Benefits Of Utilizing A Stock Screener

Generating investment ideas can be tough. If you’re looking for ways to accomplish this task I wrote a whole article on the subject here, but with this post I want to focus on one way in particular, stock screeners. A stock screener can be an excellent way to generate investment ideas in an objective, unbiased manner.

Generating investment ideas can be tough. If you’re looking for ways to accomplish this task I wrote a whole article on the subject here, but with this post I want to focus on one way in particular, stock screeners. A stock screener can be an excellent way to generate investment ideas in an objective, unbiased manner.

Talking Points:

- Benefits of utilizing a stock screener

- Recommended stock screeners

- How I use the FINVIZ stock screener

Benefits Of Utilizing A Stock Screener

One benefit I’ve already touched on is idea generation. It’s not that easy to come up with solid, undervalued investment ideas these days. And unless you want to pull a Warren Buffett and read about every stock from A-Z, then I recommend using a screener every now and then.

In addition to generating ideas, using a stock screener is a great way to eliminate bias and emotion. Technically, it’s the ultimate mechanical process. All you do is enter in the data and the screener will spit back an objective list based on the criteria you set for it.

Lastly, it’s relatively easy and takes little to no time once you have it setup. Think about it, you can set up a variety of screens, depending on what you may be looking for, and instantly see which stocks make the cut. In other words, all you have to do is a little upfront work and then hit enter from there on.

Recommended Stock Screeners

I’ve used a few screeners and there are only 2 that I would recommend and really only 1 that I use consistently.

Google Finance – Completely free, easy to use, and offers a variety of options to filter stocks. A useful tool but not one I find myself using all that often.

FINVIZ – This is the screener I prefer and the one I would recommend you using as well. It’s also free and has an excellent interface with everything you need. The fundamental tab is a great way to search for undervalued stocks.

A quick note on ready-made screeners. I’m not a big fan of using these unless you know exactly which metrics they’re analyzing AND you trust the creator. In general, I recommend to create your own for two reasons:

- It makes you think and decide which metrics you should be analyzing

- You’ll know excatly what metrics you’re filtering for

How I Use The Finviz Stock Screener

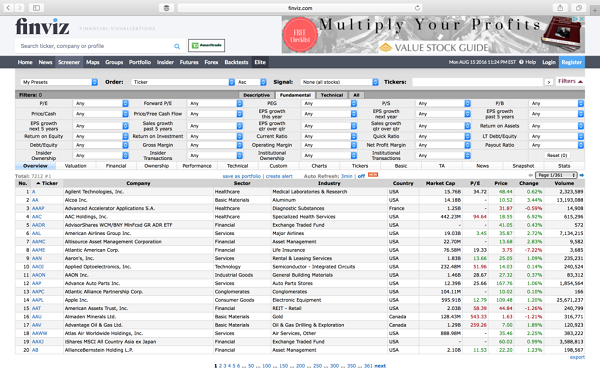

Head to FINVIZ.com, click on screener located in the top navigation bar, and go to the fundamentals section. Once you’re there it should look something like this:

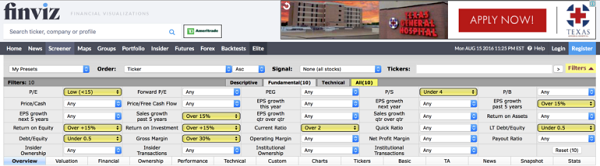

For this post, we’ll setup a screen I use all the time. It’s simple and straightforward, but still analyzes 10 different metrics. Let’s go through them real quick and then we’ll take a look at the final results:

- P/E – While I would rather use EV/EBIT or P/Owner’s Earnings, P/E will work. With this screen, I’m going to filter out any stock over 15, the historical average

- P/S – The trick is to not be too narrow or too broad when you’re creating a screen. For instance, ideally I would like to see a P/S of less than 2 but that would probably leave only a few stocks once we’re finsished. But the maximum I want to look at would be a P/S of 4 in order to narrow down our list somewhat. The main point is to generate a few ideas so we can analyze them more in depth later. And this goes for all metrics, not just the P/S ratio

- Earnings & Sales Growth Past 5 years – If management has been solid and a competitive advantage exists, then both of these should be over 15%. If not, they don’t make the cut

- Return on Equity & Return on Investment – Two metrics that Warren Buffett and Charlie Munger regularly analyze so I figure I might as well too. A consistent pattern of 15% or more is ideal

- Current Ratio – We also want a strong financial company. One way to check this is by analyzing the current ratio. I typically set this at 2 or greater

- Debt/Equity & Long-Term Debt/Equity – Another way to determine financial health is to look at short-term and long-term debt to equity. It’s important to analyze both since we want to make sure the company isn’t at risk of default as well as not taking on too much debt to fund operations. I generally set this to less than 0.5

- Gross Margin – Companies with a competitive advantage should always display high gross margins. We’re looking for a minimum of 30%

Once you apply the conditions to the screen it should look something like this:

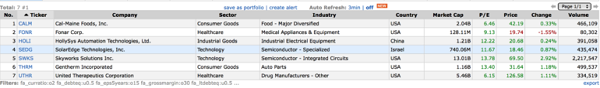

You can play around with the numbers and wind up with a variety of different lists, but this screen filtered out all stocks except these:

Remember, this is just a general screen, but it’s still one I use quite often (I currently hold positions in a few of these stocks) and have good results with.

Summary

- Stock screeners can help you generate investment ideas in an objective, unbiased manner in a matter of minutes

- My personal favorite is FINVIZ, but there are several free screeners out there so see which one you like the most

- A general screen that isn’t too narrow or broad can produce a great list of stocks

- Remember it’s just that – a list of stocks. You still need to perform fundamental analysis to determine if it’s a sound investment

Note: The author of this article is Chris Gilbert. He is a contributor to ValueWalk.com.

Category: Investing in Penny Stocks