Penny Stocks To Buy In Commodities

Penny Stocks To Buy In Commodities

Penny Stocks To Buy In Commodities

Investors are finally starting to realize just how bad commodities have been for the past year or so. Certainly anyone investing in commodities has been aware of this… but now mainstream investors are getting clued in to just how bad it’s been. And it’s not just oil, just about every commodity has taken a beating recently.

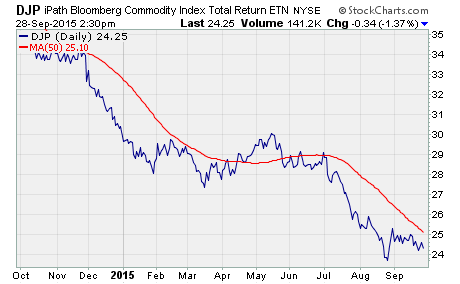

For instance, iPath Bloomberg Commodity ETF $DJP is down 18% year-to-date and 29% from this time a year ago. DJP is an equally weighted commodity index ETF, so it’s a pretty good indicator of what’s been going on overall.

Here’s the chart:

It’s obvious from the chart just how bad it’s been over the last year. But, just to give you a few more data points, check these out:

Crude oil is down 54% over the last year. Heating oil is down 45%. Coffee is down 41%. Natural gas is down 36%. Sugar is down 29%. Copper is down 26%. Even gold, the popular safe-haven investment, is down 7% over the past year.

So as you can see, commodities have basically taken a bath across the board. Does this mean you should avoid commodity penny stocks as well?

Not necessarily.

So what are the right commodity penny stocks to buy?

Commodity companies are well represented in the ranks of penny stocks, so there are plenty to choose from. However, I think the key is to avoid highly speculative companies, particularly those related to gold and oil.

Here’s the deal…

You see, one of the main reasons for the fall in commodities is oversupply. It’s particularly true of oil due to all the fracking-generated supply. The world’s oil storage tanks are basically overflowing.

As such, it’s going to be very difficult to justify spending money on a speculative oil investment when so few operations are profitable as it is. This glut could take years to sort out.

Regarding gold, with global central banks no longer stocking up on the precious metal, demand is nowhere what it used to be. Here again is a situation that likely won’t change anytime in the near future.

So then, which penny stocks to buy?

Commodities can’t stay in the dumps forever, despite the oversupply situation. But, as I explained above, some commodities are likely going to have a longer road to climb. Those are the ones to avoid.

In the meantime, there’s always going to be demand for things like corn and cocoa. Plus, these commodities can actually see immediate supply hits due to inclement weather. As such, I’d be looking at commodity companies related to agricultural and soft products as much as possible.

There are typically a fair amount of agricultural-related penny stocks out there. There may be equipment or chemicals businesses in the ag industry, to name a few possibilities. These are the better long-term commodity bets.

If you’re interested in mining companies, I’d stick to base metals companies rather than precious metal ones. There’s a built-in demand for base metals, such as copper, which provide enough intrinsic value to metals to make downturns less likely to be as severe.

The key here is to avoid the most speculative companies. Try to stick with established companies which are only down to penny stock levels due to the commodity selloff – and not due to the company itself. Keep in mind, no asset class is going to be down forever. Eventually, commodities will rebound. And, you’ll be in good shape if you own the best in class commodity penny stocks.

Good investing…

Brian Kent

Note: If you’re interested in learning more about Brian Kent’s Penny Stock All-Stars premium service… and learning about the stocks we’re trading for profit… you can get the inside scoop on penny stocks here.

Category: Penny Stocks to Buy