4 Must-Own Biotech Stocks As The Sector Comes Charging Back

Up 20% over the last three months, the biotech sector has come roaring back with a vengeance. Given the positive outlook for this sector, Bret Jensen shares his four “must-own” picks through year-end.

Up 20% over the last three months, the biotech sector has come roaring back with a vengeance. Given the positive outlook for this sector, Bret Jensen shares his four “must-own” picks through year-end.

After three quarters of significantly underperforming the overall market, the biotech sector has roared back in a big way so far in the third quarter. The sector, which recently emerged from its deepest and longest bear market since 2008, has returned just over 20% during this quarter as we go to press. The sector had become significantly oversold after a 40% peak to trough decline, and a recent uptick in M&A activity in some of the small and mid-cap portions of the industry has been a boost to sentiment and prices in the sector.

In addition, the area could get a nice post-election bounce after the November results show government will continue to be divided among the two major political parties. This should sideline any significant legislative actions that could negatively impact both the pharma and biotech industries.

Given my positive outlook on the sector going into the fourth quarter, in this column I am going to offer up a few picks through year-end that could benefit from the increasingly positive investor view on the sector and could see positive catalysts in the quarters ahead.

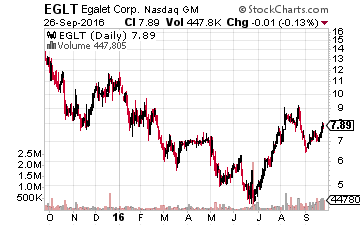

Let’s start with a small “off the radar” play in the emerging focus on non-opioid pain compounds that is being driven by the huge upsurge in deaths of opioid overdoses throughout the nation in recent years. Egalet (NASDAQ: EGLT) came public in 2014 and has a market capitalization of just $200 million at the moment. Its primary drug candidate is an abuse resistant pain compound called ARYMO ER that has an October 14th PDUFA date. Approval is highly likely as ARYMO ER was recommended for approval in early August by its Ad Comm panel by an 18 to 1 vote. The shares could also be helped this week as Pain Therapeutics’ (NASDAQ: PTIE) application for pain management drug Remoxy ER was rejected by the FDA which cratered its stock and might have investors looking for alternatives in the space. The stock of Egalet sells for just under $8 a share currently. Cantor Fitzgerald reiterated a Buy rating and $21 price target on the shares earlier in September.

Let’s start with a small “off the radar” play in the emerging focus on non-opioid pain compounds that is being driven by the huge upsurge in deaths of opioid overdoses throughout the nation in recent years. Egalet (NASDAQ: EGLT) came public in 2014 and has a market capitalization of just $200 million at the moment. Its primary drug candidate is an abuse resistant pain compound called ARYMO ER that has an October 14th PDUFA date. Approval is highly likely as ARYMO ER was recommended for approval in early August by its Ad Comm panel by an 18 to 1 vote. The shares could also be helped this week as Pain Therapeutics’ (NASDAQ: PTIE) application for pain management drug Remoxy ER was rejected by the FDA which cratered its stock and might have investors looking for alternatives in the space. The stock of Egalet sells for just under $8 a share currently. Cantor Fitzgerald reiterated a Buy rating and $21 price target on the shares earlier in September.

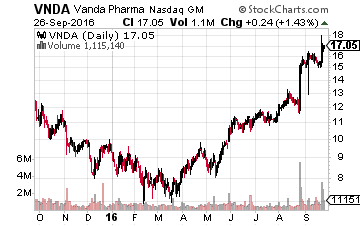

Next up is Vanda Pharmaceuticals (NASDAQ: VNDA). This small biopharma concern has two central nervous system drugs generating approximately $100 million in sales annually. According to a story in Reuters late last week, the firm is in talks with investment banks about getting an advisor to help it sort out its options, which could involve a potential sale. Given the interest in this space, Acadia Pharmaceuticals (NASDAQ: ACAD) and Sarepta Therapeutics (NASDAQ: SRPT) are two bigger names that have been the recipients of buyout rumors thanks to recent FDA approvals; I can see Vanda generating some interest from potential purchasers. The company also won a key legal victory recently that will give its key product “Fanapt” patent exclusivity through 2027.

