7 Marijuana Penny Stocks To Consider For Those Who Can Handle Risk

Source: Shutterstock

These seven marijuana penny stocks are actually worth learning more about if you can stomach risk

[Editor’s note: This story will be updated each week with new stocks and analysis. Please check back often for Mark’s latest take on marijuana penny stocks.]

Cannabis equities are in a complete meltdown. This is especially true for marijuana penny stocks. Many companies in this industry seemed like they had great prospects just a year ago. Now their stocks are crashing and many of them may not survive.

This is not surprising. History shows us that when new revolutionary industries are developed, there is an initial period of enormous growth and expansion. This is followed by a period of bankruptcies, consolidations and takeovers.

A great example of this is the car industry. Within a few years of becoming a viable business, there were more than two hundred companies in the United States that produced automobiles. A decade later there were essentially three. The same dynamics occurred in radio, television, internet and other industries that saw explosive growth when they were developing.

The cannabis industry is currently in this stage of its evolution. Investors now understand that many companies in the industry are losing a lot of money. Many of these (formerly) large companies will not make it. There will most likely soon be numerous acquisitions, consolidations and bankruptcies.

The U.S. Securities and Exchange Commission considers penny stocks to be stocks that trade for under $5 a share. The shareholders of the following seven companies have not been very fortunate. After seemingly having so much potential just a short time ago, their stocks have become penny stocks.

You need to be very careful when investing in this part of the market.

Ananjan Bhattacharyya and Abhijeet Chandra of Cornell University summed it up perfectly in a paper they wrote when they explained “Penny stocks are attractive investment avenues for small retail investors and most of them are aware that such investments might be wiped out due to huge risk associated with the penny stocks.” With that in mind, let’s take a look at several marijuana stocks that are worth a look now.

Marijuana Penny Stocks to Consider: HEXO Corp. (HEXO)

HEXO Corp. (NYSE:HEXO) grows and sells cannabis in Canada.

As recently as May, HEXO stock traded above $8 a share. The most recent close was $2.85. That is a drop of over 60%. The market capitalization was close to $2 billion. It is currently about $690 million.

The Green Organic Dutchman (TGODF)

The Green Organic Dutchman (OTCMKTS:TGODF) is a cannabinoid-based research and development company in Canada.

Last September, TGODF stock traded above $7 a share. After dropping almost 90% it is now trading around 85 cents.

The current market capitalization is about $235 million. It used to be over $1.9 billion.

KushCo Holdings, Inc. (KSHB)

KushCo Holdings, Inc. (OTCMKTS:KSHB) is a wholesale distributor of packaging supplies.

In January, KSHB stock traded above $7. Now shares are trading around $1.50. This an almost 80% decline. The market cap is about $130 million. It was over $600 million.

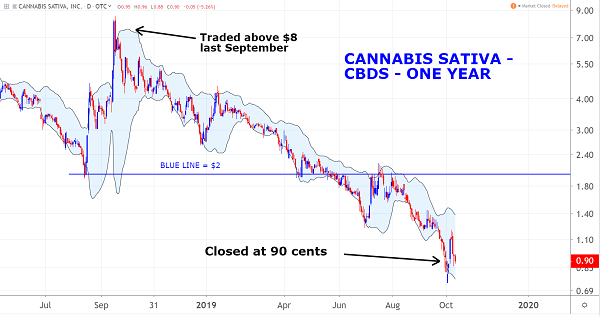

Cannabis Sativa, Inc. (CBDS)

Cannabis Sativa, Inc. (OTCMKTS:CBDS) develops, manufactures and sells herbal-based skin care products.

CBDS stock reached highs of over $8 a share last September. Since then the price has fallen by over 80%. The most recent close was at 90 cents.

Its current market cap is about $20 million. At its high, the market cap was over $175 million.

Harvest Health & Recreation Inc. (HRVSF)

Harvest Health & Recreation Inc. (OTCMKTS:HRVSF) cultivates and sells cannabis at five retail stores.

HRVSF stock was trading at levels around $10 in April. Since then, it has dropped by over 70%. Its most recent close was at $2.40.

The market capitalization used to be close to $3 billion. Now it is $692 million.

Emerald Health Therapeutics, Inc. (EMHTF)

Emerald Health Therapeutics, Inc. (OTCMKTS:EMHTF) produces and sells medical cannabis in Canada.

In January 2018, EMHTF stock traded above $7 per share. It is now trading at 78 cents. That is a decline of almost 90%.

The current market cap is $115 million. At its peak it was over $1 billion.

OrganiGram Holdings Inc. (OGI)

OrganiGram Holdings Inc. (NASDAQ:OGI) produces and sells dried cannabis and cannabis oil in Canada.

As recently as May, OCI stock traded above $8 a share. Its most recent close was $2.72. That is a decline of about 65%.

The current market cap is $420 million. It was $1.23 billion.

At the time of this writing, Mark Putrino did not have any positions in the aforementioned securities.

See Also From InvestorPlace:

- 3 Blue-Chip Stocks to Buy In October

- 7 Beverage Stocks to Buy Now

- 5 Semiconductor Stocks Worth Your Time

Category: Marijuana Stocks