Has The Market Peaked?

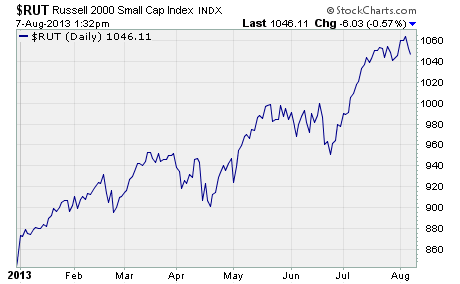

The major market indices are falling for a third consecutive day. And the Russell 2000, our proxy for penny stocks, is on track to register its second lower close in as many days.

The major market indices are falling for a third consecutive day. And the Russell 2000, our proxy for penny stocks, is on track to register its second lower close in as many days.

Given the market’s big gains this year, one has to wonder if this is the beginning of the end. Will we look back a few weeks from now and say this is the moment the market peaked?

The mainstream media says the market’s falling on concerns Fed tapering could begin as early as next month. As Bloomberg puts it, the S&P 500 “is headed for its first three-day drop since June 12, amid investor speculation the Federal Reserve will pare bond purchases as the economy strengthens.”

I would be inclined to agree if today marked the first time the Fed had hinted a change in policy is coming. But it isn’t. I’m sure you remember the central bank already broached this subject in June.

Since this news has been out there for a couple of months, I believe the market’s already pricing it in to some degree.

The market’s weakness in my opinion has more to do with concerns about corporate earnings growth.

Second quarter earnings season winds down this week. And according to Zacks, strong numbers from the Financial sector are masking weakness in most other sectors, particularly Technology.

Check this out…

Second quarter earnings for all companies in the S&P 500 are currently projected by Zacks to grow by +2.1%. However, when financial companies are excluded from the calculations, second quarter earnings are expected to drop by -3.1%.

And as for Technology, the data show earnings in this “growth” sector are actually down -10.9%!

If these projections are accurate, they certainly don’t bode well for the stock market.

Analysts have been projecting a ramp up in earnings growth over the second half of 2013 for a while now. But once they see the weakness in second quarter numbers, they will likely revise third and fourth quarter estimates lower.

Of course, the market has climbed higher this year on the assumption Fed stimulus will continue driving growth in corporate earnings. When investors realize the expected earnings growth is not materializing, I wouldn’t be surprised to see a rush to lock in profits.

And once the selling begins, there’s no telling where it will end.

Profitably Yours,

Robert Morris

Category: Breaking News