analyst downgraded her view on the stock and lowered her price target to $8 from $42, the stock would still be a double from here if she is right. BMO Capital agrees with the $8 target as they initiated coverage on the tiny biotech on Monday, April 11th.

Don’t be surprised to see more analyst coverage as aTyr Pharma participated in the 15th Annual Needham & Company Healthcare Conference in New York City from April 12-13, 2016.

Fundamentally, there isn’t a reason to own Tyr Pharma as the company has no product or sales. All the major action in the stock is likely to be news driven, i.e. analyst opinions and FDA announcements.

Dr. Paul R. Schimmel has 288,000 reasons to believe the news will tilt to the good side.

Recently, Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me just blew me away.

This bank didn’t take TARP money or other taxpayer bailouts–or any other bailouts for that matter–back in 2008 or ever.

This bank didn’t get tangled up in risky mortgage-backed securities, credit default swaps, stress tests, FDIC watch lists… you name it.

The CEO told Tim how his bank has been growing by leaps and bounds since even before the financial crash of 2008 and while impressive it’s not what stopped Tim in my tracks.

This specialty bank in America’s heartland is currently paying 7%.

He then shared with Tim exactly how his bank is able to pay so well and how everyday Americans (and Canadians!) can get in on this. Click here to find out.

Tim jotted down all of his notes and put them in this one report for you.

Click here for the full briefing that tells you exactly how and when to get started.

Note: Rich Bieglmeier is the author of this article. He has practiced the art of technical analysis and the science of fundamental analysis since 1991. He draws on a wealth of experience and practical application to help investors find actionable investment opportunities.

Category: Penny Stock Alerts