Small-Cap’s Road Back To Normal

Portfolio Manager Chuck Royce (CR) and Co-CIO Francis Gannon (FG) look at both 2Q17 and the year’s first half and see a consolidating asset class ready to make its next move up.

Portfolio Manager Chuck Royce (CR) and Co-CIO Francis Gannon (FG) look at both 2Q17 and the year’s first half and see a consolidating asset class ready to make its next move up.

What is your take on small-caps in the first half of 2017? Were you surprised that growth outpaced value?

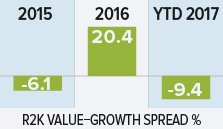

CR Coming into this year, we absolutely expected value to do better. With small-cap value reasserting its more historically familiar role in leading the small-cap market last year, we thought we’d see more of the same in 2017. Our reasoning was rooted in the dramatic shift in small-cap leadership that we saw so clearly throughout 2016—and had been waiting to see for at least a couple of years before that.

If 2017’s first half showed us anything, it was that the path back to normalization will be a winding one.

However, I would say that by the end of March, it seemed clear to us that dissipating hopes for more robust economic growth opened the door for both defensive and growth stocks to hold on to the lead they established in the first quarter. So while it was frustrating that the year did not favor many of these stocks the way we thought it would, 2017 still looks nothing like 2015 when value last lagged.

We have rising interest rates today, and QE is unwinding—the environment could not be more different than it was during growth’s last period of extended leadership. In fact, it still looks very conducive, at least to me, for value’s leadership to resume.

What is your view on cyclical stocks, which have lagged so far in 2017?

CR I don’t think investors have abandoned these stocks by any means.

Most treaded water through the first half while some—and we’re pleased to say that we hold a number of them—did just fine.

I think it’s very important to remember that, first, we are still on the road back to normalization that we’ve talked about before. Second, this is not a straight road—and it was never going to be. If 2017’s first half showed us anything, it was that the path back to normalization will be a winding one with a few sharp twists and turns.

Why do you think returns for U.S. equities have been tightly concentrated this year?

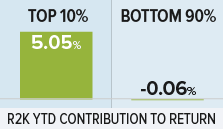

FG Most of this concentration was related to first-half leadership for growth stocks. For example, the small-cap advance was highly concentrated, with the top 10% of the Russell 2000 essentially having all of the index’s first-half return. So while about half of the companies in the Russell 2000 had positive returns in the first half of 2017, it was really a top-heavy rally.

A lot of cyclicals outside the energy industry did all right or fell back a bit while a comparatively small number of biotech and technology companies led. We saw similarly narrow leadership in large-cap, where a limited number of well-known names, the so-called ‘FANG’ group of Facebook, Amazon, Netflix, and Google, dominated first-half results.

Even in a growth-led market, leadership this narrow is pretty rare. That’s one of the reasons we anticipate that the market is likely to shift again in the coming months. We saw some realignment at the end of June, with industrial and other cyclical names reviving as some of the growth names in healthcare and tech corrected.

In 18 of the last 20 calendar years, the Russell 2000 had an intra-year decline >10%. Do you expect a similar correction this year?

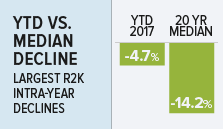

CR We’ve always been careful students of history. So when we saw that data, the first thing that sprang to my mind was that there would probably be a downturn later this year. Over the last 20 calendar years, the median intra-year correction was 14.2% while so far in 2017, the Russell 2000’s biggest decline was 4.7%.

So we lean more toward the likelihood of a pullback in the 8-12% range. I don’t think it would go much deeper than that because, at least currently, I don’t see any signs of a major market top or recession. But many market watchers were expecting a correction toward the end of the first quarter, and we still haven’t seen one even in the midst of a lot of uncertainty.

So do you think a pullback is inevitable?

CR Perhaps not inevitable. After all, the unexpected often happens, and historical trends reverse all the time.

However, when you combine this 20-year history with the fact that we haven’t seen anything like a real correction since the February 2016 small-cap trough, then a downturn looks more probable.

So while I firmly believe that many small-cap companies are in fundamentally solid, even strong, shape, I’ve also seen over the years that markets simply don’t stay elevated for this long without a little air being let out of them.

Has value’s relative underperformance this year presented you with buying opportunities?

CR Yes, though it’s very much on a discrete, stock-by-stock basis. It’s not one of those periods where multiple industries or entire sectors look appealing from a valuation standpoint. Energy is cheap, but oil prices are not yet as stable as we would like them to be for us to be buying.

However, we do see opportunities in other corners of the market that were flat or down in the first half. In my portfolios, for example, I’ve been active in banks so far this year. The normalizing interest rate environment is creating the chance for them to have good-sized spreads. There’s also the strong possibility of increased M&A activity and favorable deregulation. So we’re looking at banks that have growing loan volume which also look reasonably priced.

What other interesting opportunities have you seen?

FG We’ve seen some interesting healthcare names outside the biotech area, too. Healthcare is such an important part of our economy, and the policy uncertainty around insurance has helped to bring some valuations down to levels that we think are attractive for companies that historically have earnings or profits and are less risky than the high flyers in the biopharma complex.

What’s your current expectation for small-cap returns?

FG We think the strongest arguments in favor of small-cap are related and could benefit active managers. First, there’s ongoing earnings strength, which should be more than enough to ultimately keep a lot of small-caps in the black. We think this is true regardless of what happens in Washington. Our own analyses, our regular discussions with company management teams, and research from our friends at Strategas all reveal a pretty optimistic sales and earnings outlook for many small-cap businesses over the next year.

Finally, we think it’s important for investors to recall that this positive state of small-cap earnings has been in place since the 2/11/16 trough. We expect this small-cap earnings recovery to keep rolling over the next couple of years.

