Penny Stocks To Buy In 2016

Penny Stocks To Buy In 2016

Penny Stocks To Buy In 2016

We are rapidly approaching the end of the year. It’s going to be here before we know it. So, it’s time to start thinking about what penny stocks we should put on our radar for 2016.

Although the calendar year means very little to the financial markets, there does tend to be certain themes from year to year. For instance, 2015 was definitely a tough year for energy stocks, but a good one for technology.

So what about 2016? Are the same themes going to continue into the New Year, or will it be all new variables to consider?

What are the penny stocks to buy next year?

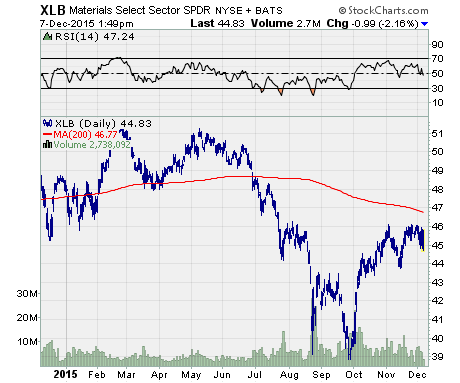

Take a look at this chart:

The Materials Select Sector $XLB is probably the most popular ETF for trading the basic materials sector. Yes, it focuses on large caps, but it will certainly give a reasonable indication of the overall sector (regardless of company size).

As you can see, the materials sector basically fell off a cliff in the early summer. While the sector has regained some ground at the end of the year, it’s still below the 200-day moving average. XLB is down about 4% year-to-date.

So what’s so interesting about the materials sector?

Investors who like to rotate among sectors may be thinking that energy is the way to go next year. However, I think energy is going to continue to be a painful experience for investors for the time being.

There’s still a huge glut of oil and gas on the market. And, new carbon rules could hurt fossil fuel industries even more. (Although, that could be a good thing for renewable energy.)

On the other hand, I believe the materials sector is ripe for a rebound. You see, basic materials tend to improve along with economic prospects.

On one hand, the US economy is certainly on the right track. The Fed is set to raise rates this month because of the strength of recent US economic data. The strong jobs market is just one sign of the improving economic fundamentals.

On the other hand, China may have finally bottomed out. If the economy starts turning around in the world’s second biggest economy, the demand for basic materials could grow exponentially.

I believe an increase in global demand will hit the materials market well before it impacts the energy market. Products like steel and copper are in good shape to get a boost in the coming year.

Fortunately, there are a multitude of penny stocks in the basic material sectors. Generally speaking, there are several small mining companies trading at penny stock prices. Some of these developmental mining companies could make excellent investments for the coming year.

However, and as always, do plenty of research before making any investing decisions. Having sales/delivery contracts in place is a good place to start when looking at developmental miners. Cash on hand is another good clue to the company’s health.

Good investing…

Brian Kent

Note: If you’re interested in learning more about Brian Kent’s Penny Stock All-Stars premium service… and learning about the stocks we’re trading for profit… you can get the inside scoop on penny stocks here.

Category: Penny Stocks to Buy