Next up is Vanda Pharmaceuticals (NASDAQ: VNDA). This small biopharma concern has two central nervous system drugs generating approximately $100 million in sales annually. According to a story in Reuters late last week, the firm is in talks with investment banks about getting an advisor to help it sort out its options, which could involve a potential sale. Given the interest in this space, Acadia Pharmaceuticals (NASDAQ: ACAD) and Sarepta Therapeutics (NASDAQ: SRPT) are two bigger names that have been the recipients of buyout rumors thanks to recent FDA approvals; I can see Vanda generating some interest from potential purchasers. The company also won a key legal victory recently that will give its key product “Fanapt” patent exclusivity through 2027.

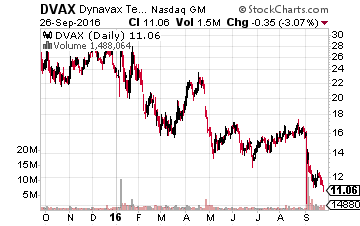

The long-running saga Sarepta had with the FDA around its treatment for Duchenne Muscular Dystrophy that finally resulted in approval last week for the company gives me hope that Dynavax Technology’s (NASDAQ: DVAX) hepatitis B vaccine HEPLISAV-B will finally be approved by the end of 2016. Hopefully at the current mid-December decision date with the FDA.

The long-running saga Sarepta had with the FDA around its treatment for Duchenne Muscular Dystrophy that finally resulted in approval last week for the company gives me hope that Dynavax Technology’s (NASDAQ: DVAX) hepatitis B vaccine HEPLISAV-B will finally be approved by the end of 2016. Hopefully at the current mid-December decision date with the FDA.

In an over 10,000 subject Phase III trial, its vaccine candidate provided not only greater protection rates (~95% to 81%) than the current standard on market but can also be effectively administered in just two doses over a month rather than three doses over six months. This will greatly improve the abysmal compliance rate of approximately 55% under the current vaccine regimen in addition to providing greater protection. The current hepatitis B vaccine does between $150 million to $200 million a quarter in revenues. Given Dynavax’s market capitalization of just $450 million, I think there is major upside to the stock if its vaccine finally gets approved. A sale to an established and larger player would also make sense upon approval.

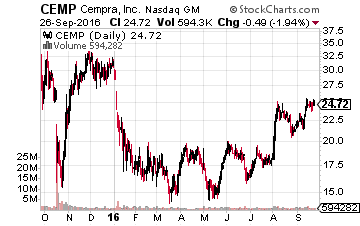

Finally, we have Cempra (NASDAQ: CEMP), a biopharma stock which has demonstrated some strength here in the market lately as well. The company’s lead drug candidate is Solithromycin which is targeting the “superbugs” that have evolved in hospitals and other medical settings in recent years thanks to the overuse of antibiotics.

Finally, we have Cempra (NASDAQ: CEMP), a biopharma stock which has demonstrated some strength here in the market lately as well. The company’s lead drug candidate is Solithromycin which is targeting the “superbugs” that have evolved in hospitals and other medical settings in recent years thanks to the overuse of antibiotics.

Solithromycin incorporates a new approach to treating patients with community-acquired bacterial pneumonia or “CABP”. According to the U.S. Centers for Disease Control and Prevention, CABP is the leading cause of death due to infectious disease in the United States, killing more than 53,000 people annually. Some 10 million scripts are written annually for CABP in the country so it is quite the lucrative niche as well.

The company has filed New Drug Applications (NDAs) on for both the oral and IV version on in the United States as well as Europe. Its PDUFA date for approval in the States is December 27th and I expect the compound to be approved and in the market both here and overseas in the first half of 2017. Pfizer (NYSE: PFE) recently picked up the antibiotics business of AstraZeneca (NYSE: AZN) and has spent more than $20 billion on acquisitions since its mega-merger with Allergan (NYSE: AGN) was derailed by the Treasury Department in April. It could be one possible suitor that might be interested in Cempra after approval.

Finding biotech stocks with upcoming catalysts for explosive growth like Xencor (up 87%), Artana Therapeutics (up 63%), and many more is a key component of my comprehensive strategy for massive profits in my newsletter, Biotech Gems.

Positions: Long ACAD, AGN, CEMP, DVAX, EGLT

Category: Biotech Stocks