7 Cheap Biotech Stocks To Buy Now

Source: Shutterstock

These biotech stocks are set for a strong comeback as investors walk away from large-cap tech companies

U.S equities largely treaded water on Wednesday as Wall Street reacted to legal events and President Trump’s somewhat muted reaction to them. Elsewhere, strong earnings out of the retail sector are helping boost sentiment.

The release of the latest Federal Reserve meeting minutes was largely a non-event, with policymakers setting the stage for another rate hike in September, but noting that policy overall is moving toward a neutral stance.

With the current bull market now the longest on record, investors are looking for new areas to move into amid ongoing scrutiny of the large-cap technology stocks. Biotechnology names in particular are perking up with the iShares Biotechnology ETF (NASDAQ:IBB) looking ready to push up and out of a two-month consolation range.

With that said, here are seven biotech stocks that are ready for new money right now:

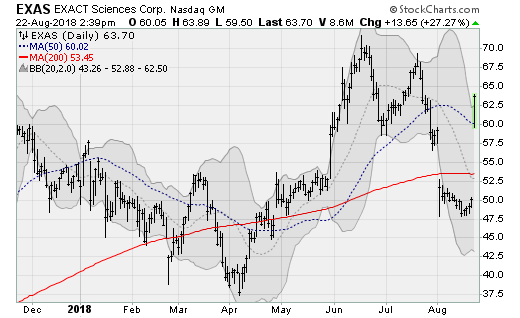

Biotech Stocks to Buy: Exact Sciences (EXAS)

Exact Sciences (NASDAQ:EXAS) shares have bolted above both their 50-day and 200-day moving averages, rising nearly 30% in mid-day trading on Wednesday to return to the upper end of a three-month trading range. The catalyst was the issuance of strong forward guidance in a call, with management looking for revenues of around $700 million vs. the $611 million analysts are looking for.

The company will next report results on Oct. 31, after the bell. Analysts are looking for a loss of 39-cents-per-share on revenues of $108.4 million. When the company last reported on Aug. 1, a loss of 30-cents-per-share beat estimates by 3 cents on a 79% rise in revenues on a year-over-year basis.

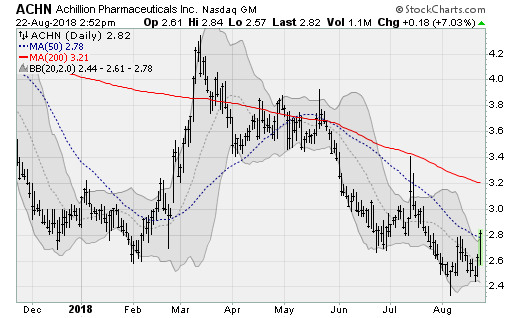

Biotech Stocks to Buy: Achillion Pharmaceuticals (ACHN)

Achillion Pharmaceuticals (NASDAQ:ACHN) shares have jumped up and over their 50-day moving average in what looks like an exit from a month-long consolidation range. Watch for a run to the 200-day moving average, last touched back in May, which would be worth a gain of more than 14% from current levels.

The company was recently upgraded to neutral by analysts at Barclays Capital and assigned a $5 price target. They noted that they see minimal downside risks at current levels.

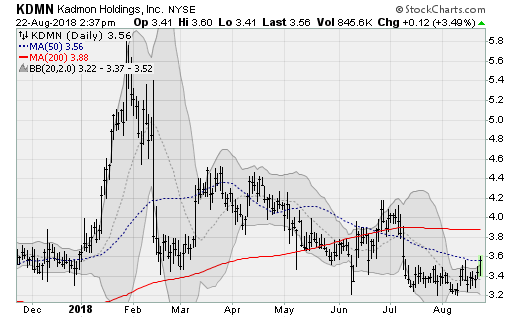

Biotech Stocks to Buy: Kadmon Holdings (KDMN)

Kadmon Holdings (NYSE:KDMN) shares look ready to push up and over their 50-day moving average, finding support near the $3.50-a-share level that has seen significant volume by price activity going back to the summer of 2017. The company is a developer of treatments for inflammatory and fibrotic diseases.

When the company reported back in March, a loss of 24-cents-per-share beat estimates by 12 cents despite a 65% fall in revenues.

