May Day, May Day Market Down, Market Down

No, its not a radio signal from an airplane, its just the sounds coming from the mainstream financial media. You see, many analysts are looking at the latest series of economic data and calling for a May selloff.

No, its not a radio signal from an airplane, its just the sounds coming from the mainstream financial media. You see, many analysts are looking at the latest series of economic data and calling for a May selloff.

You know the saying, Sell in May and go away

Can they be right?

Well take a closer look in just a moment. But first, todays not just the first day of the month of May, but its also May Day.

If youre not aware, May Day is also known as International Workers Day. As a result, a number of global stock exchanges will be closed to commemorate the holiday. For instance, China, Germany, India, and Italy will all be closed. Others include France, Greece, Portugal, and Russia.

The list goes on and on .

This is important to note, as its going to reduce US market trading volume. In fact, Joe Bell of Schaeffers Research told CNBC that the average volume on May 1st is 29% below the normal daily average.

Even if todays market closes lower today, I wouldnt rush out to sell off your portfolio just yet

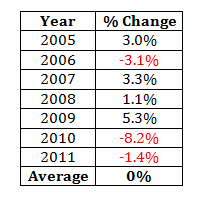

You see, sell in May and go away hasnt always been the right call in recent years. Take a look at the S&P 500s monthly performance for the month of May since 2005.

As you can see, the average monthly return over the past seven years is actually dead flat! And if you pull out the impact of the flash crash back in 2010, the average return for May would most likely be positive.

Id say, with the S&P on fire right now, the trend is hard to argue with.

Even if May Day is a down day, I wouldnt worry all that much. Its not a great representation of how stocks will end this month. And for penny stock investors, that goes double!

You see, the major averages may not move all that much on low volume, but a lack of liquidity can cause big swings in thinly traded penny stocks. Its actually opposite of how the overall market works. And that means some investors may panic if some of their holdings turn red for the day

But dont worry. Once liquidity returns to normal, a selloff in a solid penny stock simply turns into a buying opportunity for other investors waiting to get in.

The bottom line

If May Day ends in a selloff, its not necessarily a prediction that May will end badly. Remember, its a light volume day. And over the past seven years, the averages tell us that May is not the best month to go away.

What you should do is keep an eye open for big picture events, such as the jobs data this Friday. Thats the kind of stuff you need to watch to give you clues where this market is heading not some tired old saying.

Editors Note: If youre looking to add top quality penny stocks to your portfolio, our in-house penny stock guru, Gordon Lewis, can get you started off right! Discover his secret to finding winning penny stocks

Until next time,

Brian Walker

Category: Penny Stock Alerts