4 Undervalued Growth Stocks Deserving Your Interest

Pick up your pen and paper and write down the names of these four stocks that right now trade for valuations too low for their potential growth. With most stocks tading for premiums right now, finding four growth stocks with attractive valuations to add to your portfolio is worth your attention.

Pick up your pen and paper and write down the names of these four stocks that right now trade for valuations too low for their potential growth. With most stocks tading for premiums right now, finding four growth stocks with attractive valuations to add to your portfolio is worth your attention.

I have followed and invested in the biotech and biopharma arenas successfully for nearly three decades. In that time, I have never seen such an emphasis and focus on pain management which is already a huge market and growing every year. Opioid abuse has reached epic proportions in many counties and localities across the nation and has even become a campaign issue in some states. Over half a million emergency room visits happen every year because of overdoses on current pain management compounds. Over the past 15 years, prescriptions for all pain management products have more than quadrupled. The race is on for more effective drugs to ease pain and ones that are less prone to be abused.

Here are a couple of developing plays in the space with attractive risk/reward profiles at current levels.

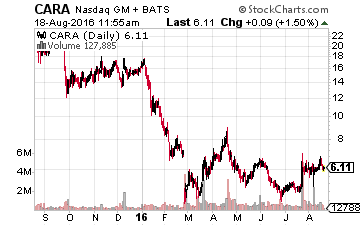

Let’s start with Cara Therapeutics (NASDAQ: CARA), a small developmental biopharma that focuses on developing pain management drugs to reduce side effects and the addictive properties of approved opioids. Cara’s most advanced compound, CR845, is currently undergoing clinical testing for acute pain and pruritus. This patented compound possesses analgesic, anti-inflammatory, and anti-pruritic activities appropriate for multiple therapeutic applications. The phase III trial result for acute pain in post-operative patients should be out by the end of 2016.

Let’s start with Cara Therapeutics (NASDAQ: CARA), a small developmental biopharma that focuses on developing pain management drugs to reduce side effects and the addictive properties of approved opioids. Cara’s most advanced compound, CR845, is currently undergoing clinical testing for acute pain and pruritus. This patented compound possesses analgesic, anti-inflammatory, and anti-pruritic activities appropriate for multiple therapeutic applications. The phase III trial result for acute pain in post-operative patients should be out by the end of 2016.

CR845’s primary benefit is that unlike currently marketed opioids, this new compound does not produce inhibition of intestinal transit (ileus), does not induce life-threatening respiratory depression, nor does it elicit signs of addiction or euphoria. Cara is also testing an oral version of CR845 for acute and chronic pain. The company plans a multiple-dose Phase 2b study in OA patients in the second half of this year which will be an upcoming milestone when it commences.

Given that Cara sports a market capitalization of approximately $175 million and a stock price near $6 a share, finding success in managing post-operative pain in a roughly $9 billion a year market could obviously be a game changer for the company. A couple of analyst firms have put price targets in the low $20s on Cara in August.

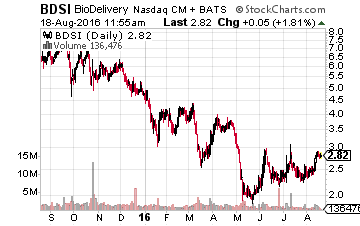

Next up is BioDelivery Sciences (NASDAQ: BDSI), which takes existing pain management drugs and puts them on a thin film strip that can melt under your tongue instead of being injected. It has two primary products on the market in the area of pain management. BUNAVAIL is one, which it wholly owns and consists of a combination of Buprenorphine and Naloxone. Buprenorphine is used for non-opioid-tolerant individuals in lower dosages and to control moderate chronic pain in even smaller doses. Naloxone blocks the effects of opioids.

Next up is BioDelivery Sciences (NASDAQ: BDSI), which takes existing pain management drugs and puts them on a thin film strip that can melt under your tongue instead of being injected. It has two primary products on the market in the area of pain management. BUNAVAIL is one, which it wholly owns and consists of a combination of Buprenorphine and Naloxone. Buprenorphine is used for non-opioid-tolerant individuals in lower dosages and to control moderate chronic pain in even smaller doses. Naloxone blocks the effects of opioids.

