Why Gold Is Heading Lower

Golds had an epic bull run over the past seven years. The precious metal rallied from just $400 an ounce, to reach a high of over $1,900 in September of 2011

a gain of over 380%!

Golds had an epic bull run over the past seven years. The precious metal rallied from just $400 an ounce, to reach a high of over $1,900 in September of 2011

a gain of over 380%!

But to quote literary legend Robert Frost, So dawn goes down to day. Nothing gold can stay. And so it is the same for the rally in the sultry metal quoted by the celebrated poet.

I guarantee many gold bugs will greatly disagree with me. Theyd cite the devaluation of the US Dollar, the collapse of fiat currencies, the accumulation of gold in Asian countries, etc…

But fundamentals are changing in favor of a gold selloff.

Heres why

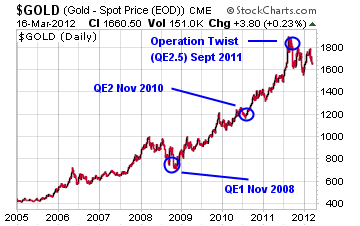

Many of you have heard of the various Quantitative Easing programs run by the Federal Reserve over the past four years. These programs go by the nickname QE1, QE2, and as of right now, ends with Operation Twist a sort of QE2.5 if you will.

These programs were rolled out to aid the US economy in avoiding deflation and entering into another great depression. But the QE programs also had another side effect creating a surge in commodity prices.

The reasons why this happened could fill an encyclopedia. But the basic idea is, every time the Fed added money to the existing supply of dollars (thats what QE is), the value of the US Dollar fell, interest rates dropped, and commodity prices surged. Of course, this includes gold!

Take a look at what each QE program did to the already rising price of gold

You can see that each time a QE was rolled out and money supply was increased, the price of gold surged. Better still, the rally in the yellow metal picked up pace in both the anticipation of each QE and during its actual implementation.

But what youll also see is that Operation Twist didnt drive gold higher. Thats because this QE2.5 didnt actually increase money supply like QE1 and QE2. And thats important to note.

As I said earlier, the fundamentals are changing

Gold has rallied into and with each additional QE round. And as the US economy failed to improve, each QE program helped keep things from turning much worse.

However, the US economy is now finally on track to continue its recovery without any further monetary stimulus. And that means the odds of another QE program (QE3) are decreasing. Theres simply no reason to suppress interest rates any further if inflation and growth are rising in the US.

A secondary reason gold is ready to collapse has to do with fear or the lack thereof.

If youre unaware, another use for gold is as a hedge. And many investors have used it as a safe place to hide during a very stormy recovery in the US market.

Now unless youve been asleep, youd know the US stock market is rallying. In addition, issues in Europe now appear to be mostly under control (thats an entirely different discussion).

The bottom line, any argument for holding gold is falling apart fast

If youve been buying gold penny stocks such as junior gold miners, you should consider selling these companies now before the floor falls out of the gold market.

When gold collapses, companies reliant upon an increase in the price of gold to help improve profits will sell off. And if you dont sell them ahead of a gold collapse, youre going to be in big trouble.

Some of these micro-cap gold exploration companies will simply fold up, much like the ridiculous tech companies that went under when the tech bubble burst.

It may not be this week, or next week but gold is headed lower in the coming months. And when the Fed announces its first interest rate increase or confirms there will be no QE3 look out below!

Editors Note: Discover how to make real money investing in penny stocks by reading our free report. Penny stock pro, Gordon Lewis, has put together a must read breakdown for anyone looking to profit in micro-caps. Click here to check it out.

Until next time,

Brian Walker

Category: Commodity Stocks, Gold Stocks