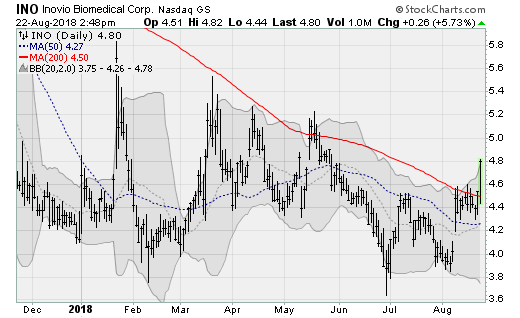

Biotech Stocks to Buy: Inovio Biomedical (INO)

Inovio Biomedical (NASDAQ:INO) shares have blasted up and over their 200-day moving average leaving behind a year-to-date trading range. Watch for a run to the upper end of its 2018 range, which would be worth a 12%+ gain from here. Back in 2016, INO reached a high of more than $11.50.

The company is a clinical stage development company researching active DNA immunotherapies and vaccines to treat and prevent cancer and infectious diseases. Its SynCon immunotherapy has the ability to break the immune system’s tolerance of cancer cells.

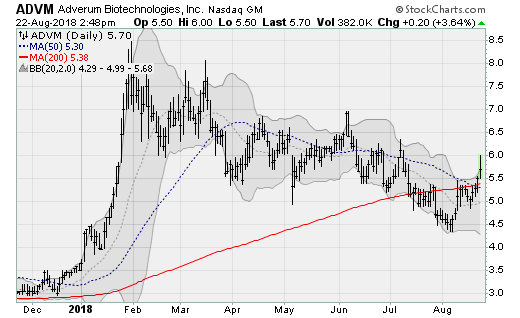

Biotech Stocks to Buy: Adverum Biotechnologies (ADVM)

Adverum Biotechnologies (NASDAQ:ADVM) shares are making a bull flag pattern, looking ready to exit their post-January consolidation to resume the uptrend started last summer that has seen shares more than double. Merely a return to the January high near $9 would be worth a 50%+ gain from here.

The company is a clinical-stage gene therapy company that targets rare and ocular diseases, including macular degeneration. Earlier this month, the company reported that it expects results from the Phase 1/2 trial of its ADVM-043 gene therapy treatment by the end of the year.

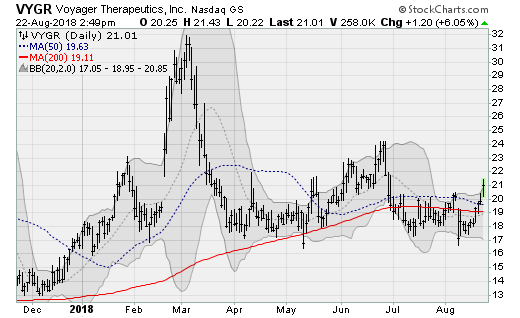

Biotech Stocks to Buy: Voyager Therapeutics (VYGR)

Voyager Therapeutics (NASDAQ:VYGR) shares are getting a lift off of their 50-week moving average ahead of a possible run to the highs not seen since March, which would be worth a 50%+ gain from here as it emerges from a two-month consolidation range. As part of this move underway, the stock has already crossed above its 50-day and 200-day moving averages.

The company is a clinical-stage gene therapy company focused on the development of sever neurological diseases, including Parkinson’s and Alzheimer’s. Back in May, analysts at H.C. Wainwright initiated coverage with a Buy rating and a $30 price target on optimism surrounding its Parkinson’s treatment.

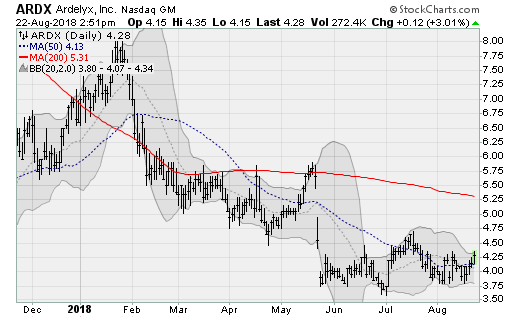

Biotech Stocks to Buy: Ardelyx (ARDX)

Ardelyx (NASDAQ:ARDX) shares are forming a base of support near the $4-a-share level since late May, setting up a run at prior highs and its 200-day moving average near $5.50, which would be worth a gain of more than 30% from current levels. The company was initiated with a Buy rating by analysts at Leerink Partners with a $13 price target.

The company develops and sells medicines for the treatment of cardio renal and gastrointestinal diseases. The lead product candidate is tenapanor, which has completed Phase III trials for the treatment of patients with irritable bowel syndrome.

Anthony Mirhaydari is the founder of the Edge (ETFs) and Edge Pro (Options) investment advisory newsletters. This article was originally published on August 23, 2018.

See Also From InvestorPlace:

- 7 Elite Dividend Stocks to Consider Now

- The 7 Best Funds to Beat Inflation

- 5 Hot Stocks to Buy for the Longest Bull Run Ever

Category: Biotech Stocks, Cheap Stocks