7 Tech Stocks That Are Bucking The Downtrend

Myriad factors are contributing to the decline in equities, yet these tech stocks are shaking it off

Myriad factors are contributing to the decline in equities, yet these tech stocks are shaking it off

U.S. equities are languishing on Wednesday as geopolitical uncertainty from President Trump’s immigration order to upcoming elections in Europe weigh on sentiment.

While large-cap stocks remain stable, the volatility and weakness is spreading in other assets from small-cap stocks to crude oil and high-yield corporate bonds.

Yet with correlations within the stock market breaking down, there are areas of strength that seem unfazed by the broader commotion. In many cases, these stocks are being driven higher thanks to positive earnings news or other individual factors representing a return to a “stock picker’s” environment not seen for months.

With the caveat that the overall market still looks vulnerable here amid extended sentiment measures, bullish investor positioning and policy uncertainty, here are seven tech stocks perking up:

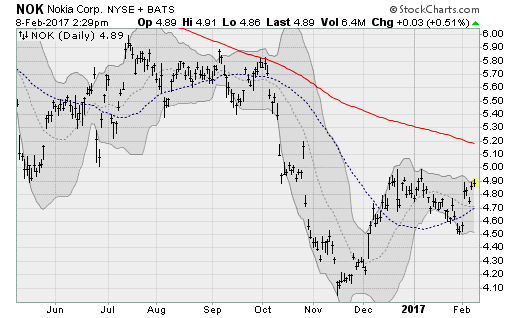

Tech Stocks to Buy: Apple Inc. (AAPL)

Apple Inc. (NASDAQ:AAPL) shares have continued their post-earnings surge as better-than-expected iPhone sales returned the company’s most critical business segment to growth.

This proved the naysayers (myself included) wrong on the uptake for the controversial iPhone 7, which not only kept the iPhone 6 form factor first introduced in 2014 but removed the analog headphone jack. Yet consumers have responded in force, suggesting incremental improvements like the dual camera lens on the iPhone 7 Plus have generated substantial interest.

The company will next report results on May 2 after the bell. Analysts are looking for earnings of $2.01 per share on revenues of $52.85 billion.

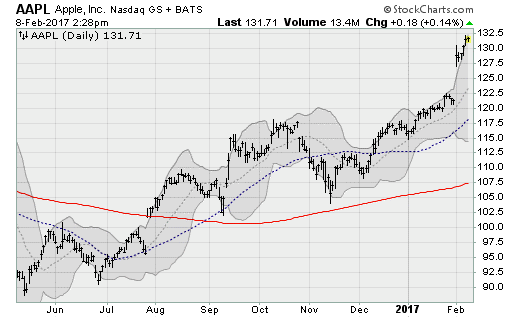

Tech Stocks to Buy: Advanced Micro Devices, Inc. (AMD)

Advanced Micro Devices, Inc. (NASDAQ:AMD) shares have surged some 40% since the middle of January after better-than-expected results — driven by increased uptake of its graphics processors — has continue the epic uptrend that started last February. Shares bottomed below $2 a share at the time, as the viability of the company was doubted. No longer.

Investors are enjoying a push to a new 10-year high after revenues grew 15% from last year. The theme in play here is that not only are GPUs continuing to drive high-end computers, they are playing a pivotal role in machine learning/AI, as well with derivative exposure to areas like autonomous transportation.

The company will next report results on May 2. Analysts are looking for a loss of four cents per share on revenues of $982.6 million.

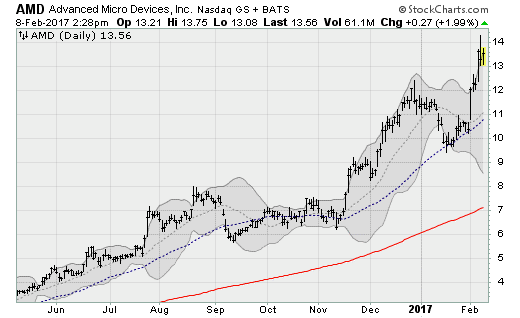

Tech Stocks to Buy: Twitter Inc (TWTR)

Troubled social media icon Twitter Inc (NYSE:TWTR) looks ready to make another attempt on its M&A-related October high as it rises above its 200-day and 50-day moving averages.

A nice base of support has been established near the $16-a-share threshold going back to June. Investors continue to focus on user metrics, which had stalled but look ready for a possible lift thanks to the well-publicized use of the messaging service by President Trump.

The company will next report results on Feb. 9 before the bell. Analysts are looking for earnings of 12 cents per share on revenues of $740.14 million.

