Penny Stocks To Buy In Renewable Energy

Penny Stocks To Buy In Renewable Energy

Penny Stocks To Buy In Renewable Energy

With roughly three months to go until the end of 2015, the major US stock indices have done very little to get investors excited. In fact, the S&P 500 is down over 3% for the year. Small and microcap stocks, as measured by the Russell 2000, have performed a little better – but are still down over 2% year-to-date.

When a market is relatively flat (say between up 5% and down 5% for the year), it’s generally considered a stock picker’s market. That is, savvy stock investors can actually make money by picking certain stocks rather than relying on index-based or overall market returns.

Of course, this is especially true for penny stocks, which already tend to move less in unison with major indices.

So what are the right penny stocks to buy?

Well, there are thousands of penny stocks to choose from. But, we could narrow the list by focusing on certain industries that are attractive.

Let’s consider the energy sector.

Why energy? Well, we know there are generally lots of energy stocks which trade under $5. We also know energy is down this year due to the low price of oil.

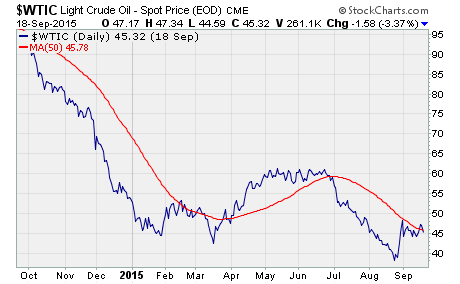

Just as a reminder, here’s the chart of oil:

The chart above shows the price of West Texas Intermediate Crude oil over the last year. WTIC is the type of oil we generally use for pricing in America. As you can see, the price of oil plunged heading into 2015. There was a moderate recovery in the spring and early summer, but oil is once again near the lows.

As you can imagine, the plunge in oil has created quite a bit of disarray in the energy industry. Several businesses are not worth operating with the price of crude so low. Moreover, other types of energy have come under investor scrutiny with oil becoming significantly more affordable.

Despite the headwinds for most energy companies, I still like the renewable energy industry for finding top notch penny stocks.

So then, why renewable energy?

First off, despite everything you hear about oil, natural gas, and any other type of fossil fuel, it can’t be denied that renewable energy is growing like crazy. Check out this table from the EIA, and you can see how much renewable energy usage has grown since 2005. It’s especially true for wind and solar power.

But that’s not all…

There are several other reasons to consider renewable energy penny stocks for investment. Let’s not forget, oil is still a finite resource. Even if it doesn’t run out anytime soon, it’s certainly going to get expensive again.

What’s more, companies and governments are starting to see real costs from the negative impacts of fossil fuel usage. Pollution, carbon emissions, waste, etc. are really starting to take a financial toll – and that’s going to get attention from all involved.

Companies in particular are going to want to find ways to save money on energy. And given all the costs associated with fossil fuels, clean and renewable energy is ultimately a cheaper product almost regardless of how it’s generated.

Finally, there are investment considerations. You see, several investors no longer want to fund oil-related projects while oil is this cheap. There’s simply no upside to those types of projects.

As such, even more investment dollars than normal are finding their way into the renewable energy industry. And, it’s just one more reason the industry is going to thrive moving forward.

Keep in mind, there are a lot of small companies in renewable energy. That means there should be lots of good small and microcap companies to choose from in the space. Do your research and I guarantee you’ll find some intriguing investment opportunities.

Good investing…

Brian Kent

Note: If you’re interested in learning more about Brian Kent’s Penny Stock All-Stars premium service… and learning about the stocks we’re trading for profit… you can get the inside scoop on penny stocks here.

Category: Penny Stock Tips