Neuromama – How To Turn $25K Into $35B (sort of)

Photo Credit: Nick Ares, Flickr

Would you like a 100 million-plus percent return on your money in a little more than four years? You would? Well, it can be done, but there are a couple of catches at the end that may prevent the enjoyment of the unearned riches.

Have a look at this article from Bloomberg.com: A $35 Billion Stock, an SEC Halt and Suspicions of Manipulation. Then meander, if you want, to the SEC EDGAR page for Neuromama.

If you read through the documents on Neuromama, it’s not different from what gets done with a penny stock to boost its value, and that is largely because it was a new penny stock when it was formed and started trading over-the-counter four years ago.

So how do you turn a sow’s ear into several billion silk purses? Simple:

- In March 2011, start the company for $3500. 35MM shares at $0.001 each.

- In 2012, sell 720,000 shares @ $0.03 each ($21,600) and go public. 30x as expensive as the first valuation. Initial name is Trance Global.

- In 2013, change the name to Neuromama, split the stock 750:1, and announce really big plans. Total shares: 3.1B+

- Borrow $370,000 to develop a website, and do a few other things.

- In late 2013, acquire a Library of Entertainment Assets including variety shows, feature films, television pilots, etc. Acquire the Assets in exchange for 4,866,180 of new common shares at a price of $20.55 (the closing price on September 3, 2013) for a total value of $100,000,000. The main owner cancels 80% of the common shares (which belonged to him) as an aspect of the deal. (Note: no cash changes hands.) Total shares: 630MM+

- Never file another financial statement with the SEC. Issue occasional 8Ks, and engage in a running dialogue with the SEC over how the development stage company doesn’t earn any money and has negative tangible net worth.

- Watch occasional minimal trading raise the price of the shares to $56+/sh. Market cap exceeds $35 Billion.

- Watch the SEC halt trading.

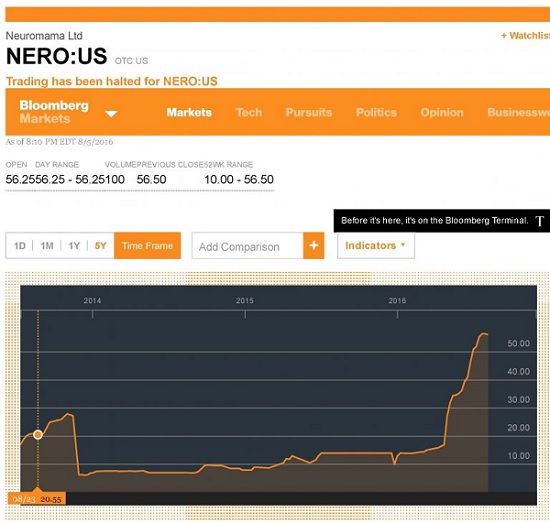

In my opinion, buying the intangible assets and attributing a price of $20.55/share for the stock given in exchange was the critical element of getting the market valuation so high. If you look at the graph at Bloomberg.com, and click the 5Y button, you will see that in late 2013 after the exchange was made, the stock price hovered in the $20s. (or, click on the image below for a static image of poorer quality abstracted from the Bloomberg website)

Neuromama / Picture Credit: Bloomberg.com

Here is a market cap of $35 billion for this stock with no business, no appreciable assets, no proprietary technology, no tangible net worth and no income — and can’t even do a few filings with the SEC. (It looks like they gave up talking in September 2014.)

So what is it worth? My best estimate is zero, to the nearest billion. ? This is still a cash-starved developmental stage business with no revenues after five or so years. It has had the chance to bootstrap a business together, and there is nothing except the website. The price should drop to something near zero when trading resumes.

Even if trading had not been halted, the ability of the owners to realize the value would have been quite limited. All they would have had to do is sell a 100,000 shares, and the stock price would collapse, because there is no one out there with $5 million of real cash that wants to buy 0.015% of an empty company like Neuromama. The interesting question is “who has been trading the stock,” because it is strictly speculative. It is possible that related parties have slowly pushed the price up.

Anyway, this is a good reason to stay away from developmental stage companies — really, anything that doesn’t generate significant revenue. It is also a reason to watch the fundamentals of a company rather than the stock chart only, which in this case has run up hard since 2014, but on almost no volume. The market capitalization is an illusion if there is nothing that can produce the cash flow to justify it.

Note: This article was written by David Merkel. He is a contributor to ValueWalk.com.

Category: Penny Stock Tips