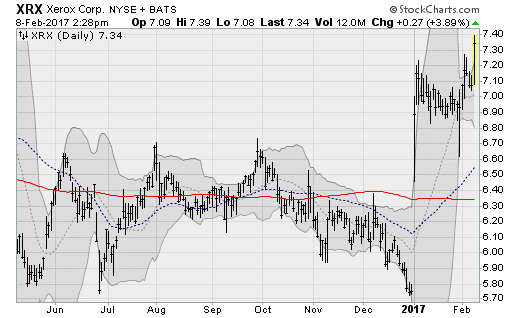

Tech Stocks to Buy: Xerox Corp (XRX)

Xerox Corp (NYSE:XRX) shares are lifting up and out of a two-month trading range on Wednesday to challenge its mid-2015 and mid-2016 highs. This would represent a breakout from a three-year consolidation range after shares settled into the doldrums following an impressive near-tripling from its 2012 lows into the late 2014 high.

The company reported mixed results on Jan. 31, with earnings in line with estimates, but revenues came in soft, down 7.2% from last year.

The company will next report results on May 2 before the bell. Analysts are looking for earnings of 16 cents per share on revenues of $2.45 billion.

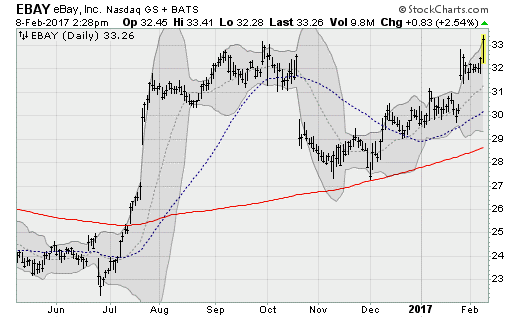

Tech Stocks to Buy: EBay Inc (EBAY)

EBay Inc (NASDAQ:EBAY) shares have pushed up and over its September/October highs to push to new record highs. Investors were pleased, apparently, with the announcement it would partner with WineDirect to expand its wine offerings by 1,400-plus wineries.

Shares for a lift in late January despite reporting mixed results for the prior quarter. Earnings came in at a better-than-expected 54 cents per share while revenues, despite growing 3.1% from the year ago period, missed slightly. Sentiment was boosted by strong holiday sales metrics.

The company will next report results on April 26 after the close. Analysts are looking for earnings of 48 cents per share on revenues of $2.21 billion.

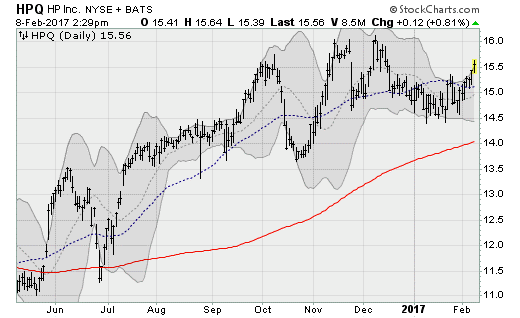

Tech Stocks to Buy: HP Inc (HPQ)

HP Inc (NYSE:HPQ) shares are lifting up and out of a three-month consolidation range to challenge its November/December highs near $16. Investors had been looking past the stock, on concerns over the health of the PC industry as well as cautious forward guidance issued by management back in November.

Sentiment seems to be turning, a possible sympathy rally related to AAPL’s numbers showing that consumers — emboldened, perhaps, by tax cut hopes and increased economic confidence — are opening their wallets for the latest electronic toys.

The company will next report results on Feb. 22 after the bell. Analysts are looking for earnings of 37 cents per share on revenues of $11.8 billion.

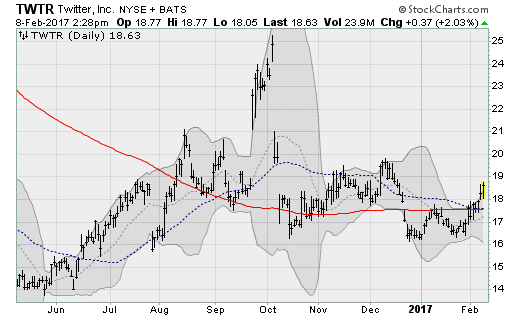

Tech Stocks to Buy: Nokia Corp (ADR) (NOK)

Nokia Corp (ADR) (NYSE:NOK) shares look ready to lift up and over December/January resistance to make a run at its 200-day moving average — a level not crossed since January 2016. The stock price is getting a lift thanks to an upgrade to overweight from analysts at Morgan Stanley on Tuesday.

Last week, the company reported better-than-expected earnings on in-line revenues. While its networks business is suffering from intense competition, the company is also aggressively moving into new areas like virtual reality

The company will next report results on May 4 before the bell. Analysts are looking for earnings of three cents per share on revenues of $5.8 billion.

Note: This article originally appeared at investorplace.com. For more articles about stocks to buy, click here…

The author of this article is Anthony Mirhaydari. Anthony is founder of the Edge and Edge Pro investment advisory newsletters.

Category: Technology Stocks