The Three Worst Places To Put Your Money Right Now!

Judging from yesterdays market reaction, investors are afraid

very afraid. The first thing far too many investors do is hit the panic button and sell out stocks in their portfolio.

Judging from yesterdays market reaction, investors are afraid

very afraid. The first thing far too many investors do is hit the panic button and sell out stocks in their portfolio.

But right now, running for safety is the last thing investors should be doing.

Dont believe me? Ill explain why you should be holding US stocks instead of three traditional safe havens.

To make myself clear, traditional safe havens arent all that safe any longer. The top three choices most investors use as a safe haven are gold, government bonds, and cash. Sadly, all three present investors with some downside at the moment.

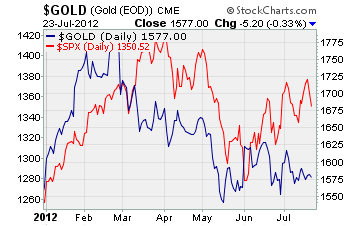

First off, gold has done nothing but fall since the high it hit back in March of this year. The chart below tells the sad tale of gold (blue line) versus the S&P 500 (red line).

Does that look like a safe haven to you? Clearly, youd have been better off holding stocks so far this year rather than the shiny yellow metal

Even worse, the gold bugs case as an inflation hedge can be thrown right out the window. With Junes Consumer Price Index (CPI), the official US gauge of inflation, coming in at just 1.7%… its hard to say anyone should be concerned about inflation right now.

Now, if you agree gold isnt a place to wait out the market turbulence right now, government bonds are no bargain either literally!

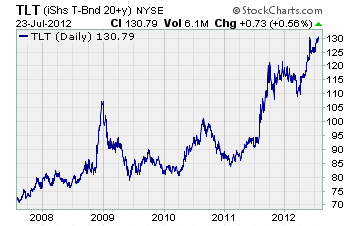

To understand better, take a look at the ETF that tracks the principal value of the US 20-year note

As you can see, US Treasuries are trading at record highs. And that makes them quite expensive at the moment. Even worse, the yield on these safe haven securities makes them equally as devastating to your portfolio.

For example, the 10-year note and 30-year bond each touched all time lows 1.398% and 2.477% respectively.

What kind of a return is that?

To give you an example, if you just bought US government debt, you now hold an investment with a rate thats so low, the 10-year note doesnt even keep up with the current CPI (inflation) of 1.7%!

Over the long run, that will destroy your buying power faster than you can imagine.

While bonds are clearly not worth buying right now, there is one worse place to be and thats in cash. Sadly, selling all of your stocks to prevent your portfolio from crashing is actually a great idea.

Timing the market, however, is a horrible one.

Unless you have a crystal ball that tells you when and where the market will turn, average investors have no business trying to time the market. Heck, even the pros are struggling to get it right these days. Simply tune into the mainstream financial media and youll hear how badly some hedge funds have done this year.

I want you to consider this

If you sold off all your stocks at the bottom of the crash last summer thinking the market was heading back to 2009 lows again youd be kicking yourself right now. Instead of saving your portfolio, youd have turned a 20% paper loss into a 20% realized loss.

I know for a fact some of you out there may have thrown in the towel last summer… and thats your story.

Certainly the headlines right now are concerning. The EuroZone debt crisis refuses to go away, and analysts are projecting further slowdowns in China and other BRICS nations.

But for US investors, stocks still remain the place to be. With over 70% of the hundred S&P 500 companies that have reported meeting or beating earnings expectations, stocks are proving to have the most upside potential of any investment.

Listen, certainly youre going to see a portfolio loaded with stocks move around in a volatile fashion these days. I dont care if its penny, small-cap, large-cap, or even mega-cap stocks its going to be a bumpy ride.

The thing is, safe havens really arent safe any longer. And if youre investing for the long haul, Id recommend you buy and hold stocks of companies you believe in.

When all this mess clears up, I can guarantee youll be glad you did.

Editors Note: Want to discover how to find the best penny stocks to hold during this crazy headline-driven market? Our penny stock pro, Gordon Lewis, has compiled a must read breakdown for anyone looking to profit in micro-caps. Click here to check it out.

Until next time,

Brian Walker

Category: Investing in Penny Stocks