7 Micro-Cap And Small-Cap Stocks That Insiders Are Buying

Source: Shutterstock

Insiders sell for many reasons, but they only buy for one. To make money.

Insider buying could be a bullish signal for a stock. When an insider of a company wants to buy or sell their company’s stock, they need to inform the U.S. Securities and Exchange Commission. An insider is a person who has access to confidential information about a company. In other words, the important people in a company need to tell the public if they are buying or selling their company’s stock.

I always like to know what the insiders are doing when I consider making an investment. Even more so, I like to see if they are buying after the price has dropped dramatically. A lack of insider buying could suggest that the selloff was justified, while meaningful buying could be a significant bullish signal.

There are many reasons why an insider of a company may decide to sell. They may need money tuition or to buy a new house. But there is only one reason why an insider would buy their company’s stock. They believe it is undervalued and eventually they will make money.

There has been significant buying by the insiders in the following micro-cap and small-cap stocks recently.

Ideanomics (IDEX)

Ideanomics Inc. (NASDAQ:IDEX) is a fintech company with significant operations in the Chinese electric vehicle market. It is currently trading with a valuation of around $200 million.

Like many companies with exposure to China, IDEX has seen the price of its stock decline over the past year. However, it does seem to be coming back. Despite the recent volatility it is up 27% year-to-date. This company seems to have a lot going for it. Many analysts expect the Chinese EV market to expand rapidly over the next few year which would benefit IDEX.

Additionally, in the most recent quarter the company reported earnings of 5 cents a share. This is a significant improvement over last year’s loss of 12 cents in the same quarter. This could be a signal that Alfred Poor, who became the CEO a year ago, has begun to turn things around.

Bruno Zheng Wu is the chairman of the company. He recently acquired a block of stock in a private transaction. The seller was having liquidity concerns due to issues with other investments, so Wu agreed to pay $3 a share for 1.7 million shares. This was a personal investment of over $5 million and could be a significant bullish signal.

Briggs & Stratton (BGG)

Briggs & Stratton (NYSE:BGG) designs, manufactures and sells gasoline engines and outdoor power equipment. After its recent price drop, the company has a market cap of $187 million. Most analysts would consider this to be a micro-cap stock.

BGG stock dropped by almost 50% when it reported earnings which were way short of estimates. The company lost 45 cents a share while estimates called for a 45 cent profit. It traded at a multi-decade low but has since recovered a little.

Some of the insiders must think that this selloff was an overreaction and that the stock is a good value at these levels. There has been significant insider buying.

Frank Jaehnert is a director of BGG. He just bought 40,000 shares at $4.39. This was a $175,600 investment. Vice President of Product Innovation Mike Zeiler just paid $4.25 for 43,000 shares. This was an investment of $180,000. Other insiders have recently purchased the stock as well.

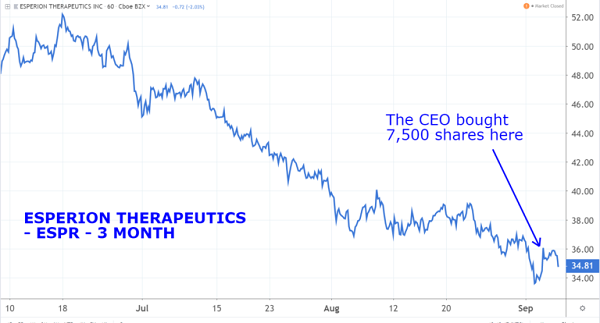

Esperion Therapeutics (ESPR)

Esperion Therapeutics (NASDAQ:ESPR) operates as a clinical stage bio-pharmaceutical company. The current market cap is about $1 billion.

ESPR stock has trended lower since June when it was trading around $52. Now it is around $35.

This could be because the company continues to lose money. In early August it reported an earnings loss of $2.01 per share. Analysts were looking for a loss of around $1.85 per share.

Tim Mayleben is the president and CEO of the company. He must think that the sellers have over-reacted to the news because he is buying the stock. He just made a substantial investment of $260,000 when he purchased 7,500 shares at an average price $34.55 on Sept. 6.

Wall Street agrees with Mayleben that the stock is a good value at current levels. Twelve firms follow Esperion. Nine of them have “buy” ratings on it while there are two “holds” and one “sell.” The average target price is around $85, significantly higher than current levels.

Forterra (FRTA)

Forterra (NASDAQ:FRTA) manufactures and sells pipe and precast products. At current levels the market valuation is around $402 million.

FRTA stock has been on a roller coaster ride over the past year. After trading around $9 last August, it lost almost two-thirds of its value when it traded as low as $3.45 in December. Since then it has been very volatile, but it is slowly recovering and currently trading around $6 a share.

Karl Watson is the CEO of Forterra. He is betting that this rally will continue. He just paid $5.98 for 20,000 shares. Back on Aug. 9, he made an even larger investment. He put $450,000 into the stock when he bought 65,200 shares at an average price of $6.94.

Other insiders have been buyers of the stock as well. Clinton McDonough is a director of Forterra. He recently bought 10,000 shares at $6.84. President of the Water & Pipes Products Divisions Vikrant Bhatia also made a substantial investment when bought 17,175 shares at $6.56 per share in August.

Sally Beauty (SBH)

Sally Beauty (NYSE:SBH) is an international retailer and distributor of professional beauty supplies. SBH stock’s current market cap is around $1.6 billion.

SBH has been trending lower since April. Now shares are in the $13 range. Some analysts believe that this is due to shareholders’ concern about the trade war and predictions of a recession.

This is in spite of the fact that it has solid earnings and at current levels has a very low forward price-to-earnings ratio of 6.

John Miller is a director of the company. Apparently he thinks the stock will soon rally because he just made a $500,000 investment. He paid $12.21 for 40,500 shares. Marshall Eisenberg recently paid $11.89 for 10,000 shares. He is also a director of Sally Beauty.

Harvest Capital Credit (HCAP)

Harvest Capital Credit (NASDAQ:HCAP) is an externally managed closed-end investment company. This is a micro-cap company with a current market value of around $62 million.

HCAP has been trending lower since reporting earnings and revenue that each fell short of expectations. Since then it has dropped by about 10%.

CEO of Harvest Capital Credit Joe Jolson has made numerous investments in the stock. The most recently reported one was on Sept. 6. He made a $150,000 investment when he paid an average price of $9.77 for 15,100 shares.

In addition to this, over the prior few weeks he also bought about a total of 15,000 shares. It could be that he is attracted to the current dividend at these levels, which is almost 10%.

Gulf Resources (GURE)

Gulf Resources (NASDAQ:GURE) manufactures chemical products. At current levels it has a market valuation of about $34 million, making it a micro-cap company.

Like many other companies in this sector, Gulf has been facing some challenges. This stock has lost about half of its value since April when it was trading around $1.41. The most recent close was 76 cents.

As a penny stock company that is based in China, this company is probably an extremely risky investment. Remember, penny stocks are penny stocks for a reason.

Ming Yang is a director of Gulf Resources. He must believe that despite the risk, it may be a good investment at current levels. He invested almost $500,000 into the stock when he bought over 660,000 shares at 72 cents.

At the time of this writing, Mark Putrino did not have any positions in the aforementioned securities.

See Also From InvestorPlace:

- 7 Triple Threat Growth Stocks to Buy for the Long Term

- 7 Deeply Discounted Energy Stocks to Buy

- 7 of the Best Financial Stocks to Buy Now

Category: Penny Stocks to Buy, Small-Cap Stocks