Marijuana Investing For Dummies… Part II

In part one last week, I told you how the recent election brought about the passage of two state laws legalizing marijuana. In both Washington and Colorado, voters passed separate laws legalizing either the possession and/or sale of the recreational drug.

In part one last week, I told you how the recent election brought about the passage of two state laws legalizing marijuana. In both Washington and Colorado, voters passed separate laws legalizing either the possession and/or sale of the recreational drug.

As I pointed out, this is not yet a done deal

While the voters of each state have made themselves clear, the reality is current federal laws pertaining to marijuana make possession and sale of the drug illegal. In its current form, the pot industry is doomed to remain in limbo.

So unless the new state laws impact changes in current federal laws, the reality of truly legalized marijuana may be just another pipe dream (so to speak).

That makes buying marijuana stocks right now extremely speculative

Certain dishonest entities are already trying to take advantage of unsuspecting investors. You see, the pump and dump crowd is already finding marijuana penny stocks to work on in the wake of the recent voting.

They may not be on record as being paid to pump these stocks yet, but theyre trying desperately to gain the attention of those third parties with all the cash. They see it as a great pumping opportunity

That means stocks like Medical Marijuana (MJNA) are being talked about by known paid promoters. The pumpers just cant help themselves. And even though the companys stock isnt even registered with the SEC, the pumpers are making MJNA out to be a must own investment.

Shame on them

After seeing these characters jump on MJNA so fast, I felt it would serve my readers well to hear about some other ticker symbols out there in the marijuana world. Below are just a couple of the stocks that are being written up by the pumping crowd, even though theres no record of paid pumping here. Again, these stocks arent technically being pumped, but you would be wise to avoid them anyway.

Cannabis Science (CBIS)

Cannabis Science is the latest iteration of a company that was started out as Patriot Holdings back in 1996. Between now and then, the company has been a healthcare tech entity, into oil and gas, and eventually became what they are today. Their current business plan involves developing marijuana-based medicines to help cancer and HIV patients.

Unfortunately, CBIS has $0 cash as of their latest quarterly report and the company lost $2 million in the same period. This may be a company worth looking at down the line, but not exactly something Id recommend you run out and plop your life savings in.

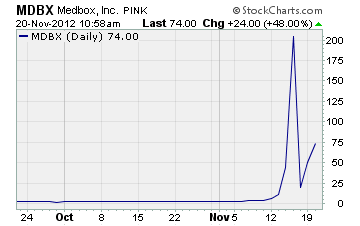

Medbox (MDBX)

Medbox has patented a kiosk-style dispensing machine that a number of medical marijuana dispensaries are currently using. The machine verifies the patients fingerprint and dispenses the proper dosage to them.

The company itself has some decent revenue, and turned a profit last quarter.

However, the trading on the stock has sent shares to ridiculous levels over the past week. Its been so bad, that the company CEO released a statement confirming there were no fundamental reasons for the stock to trade as high as it has. Take a look at the chart for yourself

Boy, Id hate to be the guy who bought at $200 a share!

Medbox management explained that since the company still holds most of the shares, the high demand and low float are whats caused the price to run so high. Theyve even urged caution to current investors.

MDBX is a case of a penny stock being caught up in the post-vote hype. Agreeing with the management here, potential investors should not only be cautious, but completely avoid buying Medbox shares.

The downside is far greater than the upside at this point.

Overall, theres too little visibility right now in the marijuana industry to warrant an investment. Even though these stocks may eventually become market leaders, the fact theyre being talked about by the pumping scene has me worried. Investors usually end up getting burned when that happens.

The bottom line

Keep your hard earned cash on the sidelines until the legislative smoke clears.

Until next time,

Brian Walker

Category: Penny Stock Alerts