Hot Penny Stocks: ZOOM, CAMT, DSS

It’s an exciting time for penny stocks, especially penny stocks like Zoom Technologies (ZOOM), Camtek (CAMT), and Document Security Systems (DSS)

It’s an exciting time for penny stocks, especially penny stocks like Zoom Technologies (ZOOM), Camtek (CAMT), and Document Security Systems (DSS)

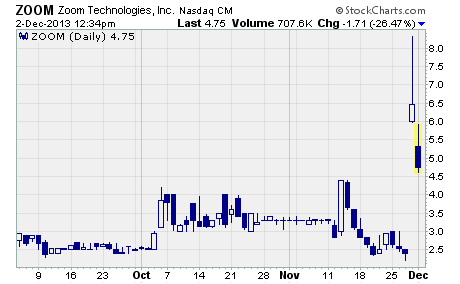

Zoom Technologies (NASDAQ: ZOOM)

This Chinese tech stock zoomed higher last week!

As you can see, ZOOM soared on Friday to a high of $8.30 before falling back to finish the week at $6.46. The move was good for a stunning 182% gain to the high from the prior week’s closing price of $2.94.

And despite a flurry of profit-taking, the stock closed out the the week with a profit of 120%.

China-based Zoom Technologies is a distributor of wireless communications services and equipment in the US. It distributes T-Mobile products and services to about 100 exclusive T-Mobile retail stores and approximately 1,000 multi-carrier retail locations. The company also manages T-Mobile retail stores.

Why did the stock take off?

On Wednesday evening, the company announced it is attempting to acquire Beijing Baifen Tonglian Information & Technology Co. (Baifen). Baifen is one of China’s leading providers of mobile advertising services.

ZOOM’s CEO, Mr. Lei Gu, had this to say about the deal…

“Baifen has a good business model with sustainable growth… enviable margins and a scalable business. We are truly excited for shareholders of Zoom. Baifen has a clear vision to maintain its position as a top player in the mobile advertising space.”

Shares of ZOOM are falling by more than 25% in today’s trade to around $4.75 per share. The heavy selling suggests the Street doesn’t like the proposed deal. However, the drop could have more to do with the company announcing today that it lost over $14 million in the third quarter.

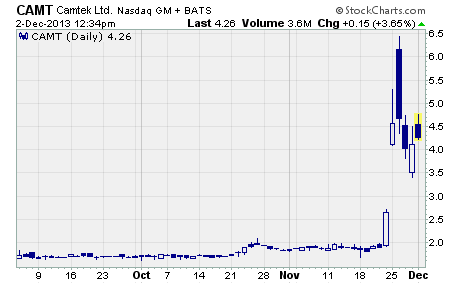

Camtek (NASDAQ: CAMT)

CAMT had a crazy week!

The stock surged from $2.65 to a high of $6.43 before falling back to a close of $4.11 for the week. Despite being unable to hang on to a 143% gain at the high, CAMT managed to finish the week with an impressive gain of 55%.

Why were the shares so volatile?

The stock took off on Monday thanks to a positive article about the company. Among other things, the article pointed to a statement by management that Camtek plans to launch a 3D inkjet solder mask printer early next year.

The new product launch would be a huge step forward for the company.

According to management, this new technology would expand the company’s addressable market by an additional $600 million to $700 million. It’s a significant potential change for a company that generated $79 million in revenue over the past 12 months.

However, management threw cold water on the euphoria the very next day.

On Tuesday, the company issued a statement intended to clarify its position on the 3D printing product. The company said…

“The first installation of the GreenJet System for evaluation in a customer’s manufacturing environment is expected to take place in the beginning of 2014 and, subject to the results, the Company’s expects the first commercial sales… to take place during 2014.”

There’s no question investors drove the stock up thinking the product would hit the market in early 2014. After the company’s clarifying statement, however, it became clear the product won’t be available for commercial sales until later in the year.

As such, many investors decided to book their profits now rather than wait to see what happens with the customer evaluations.

With that said, if Camtek’s 3D printing technology is a success, the stock could really take off. This is definitely one penny stock that is worth a closer look and possibly adding to your portfolio.

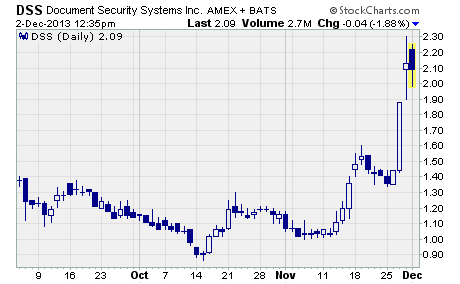

Document Security Systems (NYSE: DSS)

DSS has been trending higher since hitting a low of $0.86 in mid-October. But last week, the stock took off like a rocket!

Take a look at the chart…

As you can see, the shares jumped from $1.41 to a high of $2.30 before closing out the week just off the high at $2.13. That move was good for a one-week gain of 51%.

And the stock’s now up 143% from the low.

Document Security Systems provides turnkey security solutions to corporations, governments, and financial institutions around the world. Their security programs are designed to defeat fraud and to protect brands and digital information from an expanding worldwide counterfeiting problem.

Why did DSS surge last week?

The stock soared after the company said it filed a patent infringement lawsuit on Wednesday against Apple (NASDAQ: AAPL). The suit claims Apple has infringed on two specific patents that disclose systems and methods of using low power wireless peripheral devices.

What’s more, the suit alleges that Apple has used the patented technology in its Mac, iPhone, iPad, iPod Touch, and iPod Nano devices.

No question about it, investors piled into DSS thinking the company may be in line for a huge payday.

It’s not clear at this point just how valuable these claims truly are. But there’s no doubt the value is substantial as the devices listed above have generated tens of billions of dollars in sales for Apple.

DSS is definitely worth a closer look for your own portfolio. At a current price of $2.09, the stock has upside potential of over 90% to the analysts’ price target of $4.00 per share.

Profitably Yours,

Robert Morris

Category: Hot Penny Stocks