Chinas Hidden Buy Signal, Revised

Im going to take a look back at a hidden buy signal I handed our subscribers last summer. It was a pretty obscure buy signal, but it seems to have been spot on

Im going to take a look back at a hidden buy signal I handed our subscribers last summer. It was a pretty obscure buy signal, but it seems to have been spot on

When the news broke about Chinas GDP last year falling to 7.6%, many investors were ready to throw in the towel (again). The notion was that China couldnt keep growing at an exponential rate, and it worried the main stream on Wall Street.

How will China re-ignite their massive economy? and What can they possibly do? asked the pundits and analysts

It was at that moment I recall pounding the table for investors to buy not only Chinese stocks, but also penny stocks!

Heres what I had to say

Retail sales wont tell us what the government is planning to keep the Chinese economy moving. This, my friends, can be seen in Chinas Urban Fixed Asset Investments.

I went on to explain that fixed assets is a broad term for spending on construction, railways, machinery, and purchases of other hard assets. Government spending is what China would do to keep their economy growing, simply by building out their urban infrastructure.

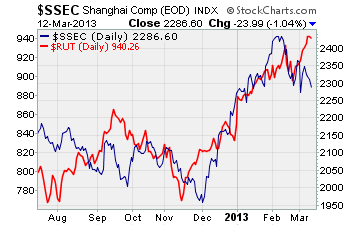

To get a visual of a bottoming in fixed asset investments, I showed you the below chart below for reference

While this hidden buy signal didnt cause an immediate rally, it was a fundamental catalyst. You see, that level of investment needs to work its way into the economy- and thats exactly what happened.

Im sure some of you are thinking, Hey, thats great Brian, good job but the past is the past. What about now?

Once again, lets take a look at the latest private investment data to see whats coming down the pike.

The important takeaway here is private investments in Chinas fixed assets is still very high. And for the moment, that may be enough to help keep the Chinese stock market rally rolling on

Until next time,

Brian Walker

Category: Chinese Penny Stocks, Investing in Penny Stocks