So you’re not concerned that valuations for small-caps are too high?

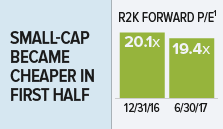

FG Valuations actually became more attractive for small-cap companies in the first half of 2017. At the end of 2016, the average P/E for the Russell 2000 was 20.1x while at the end of June 2017 it fell to 19.4x.

During this same period, the yield on the 10-year Treasury yield dropped from 2.4% to 2.3%.

So both on an absolute basis and relative to bonds, we feel very good about the way small-cap valuations look for the kind of companies that we prefer.

If inflation stays below its historical average, then valuations can stay above their historic levels. Yet we’re not looking for valuations to increase from this point. If small-caps can track earnings growth, then an expectation of mid- to high single digit returns over the next several years seems reasonable to us. In a low-return world, that could be a very competitive return.

1 The P/E Ratio calculation uses one year earnings estimates and excludes companies with zero or negative estimated earnings (28% of Russell 2000 holdings as of 12/31/16 and 29% of holdings as of 6/30/17).

Source: Factset

Can you offer a rationale for why volatility might pick up?

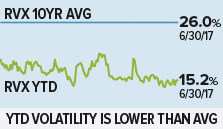

FG It’s essentially reversion to the mean. Since stocks began to recover early in 2016, we’ve seen a small number of very volatile moments, such as Brexit or the elections, but otherwise volatility has been quite low.

Our idea is that this can’t persist in the context of increasing normalization of the economy, interest rates, and the equity markets. As all of these settle into more historically familiar patterns, we think we’ll see increased volatility, which we believe has sizable potential benefits for active managers who seek to use volatility to their advantage.

Do you think the global economy can continue to heat up?

CR We do. In fact, we see Europe’s improvement as another aspect of normalization. So while the signals from large developing nations have been more mixed, especially with China working through some challenges, we feel confident in the overall global economy. With the dollar weakening, we also expect to see some demand for U.S. exports.

Some would argue that this could be bad news for small-cap stocks. Since they derive most of their revenues from domestic sources, this would put them at a disadvantage versus large-caps. We would not disagree.

However, renewed growth outside the U.S., while not great news for the asset class as a whole, might be good news for active managers, at least for those with approaches that focus on businesses with earnings during an upswing for cyclical industries. But I’m not necessarily convinced that Europe will grow faster than the U.S., at least not beyond a relatively short period.

The CBOE Russell 2000 Volatility Index (RVX) measures market expectations of near-term volatility conveyed by Russell 2000 stock index option prices.

How can higher global growth help U.S. small-caps?

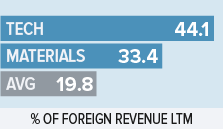

FG There’s a lot of variation by sector based on the percentage of revenues small-caps derive from non-U.S. sources.

We’ve found that cyclical sectors such as Information Technology and Materials, as well as industry groups in which we typically have high weightings, such as machinery and auto components, derive a good-sized percentage of revenues from outside the U.S.

There are also a lot of small-caps, most notably tech companies, that do most or all of their business with U.S. firms that have an international reach. This means that they participate in global growth while technically deriving all or most of their revenues domestically. A good example would be a small electronic equipment company that sells components to Amazon or Google. So we’re confident that small-cap active management approaches can remain successful as long as there is a reasonable amount of economic growth, either here or overseas.

Source: Factset

With the downturn in oil prices, are you concerned about the knock-on effects in the industrial area like in 2015?

CR We haven’t seen it, and with energy stocks already having suffered a substantial decline in the first half, I don’t think we will. It seems that many industrial companies that service energy businesses rationalized capacity throughout 2016, which has helped to insulate many of them from the contagion. Which has frankly been good news for some of our industrial holdings with exposure to the energy industry.

How are you navigating the financial sector currently?

CR In addition to the growing interest in banks, I continue to devote a lot of my focus to asset managers and other capital markets companies. And that’s what makes my approach to the sector non-traditional. I’ve typically had high exposure while being underweight in banks and significantly overweight in capital markets. That’s in large part because our position as a small-cap asset manager makes other companies in the industry easier for me to know at a deep level.

Over the last couple of years, I’ve been increasingly drawn to non-traditional asset managers. I’ve been very interested in alternative asset managers, which I think is an undervalued zone in an asset-light business that isn’t well understood by other investors. That’s a near-perfect fit for me as an investor.

Are you anticipating further rate hikes from the Fed this year?

FG We expect the Fed to hike at least once more in 2017. It’s also important to keep in mind Mario Draghi’s remarks at the end of June, when he voiced concerns about reflation in the eurozone. We think this adds up to the fact that the era of central bank intervention looks very much as if it’s coming to a close.

This is actually a scenario where the greater cyclical tilt to small-caps can be beneficial. Small-cap stocks have historically had roughly half the correlation to high-grade bonds that large-cap stocks do. This is because rates typically climb when the U.S. economy is doing well, and a growing economy has often been good for small-cap stocks.

…the majority of the companies we’ve been meeting with remain confident about their business.

Do you think the declining 10-year Treasury yield signals an upcoming economic slowdown?

CR We don’t. The rally for the 10-year looks more to us like a sign that investors expect to see persistently low inflation. Interest-rate sensitive stocks such as high growth and utilities were strong, which we think supports our point.

The ongoing optimism we’ve been hearing every day from management teams also contradicts the expectation of an economic slowdown. Order books are continuing to fill up, and the majority of the companies we’ve been meeting with remain confident about their business. That in turn gives us a lot of confidence in what we do.

Note: This article was contributed to ValueWalk.com by Royce Funds.

Category: Investing in Penny Stocks