7 Marijuana Penny Stocks To Consider For Those Who Can Handle Risk

Source: Shutterstock

Investing in marijuana penny stocks could bring great profits. Here are seven to consider

The allure of investing in marijuana penny stocks can be very strong. Every investor has dreams of investing a couple thousand dollars in a penny stock, watching it go to $100 per share, and making millions of dollars. I know that I sure do.

Even more tempting are penny stocks of companies that are in the marijuana industry. In this rapidly boom industry, it seems reasonable to assume that there are some hidden gems out there.

But you need to be careful when investing in low prices stocks because most of these companies will not survive. After all, there is a reason why they trade at such low prices.

The following seven marijuana penny stocks are worth considering for different reasons. These are not recommendations. I just want to give you some insights to help you make a decision.

Emerald Health Therapeutics Inc. (EMHTF)

Emerald Health Therapeutics (OTCMKTS:EMHTF) is a pharmaceutical company that produces and sells cannabis products.

I think that there will soon be a price war in the cannabis industry. That is because investors are starting to realize that the costs savings of growing cannabis outside outweigh any benefits that growing indoors or in greenhouses.

The large growers like Tilray (NASDAQ:TLRY), Cronos (NASDAQ:CRON), Aphria (NYSE:APHA) and Aurora (NYSE:ACB) primarily grow indoors or in greenhouses. They may have difficult time competing with the outdoors growers that can offer their customers much lower prices.

Emerald Health grows in greenhouses but they are moving into outdoor growing. The company just received it cultivation license from Health Canada for a 12-acre outside grow area. This early move into outside growing could be a very bullish dynamic.

Technically, this could be a logical place to buy EMHTF. It is a level that was support in December. It is also very oversold.

48North Cannabis Corp (NRTH)

48North Cannabis Corp (TSE:NRTH) grows and sells medical marijuana.

NRTH is also moving towards outdoor growing. The company announced last week that it successfully completed the planting of its first outdoor cannabis crop. This was at their 100-acre farm in Bryant County, Ont.

This farm has 3.7 million square feet of growing space and the ability to yield over 100,000 pounds per harvest. That’s a lot of weed. And its organic.

I think that in addition to the cost savings, outdoor growing may have two other advantages as well. Some marijuana aficionados say that the best marijuana is grown in natural sunlight, so there may be an advantage in quality.

The second advantage could be that growing in natural sunlight is socially conscious. The indoor growers need a tremendous amount of electricity for their operations and that results in pollution. Many customers of this industry are very concerned about climate change so this may affect their buying decisions.

Cannabix Technologies Inc. (BLOZF)

Cannabix Technologies Inc. (OTCMKTS:BLOZF) develops and manufactures marijuana breathalyzers for the police. The stock symbol is pretty cool. BLOZ which is pronounced as blows. The F is added because it is a foreign company.

I like idea behind Cannabix but I am not so sure that its future prospects are good. Unfortunately for BLOZF shareholders, the company has not turned a profit in the past 5 years. The stock just broke support at the 80 cents level. This level will now probably become a resistance level.

Support becomes resistance because people who bought the stock at 80 cents are now losing money. They tell themselves that if it rallies back to 80, they will sell it. This sell interest creates the resistance level.

Medipharm Labs Corp. (MEDIF)

Medipharm Labs Corp. (OTCMKTS:MEDIF) is a medical cannabis company that focuses on downstream extraction and purification technologies.

This company caught my attention due to the increased trading volume. This shows that maybe some of the bigger Walls Street funds or investors are getting involved.

Medipharm just announced that it is moving from the Toronto Venture Exchange to the Toronto Stock Exchange. When a company moves its stock what is considered a higher tier exchange, such as in this case, it means that it will have more transparency and will make more disclosures.

This is typically considered a bullish development for a company. Being on a higher tiered exchange gives it more credibility and makes it more appealing to investors.

Neptune Wellness Solutions Inc. (NEPT)

Neptune Wellness Solutions Inc. (NASDAQ:NEPT) engages in the extraction, purification, and formulation of cannabis products. This company caught my attention because it has been trending higher all year. Then yesterday, some positive news hit the tape.

NEPT raised $41 million in a private placement. This means they issued new shares to private institutional investors in exchange for the cash. Shareholders must believe this is great news because the stock was up over 10% yesterday.

Two Wall Street firms follow NEPT and they each have buy ratings on it. The average target price is $8.50.

Valens Groworks Corp. (VGWCF)

Valens Groworks Corp. (OTCMKTS:VGWCF) is a biotechnology company that provides products which are developed from proprietary extraction techniques.

This company has been trending higher since the beginning of the year. On July 15th, it released its second-quarter results. These showed that the company has made some significant improvements.

Revenue increased to $8.8 million CAD. This was a 296% increase from the first quarter. Gross profit was $5.1 million CAD, which was 58% of revenue as compared to 38% for the first quarter.

Wall Street is very bullish on this stock. 4 firms follow it and they all have it rated as a buy. The average price target is $8.20, which is about 150% higher than current levels.

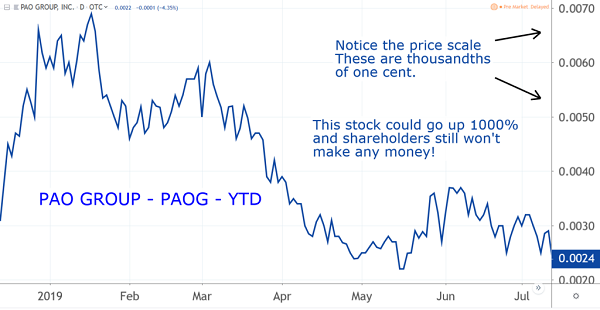

PAO Group Inc. (PAOG)

PAO Group Inc. (OTCMKTS:PAOG) is a holding company which is dedicated to alternative patient care treatments.

I have included this company to illustrate how some advertising in the financial media can be extremely mislead if not downright fraudulent.

I am sure you have seen adds touting the recent alleged great performance of this or that recent recommendation. Ads that say thing like “this stock doubled” or “this stock is up 1,000%” are everywhere. Even though some of these headlines may technically be correct they can also be very misleading.

For example, every stock has a bid and an offer. The bid is the highest price someone will pay for it and the offer is the lowest price someone will sell it for.

Suppose a penny stock has a bid of 1 cent and an offer of 2 cents. If is someone sells it the last trade will be 1 cent. Then suppose some buys it. Now the last trade is 2 cents. The price has doubled, but the stock hasn’t moved!

Take a look at the PAOG price scale on the chart. This stock trades not in pennies but in ten thousandths of a penny. It could rise 1000% from 24 ten thousands to 240 ten thousandths. But there is no way you can make money. The trading costs would make it impossible to profit.

So be careful when you see advertisements promoting supposed great returns. These returns may just be trading anomalies to are impossible to profit from.

As of this writing the author, Mark Putrino, held no positions in the aforementioned securities.

See Also From InvestorPlace:

- 7 Great Sector ETFs to Buy for the Short or Long Term

- 5 Cheap Fidelity Funds That Compete With Vanguard

- 5 Biotech Stocks to Buy for a Strong Growth Prognosis

Category: Marijuana Stocks