Belbuca consists simply of buprenorphine delivered via this film strip and is marketed and distributed by a partner, Endo International (NASDAQ: ENDP). In the most recent quarter, BioDelivery Sciences signed a major deal with a managed care network that covers slightly over 10 million individuals to be a preferred formulary choice. BUNAVAIL has also been added to a second smaller plan where it will replace Zubsolv and share preferred status with Suboxone film. This should boost sales substantially in 2017 when the contracts come into effect.

Belbuca was just launched in late February and is showing a solid growth trajectory. In the week ending July 29th, Belbuca had 1,300 prescriptions, its highest weekly total to date. At around the same market capitalization of Cara, this stock has nice upside as Belbuca sales continue to grow and BUNAVAIL moves to a higher revenue plan with its managed care contracts kicking in in less than 5 months.

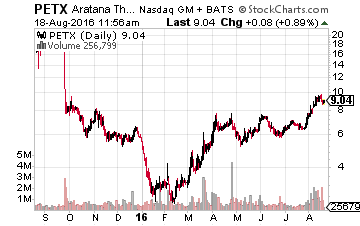

Next up is Aratana Therapeutics (NASDAQ: PETX), which had its compound, “Nocita”, approved by the FDA last Tuesday for managing post-operative pain in canines. It was the third drug this unique veterinary drug play has garnered in less than six months. It’s first drug “Galliprant” was approved in March. This compound is intended to control pain and inflammation associated with osteoarthritis in dogs. The company signed a large collaboration deal with Elanco to market and distribute this compound in April. Entyce was approved for stimulating appetite in canines in May and is wholly owned by Aratana and will be on the market in early 2017. Even with its recent rally, the stock has just over a $300 million market capitalization and over $100 million of that is net cash. This equity has the “Big Mo” and further upside.

Next up is Aratana Therapeutics (NASDAQ: PETX), which had its compound, “Nocita”, approved by the FDA last Tuesday for managing post-operative pain in canines. It was the third drug this unique veterinary drug play has garnered in less than six months. It’s first drug “Galliprant” was approved in March. This compound is intended to control pain and inflammation associated with osteoarthritis in dogs. The company signed a large collaboration deal with Elanco to market and distribute this compound in April. Entyce was approved for stimulating appetite in canines in May and is wholly owned by Aratana and will be on the market in early 2017. Even with its recent rally, the stock has just over a $300 million market capitalization and over $100 million of that is net cash. This equity has the “Big Mo” and further upside.

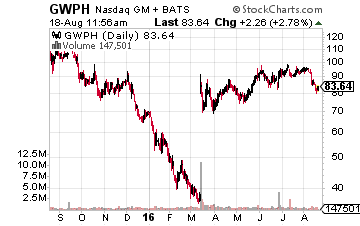

Finally, we have medical marijuana pioneer, GW Pharmaceuticals (NASDAQ: GWPH). It is using the properties of that plant that has long been used to help cancer patients and others in severe pain be able to hold down food and ease discomfort in a variety of medical conditions through a fairly extensive pipeline as can be seen in the chart above. It has numerous upcoming trial milestones and also has gotten a lot of analyst support of late as well. In the past two weeks, Cowen & Co., Piper Jaffray and Cantor Fitzgerald have reiterated Buy ratings with price targets ranging from $135 to $165 a share. The stock currently trades a little above $80 a share, implying significant upside.

Finally, we have medical marijuana pioneer, GW Pharmaceuticals (NASDAQ: GWPH). It is using the properties of that plant that has long been used to help cancer patients and others in severe pain be able to hold down food and ease discomfort in a variety of medical conditions through a fairly extensive pipeline as can be seen in the chart above. It has numerous upcoming trial milestones and also has gotten a lot of analyst support of late as well. In the past two weeks, Cowen & Co., Piper Jaffray and Cantor Fitzgerald have reiterated Buy ratings with price targets ranging from $135 to $165 a share. The stock currently trades a little above $80 a share, implying significant upside.

Those are my picks in the evolving world of pain management, a part of the biopharma world that is getting more and more focus these days.

Finding biotech stocks with upcoming catalysts for explosive growth like Inovio and Novavax is a key component of my comprehensive strategy for massive profits in my newsletter, Biotech Gems.

And while I spend hours researching biotech stocks every week, I select only those meeting my stringent 6 point criteria developed over my decades-long successful biotech investing career.

Positions: Long BDSI, CARA, PETX

Category: Biotech Stocks