This Industry Has Triple Bottomed Buy It Right Now!

I had just finished submitting this very article for final editing and not five minutes later my cell phone rang. The name on the caller ID was none other than William Davis, Editor In Chief of our company.

I had just finished submitting this very article for final editing and not five minutes later my cell phone rang. The name on the caller ID was none other than William Davis, Editor In Chief of our company.

After some pleasantries were exchanged, Bill expressed some concerns about what I was writing

Brian, I really dont think its fair to the paying subscribers of Penny Stock All-Stars that you publish this article right now. I mean, this is some really good stuff here they should be getting it first!

Relax Bill, I said

I continued on, Im sure Gordons got something tasty hes cooking up for our paying subscribers this week. Besides, I really think its important to get this kind of research out there and into the hands of regular investors as soon as we find it.

Well, Im still not sure Brian, Bill replied. I just dont want to piss off anyone whos buying our newsletter no matter how much theyre making right now on Gordons penny stock picks.

There was a moment of extended silence before I replied

Seriously boss, I dont think this is flying under Gordons radar. He doesnt miss all that much. Theres something you need to remember. Gordons picks have great valuations, and with the condition of the players in this industry it may be too soon to get his subscribers into them. That may change in the coming months, but I dont think nows the time.

Brian, thats a great point, Bill once again said.

I wrapped it up by saying, Right now, anyone buying penny stocks in this industry is speculating big time. Its been a beaten down industry for over four years now a few months wont change that. Lets see how things pan out, and Im sure Gordon will be ready to roll out a trade when the timing is perfect!

Ok Brian, Im sold. You have my permission to go ahead on this.

So what industry were we talking about?

None other than the shipping industry, of course. You know, dry bulk shipping, tankers, etc the really big stuff whose rates are tracked on the Dry Baltic Index.

For nearly four and a half years, weve seen this industry in shambles. During this time, shipping rates have dropped to the point where shipping companies cant even cover their cost of operations to transport goods.

And of course, shipping stocks have sunk to the depths of the ocean floor as a result.

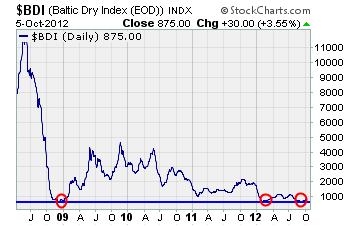

But the rates appear to have put in a bottom yet again this is the third time in the past few years the Dry Baltic Index has fallen near and tested the 650 level.

Take a look at the chart below to see the very recent retest of support

The red circles on the chart show a triple bottom has been formed over the past 3 plus years. Thats very powerful support were seeing here, and presents a huge opportunity for a massive move higher.

So whats behind the recent move off the bottom?

Well, two things are going on here that you should know about.

First, and most obvious, QE3 has arrived. Basically, QE3 (and the ECBs monetary stimulus) have been put in place to stimulate economic growth. As that happens, shipping demand will certainly increase as goods travel across the globe once again.

Second, and more specific to the industry itself, the United States will be a net exporter of Liquid Natural Gas (LNG) in the next couple of years. If you werent aware, Cheniere Energy (LNG) is the first natural gas company thats been approved by the US Energy Department to start exporting natural gas in 2015.

And there are dozens more with applications pending

In addition, demand is increasing in Asia where they already import natural gas at a major premium. This is no truer than in Japan, who has shut down their nuclear reactors – which is set to create record demand for the energy source.

Now heres the deal

Clarksons Shipping Research is reporting that nearly 59% of the $50 billion of new ship orders so far in 2012 are for LNG. Thats some pretty powerful data that leads me to believe the shipping industry is gearing up for the next big expansion in the industry.

In fact, its the combination of QE3 with the coming expansion of LNG exports that will certainly drive shipping rates once again to profitable levels.

Needless to say, there are plenty of penny stock shipping companies to choose from. In fact, weve highlighted some of them in past articles. Just be certain you know what youre buying, and as always- do your homework!

***Editors Note*** If youre considering shipping stocks, but just dont know when to get into the industry, our in-house guru Gordon Lewis has created a must read guide for anyone looking to capitalize on individual penny stocks. Click here to check it out.

Until next time,

Brian Walker

Category: Penny Stocks to Buy