Inflation Is Nothing To Worry About

Recently, my colleague Brian Walker wrote this article on why golds price drop makes for a great buying opportunity. But one of the reasons he gives for investing in the precious metal is because he expects inflation to soar.

Recently, my colleague Brian Walker wrote this article on why golds price drop makes for a great buying opportunity. But one of the reasons he gives for investing in the precious metal is because he expects inflation to soar.

More specifically, he believes Operation Twist, and other recent quantitative easing programs put forth by the Fed, will flood the economy with money and lead to inflation.

Of course, gold is considered by many to be an excellent inflation hedge. So, this recent pullback in the price of gold creates a particularly attractive entry point.

I agree with Brian the gold bubble hasnt popped. I view this as a temporary setback and believe the price will once again head higher.

But I dont think it has anything to do with inflation. In fact, Im not even remotely concerned about inflation right now.

Heres the thing

Inflation generally occurs when too many dollars are chasing too few goods. But thats clearly not a problem were having right now!

Look, the average person isnt seeing any of the Feds cash. And even if they were, theyd probably use it to pay down debt or stash it in a bank account.

Moreover, most companies arent spending either. Theyre hoarding cash, buying back shares, or acquiring other companies. None of those things will directly lead to inflation.

Fact is, most of the Feds easy money is sitting in the reserve accounts of large banks.

But what about commodities? Shouldnt we be worried about food and energy inflation?

The thing is, the recent bull market in commodities was mostly due to legitimate supply and demand concerns (and to some extent, the easy access to commodities from ETFs).

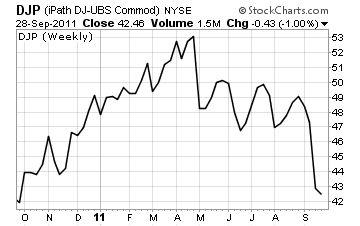

Dont believe me? Just look at the chart of the iPath Dow Jones-UBS Commodity Index ETN (DJP). Its a good indicator of the overall commodities market.

That sure doesnt look like investors are worried about inflation. More likely, its a sign that the demand driven surge in commodity prices is at an end.

Heres the key

Brian may be wrong about inflation, but hes not wrong about gold.

For many reasons, gold is considered a safe haven investment. It doesnt really matter if investors view it as a hedge against inflation, deflation, political uncertainty, or whatever. The important thing is that its viewed as safe. Period.

I mean, central banks around the world are buying gold by the ton! I cant think of any greater way to endorse golds safe haven status than the hoarding of it by central banks.

Whats more, it means theres a floor under the price. Those central banks wont be liquidating their gold holdings anytime soon.

Bottom line

Im not concerned about inflation whatsoever. But I do think this is a good time to buy gold, particularly gold miners. And gold miner penny stocks are trading at extremely favorable valuations right now. Dont hesitate to grab them while theyre cheap.

Yours in profit,

Gordon Lewis

Category: Gold Stocks