6 Cheap Gold And Silver Stocks To Buy Now

Precious metals have perked up nicely alongside the gold and silver mining stocks

Precious metals have perked up nicely alongside the gold and silver mining stocks

Investors on Wall Street have been growing nervous in recent weeks, and for good measure.

The yield curve has inverted, a strong signal a recession is coming. The trade tensions between the United States and China remain high. And President Donald Trump seems determined to bully the Federal Reserve into cutting rates aggressively and weakening the U.S. dollar, all in an effort to bolster the U.S. economy and punch back against competitive devaluations underway by China and others.

So it’s not surprising that precious metals have perked up nicely alongside the gold and silver mining stocks. This is an area of the market that was left for dead for years — as cryptocurrencies like bitcoin enjoyed the anti-dollar attention. But that’s changing now.

Here are six cheap gold and silver stocks worth a look:

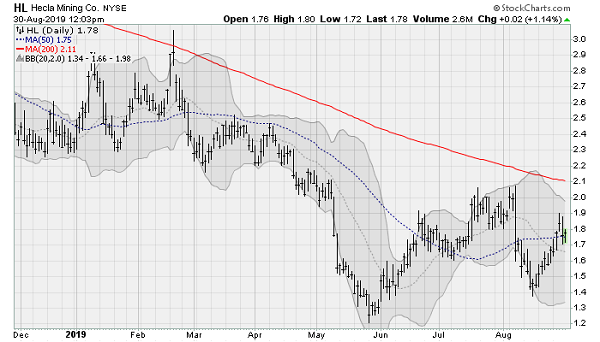

Hecla Mining (HL)

Hecla Mining (NYSE:HL) shares have scrambled back up and over their 50-day moving average, pushing up off of a solid base of support established over the last few months. Watch for a breakout attempt above the 200-day average, which hasn’t been crossed in a major way since the middle of 2017.

The company will next report results on Nov. 7 before the bell. Analysts are looking for a loss of two cents per share on revenues of $167.8 million. When the company last reported on Aug. 7, a loss of two cents per share missed estimates by seven cents on a 8.9% decline in revenues.

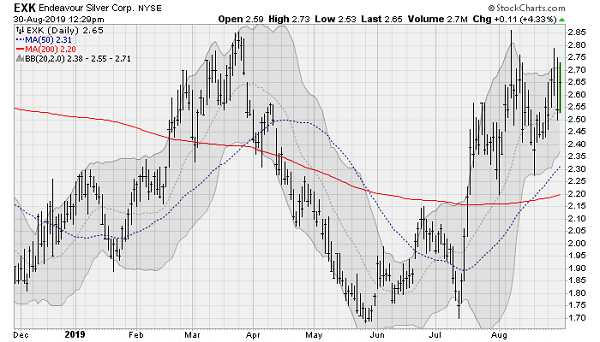

Endeavour Silver (EXK)

Shares of Endeavour Silver (NYSE:EXK) are moving back up to challenge their late March highs, making another attempt on the 200-week moving average after once again rising off of support near the $1.80-a-share level established in late 2018. The company will present at the upcoming Denver Gold 30th Annual Forum on Sept. 15.

Analysts at Noble Capital Markets recently downgraded shares on worries production costs were too high in a low price environment. But with metals prices on the rise, these concerns should fade.

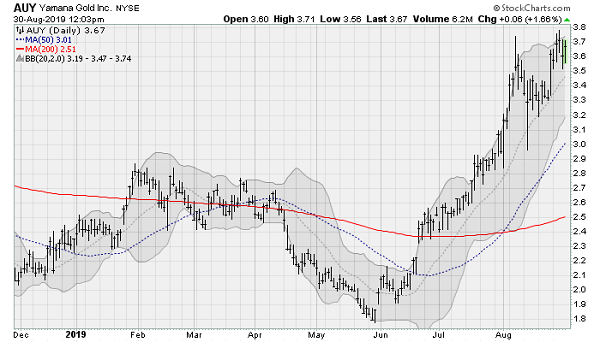

Yamana Gold (AUY)

Shares of Yamana Gold (NYSE:AUY) have been on a tear lately, maintaining a steady rise above its 20-day moving average to return to the highs last seen in early 2018. An extension of the push here would return prices to levels not seen since 2016.

The company will next report results on Oct. 24 after the close. Analysts are looking for earnings of two cents per share on revenues of $368 million. When the company last reported on July 25, earnings of two cents per share matched estimates on a 6.4% rise in revenues.

IAMGOLD (IAG)

IAMGOLD (NYSE:IAG) shares have returned to the trading range near the $4-a-share threshold that has halted the bulls repeatedly over the past year. But with gold prices on the move, I think a push past the resistance level and move above its 200-week moving average for the first time since early 2018.

The company will next report results on Nov. 5 after the close. Watch for earnings of one cent per share on $282.1 million in revenues. When the company last reported on Aug. 7, a loss of three cents per share missed estimates by two cents on an 11.1% decline in revenue.

Kinross Gold (KGC)

Kinross Gold (NYSE:KGC) is riding a steady support line along its 20-day moving average, returning to highs not seen since the middle of 2016. The company recently announced the acquisition of a property in Russia for $283 million — extending the company’s 24-year history of operating in the country.

Management will next report results on Nov. 6 after the close. Analysts are looking for earnings of seven cents per share on revenues of $949.9 million. When the company last reported on July 31, earnings of six cents per share beat estimates by three cents on an 8.1% rise in revenues.

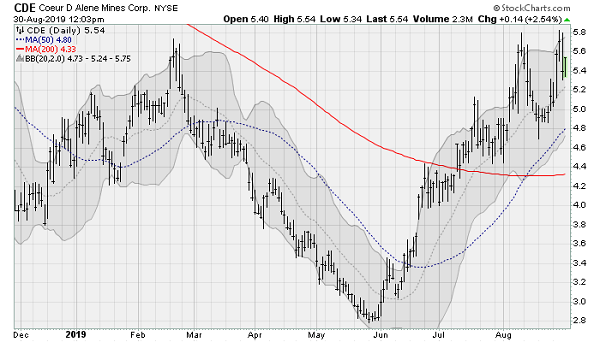

Coeur D Alene Mines (CDE)

Shares of Coeur D Alene Mines (NYSE:CDE) have returned to prior resistance levels near the $6-a-share level. Watch for an extension back towards the 200-week moving average, which hasn’t been tested since the summer of 2018.

The company will next report results on Oct. 30 after the close. Analysts are looking for a loss of four cents per share on revenues of 205 million. When the company last reported on Aug. 7, a loss of 11 cents per share matched estimates on a 4.6% decline in revenues.

Note: The author of this article is William Roth.

See Also From InvestorPlace:

- 7 Tech Industry Dividend Stocks for Growth and Income

- 4 Biotech Stocks on the Move

- 7 Stocks the Insiders Are Buying on Sale

Category: Cheap Stocks