3 Small Cap Stocks For Apple-Like Returns

Imitating the amazing returns that Apple handed investors since it launched the iPhone is no easy task, but Bret Jensen thinks that these three stocks might be able to come close.

Imitating the amazing returns that Apple handed investors since it launched the iPhone is no easy task, but Bret Jensen thinks that these three stocks might be able to come close.

Don’t look now, but first quarter earnings seasons is coming up directly ahead. The first quarter for the market was largely a positive one for investors. The NASDAQ powered ahead by almost 10% in the first quarter of the year, and the S&P 500 delivered a 5.5% return in the quarter. The DJIA was up 4.6%.

Small caps have sat out the rally since an immediate post-election surge in November and early December. The small cap benchmark, the Russell 2000 was flat in the opening quarter of the year while its larger brethren delivered solid rallies to investors.

Now we will see if the “rubber hits the road” and if the rise in the market in the first quarter was merited by actual earnings results. On this front, things do look positive. According to Factset, earnings growth amongst the S&P 500 companies should be just over 9% on a year-over-year basis on a mid-single-digit rise in revenues. If this holds, this would be the best quarter of earnings growth since 2011.

In my last column, I talked about some solid large cap plays that have had nice performance in the first quarter but look to have upside as their prospects continue to improve. Today, we will look at some solid small cap stocks that have largely sat out the rally so far in 2017. These names could benefit the next time investor sentiment shifts in their favor as the market “reverts to the mean”.

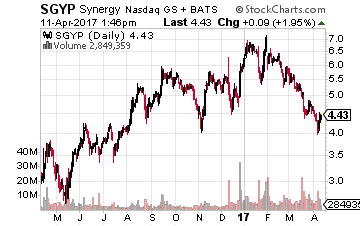

Let’s start with Synergy Pharmaceuticals (NASDAQ: SGYP). This stock has been on the decline since “Trulance”, its first commercial product was approved by the FDA to treat Chronic Idiopathic Constipation in late December of last year. Investors have bid down the stock from approximately $7.00 a share on approval to approximately $4.25 a share. Enthusiasm about the approval and possible buyout of the company by a larger player in the gastrointestinal space has been replaced by worries about Synergy’s ability to roll-out Trulance effectively on its own.

Let’s start with Synergy Pharmaceuticals (NASDAQ: SGYP). This stock has been on the decline since “Trulance”, its first commercial product was approved by the FDA to treat Chronic Idiopathic Constipation in late December of last year. Investors have bid down the stock from approximately $7.00 a share on approval to approximately $4.25 a share. Enthusiasm about the approval and possible buyout of the company by a larger player in the gastrointestinal space has been replaced by worries about Synergy’s ability to roll-out Trulance effectively on its own.

These concerns seem overblown. Initial script count compares favorably to the rollout of Linzess, the market leader in the space. That drug does over $150 million in quarterly sales and is still seeing solid growth. Trulance proved to be slightly faster acting in trials and has less side effects, especially diarrhea which should bode well for establishing itself and taking market share from Linzess.

In addition, the compound should be approved for IBS-C this summer which will expand the drug’s potential customer base. The median analyst price target on Synergy is just north of $13.00 a share – or three times the stock’s current trading levels.

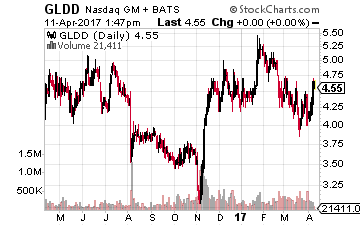

Moving on to the infrastructure space. Great Lakes Dredge & Dock (NASDAQ: GLDD) has made a tiny move recently but is still selling for 60 cents on the dollar to where the stock was trading two years ago. The company should benefit nicely over the next few years from expanding ports to accommodate the much larger cargo ships that can now pass through the Panama Canal. Dredging provides over 80% of the company’s revenues.

Moving on to the infrastructure space. Great Lakes Dredge & Dock (NASDAQ: GLDD) has made a tiny move recently but is still selling for 60 cents on the dollar to where the stock was trading two years ago. The company should benefit nicely over the next few years from expanding ports to accommodate the much larger cargo ships that can now pass through the Panama Canal. Dredging provides over 80% of the company’s revenues.

The firm has been plagued over the past two years by a lack of international demand, poor leadership and cost overruns on a new huge dredging vessel under construction for the company. However, the company has brought in a new CEO and some small activist investors have taken stakes in the firm.

Just as important, the new dredging vessel “Ellis Island” should be operational this quarter. Instead of costs incurred during the construction phase, the vessel should start throwing off $20 million annually in incremental EBITDA as it is made operational. Finally, the stock saw significant insider buying in February and March of this year, which is always a nice vote of confidence.

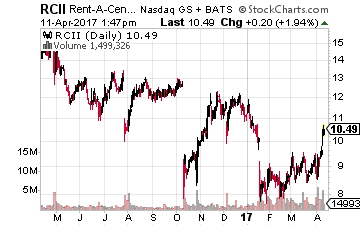

Rent-A-Center (NASDAQ: RCII) is another turnaround play along the lines of Great Lakes Dredge & Dock. It too has been an underperformer which has attracted activist investors, moved its co-founder into the CEO role and has seen significant insider buying in the stock so far in 2017. The stock also sells for around 60% of its 52-week highs as well.

Rent-A-Center (NASDAQ: RCII) is another turnaround play along the lines of Great Lakes Dredge & Dock. It too has been an underperformer which has attracted activist investors, moved its co-founder into the CEO role and has seen significant insider buying in the stock so far in 2017. The stock also sells for around 60% of its 52-week highs as well.

Activist Engaged Capital has taken a stake in the rental firm and has been pushing for a sale of the entire company. Management has other plans and just outlined plans to boost sales growth, operational cash flow and improve margins. The company has stated that if it can successfully execute against these plans, earnings per share should hit $1.20 to $1.40 in FY2018 and $2.00 to $2.25 a share in FY2019.

Given the shares currently go for under $10.00 a share, the stock will look significantly undervalued if management is able to deliver anywhere close to its goals. Insider buying shows confidence they will succeed and activists will continue to hold management’s feet to the fire to ensure they do as well.

Positions: Long GLDD, RCII and SGYP

1 Stock to Profit 285% or More from President Trump’s Biggest Campaign Promise

With not even a month of being president under his belt, Donald Trump has shown America that he is a man of action. Whether you support his policies or not, at least make some money by investing in the fact that President Trump plans on fulfilling every promise he made on the campaign trail. And, the biggest campaign promise that President Trump made was investing $1 trillion in America’s infrastructure.

Investors stand to make upwards of 285% gains by investing into this specific construction stock that can almost triple in size by taking advantage of the coming infrastructure boom. Find out all the details and why you must own this stock before March 15th in Bret Jensen’s new report “The One Stock You Want to Own to Cash in on Trump’s $1 Trillion Infrastructure Boom”.

Category: Penny Stocks to Buy