The Next 3 Major Biotech Takeover Targets

After record years for deal volume in both 2014 and 2015 in the biotech and pharma industries, M&A transactions have posted a significant decline in the volume of deals so far in 2016 across these industries. As of late August, transactions based on dollar volume were down almost 65% from the same period in 2015.

After record years for deal volume in both 2014 and 2015 in the biotech and pharma industries, M&A transactions have posted a significant decline in the volume of deals so far in 2016 across these industries. As of late August, transactions based on dollar volume were down almost 65% from the same period in 2015.

One thing that hurt overall deal volume was the Treasury Department derailing the over $150 billion proposed tie-up between Pfizer (NYSE: PFE) and Allergan (NYSE: AGN) on its third try in April of this year. This put a chill on large mergers and even mid-level purchases if they had a “tax inversion” angle. Ironically, it also created the conditions for the recent pick-up in acquisitions in the small and mid-cap part of the market.

Stymied from acquiring Allergan, Pfizer has been on a real tear recently. It picked up Anacor Pharmaceuticals (NASDAQ: ANAC) in late May for over $5 billion. Last month it outbid French drug giant, Sanofi (NYSE: SNY), by some $3 billion to purchase mid-cap oncology concern Medivation (NASDAQ: MDVN) for some $14 billion.

Allergan has also been aggressive in making some “bolt-on” acquisitions since completing a $40 billion sale of its generic drug business to Teva Pharmaceuticals (NASDAQ: TEVA). Last week it paid over a 150% premium to pick up Vitae Pharmaceuticals (NASDAQ: VTAE) for just over $600 million to expand its footprint in the dermatological space and just announced yesterday that it will purchase Tobira Therapeutics Inc. (NASDAQ: TBRA) in a whopping $1.7 billion dollar deal that sent the stock price soaring from just under $5 to right around $38.

With interest rates near historical lows and the need to replenish pipelines at major pharma and biotech companies, I think M&A activity could continue to pick up in coming months. I think this is especially true if the upcoming election results in the government make any significant legislative changes around drug pricing policies moot subjects.

So which stocks do I like as standalone entities but also make sense as potential buyout targets? Here are three names I would consider here.

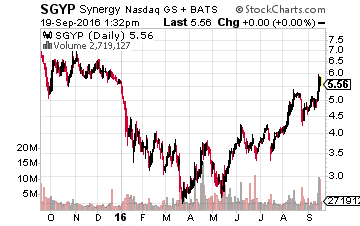

Let’s start with Synergy Pharmaceuticals (NASDAQ: SGYP) which had a nice little run up last week after Citigroup speculated it would make a great strategic pick up for Japanese based Takeda Pharmaceuticals (OTC: TKPYY). The company’s main drug candidate is plecanatide which should be approved by the FDA for the treatment of idiopathic chronic constipation by the end of January. It also should release key Phase III trial results for the treatment of another gastrointestinal indication by the end of this year. The company has one other interesting compound in the same area in mid-stage development.

Let’s start with Synergy Pharmaceuticals (NASDAQ: SGYP) which had a nice little run up last week after Citigroup speculated it would make a great strategic pick up for Japanese based Takeda Pharmaceuticals (OTC: TKPYY). The company’s main drug candidate is plecanatide which should be approved by the FDA for the treatment of idiopathic chronic constipation by the end of January. It also should release key Phase III trial results for the treatment of another gastrointestinal indication by the end of this year. The company has one other interesting compound in the same area in mid-stage development.

In trials, plecanatide works very much like Linzess which should do a billion dollars in annual sales by 2020, except plecanatide seems to be slightly faster acting and more importantly, has less side effects such has diarrhea. With just a $1 billion market capitalization, if Synergy does not appeal to Takeda, it certainly could appeal to Allergan which has stated it wants to expand its presence in the GI area.

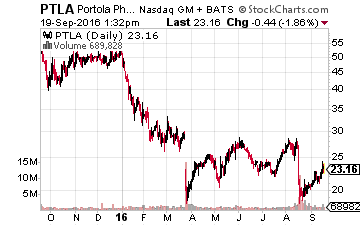

Portola Pharmaceuticals (NASDAQ: PTLA) has recovered over half of its 30% plunge in August as the result of getting a complete response letter ‘CRL’ around its application for Andexxa which is looking to be a universal antidote to the new anti-coagulants on the market such as Eliquis and Xarelto. However, the CRL was issued to address concerns on the manufacturing process, not the trial results from the drug itself that were very solid.

Portola Pharmaceuticals (NASDAQ: PTLA) has recovered over half of its 30% plunge in August as the result of getting a complete response letter ‘CRL’ around its application for Andexxa which is looking to be a universal antidote to the new anti-coagulants on the market such as Eliquis and Xarelto. However, the CRL was issued to address concerns on the manufacturing process, not the trial results from the drug itself that were very solid.

The industry needs this drug as some 80,000 people end up in emergency rooms annually in this country to reverse effects from these new age anticoagulants. What the CRL did show was that perhaps the drug and company belonged in more experienced hands now that it is on the cusp of commercialization. Given Pfizer produces Eliquis and has been on an acquisition spree lately, this would be a solid strategic purchase.

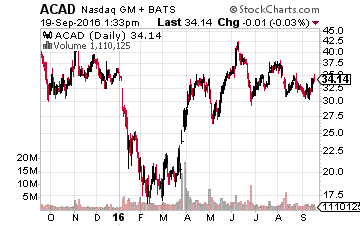

Finally, we have Acadia Pharmaceuticals (NASDAQ: ACAD), the largest of my possible buyout targets with a market capitalization of around $4 billion. In contrast to Andexxa, its compound “Nuplazid” flew through the approval process and started being marketed late in the second quarter. This is the first approved treatment for the psychosis that impacts about 40% of the one million Parkinson’s patient population in the United States.

Finally, we have Acadia Pharmaceuticals (NASDAQ: ACAD), the largest of my possible buyout targets with a market capitalization of around $4 billion. In contrast to Andexxa, its compound “Nuplazid” flew through the approval process and started being marketed late in the second quarter. This is the first approved treatment for the psychosis that impacts about 40% of the one million Parkinson’s patient population in the United States.

The drug should eventually do $1 billion or more in annual peak sales just for this indication but is also in mid and late stage trials for possible treatments for the psychosis found in Alzheimer’s and the schizophrenia populations. Given trial results so far, I think the drug will be used “off-label” for these diseases even if not approved by the FDA.

Acadia would be a logical target for Biogen (NASDAQ: BIIB) given the company’s interest in expanding its neurology footprint. The company has also announced that it is spinning off its hemophilia business which should be worth somewhere between $5 billion and $7 billion. Merck (NYSE: MRK) has also been mentioned as a logical option for Acadia.

Even if none of these buyout scenarios come up to pass over the next six to 12 months, I still like all three selections just fine on their own.

Finding biotech stocks with upcoming catalysts for explosive growth like Xencor (up 87%), Artana Therapeutics (up 63%), and many more is a key component of my comprehensive strategy for massive profits in my newsletter, Biotech Gems.

Positions: Long ACAD, BIIB, PTLA, and SGYP

Category: Biotech Stocks