Investors Believe The Fed Will Hike Interest Rates Again

The possibility of a US recession is diminishing, and the Federal Reserve is on track to hike interest rates twice a year for the foreseeable future that’s according to Bank of America Merrill Lynch’s most recent US Credit Investor Survey.

The possibility of a US recession is diminishing, and the Federal Reserve is on track to hike interest rates twice a year for the foreseeable future that’s according to Bank of America Merrill Lynch’s most recent US Credit Investor Survey.

Bank of America’s credit survey gives an interesting insight into the world of the bank’s credit clients. The report can also be used as a broad indicator of credit investor sentiment, and therefore an indicator of US business sentiment.

Investors believe the Fed will hike interest rates again

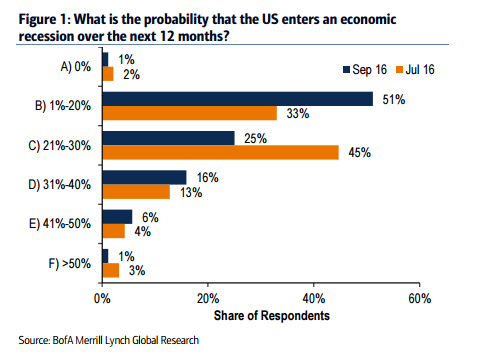

Following the wave of positive July economic data, BoA’s credit investor survey conducted last week showed a remarkable reduction in the perceived recession possibilities relative to the July survey.

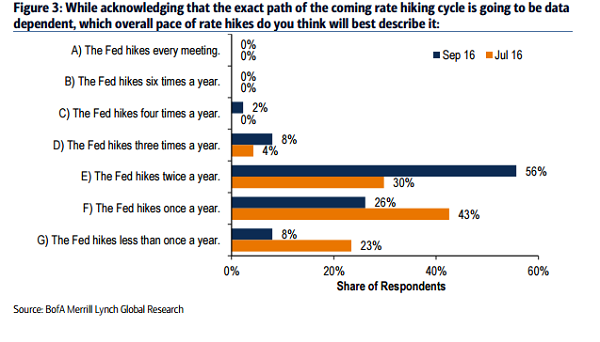

Specifically, 52% of investors now estimate a 20% or lower recession probability over the next year, up sharply from 35%. Furthermore, with the expectations for a recession falling, credit investors have revised their expectations around interest rates. More than half (56%) of the respondents to the survey now expect the Fed to hike twice a year, an increase of 30% from the July survey. Consistent with investors’ outlook for a more aggressive Fed, the proportion expecting the rate hiking cycle to be associated with wider spreads like in 1994 more than doubled to 43%, which is now twice the share of investors expecting tighter spreads like in the 2004 cycle.

Investors believe the Fed will hike interest rates again

A more active Fed and widening spreads have pushed items such as “rising interest rates”, “spread tightening” and “bubbles” up the list of credit investors’ biggest concerns going forward. Rising interest rate jumped to #7 on the list of investors’ most major concerns, from the very last place in July. China and geopolitical risk retain the #1 and #2 spots. Asset bubbles are now the #3 investor concern, up sharply from fifth place during the last survey.

Market crashes are usually caused when market participants are caught by surprise and from the responses to BoA’s credit investor survey, it looks as if the bond sell-off on Friday and Monday has caught many credit investors by surprise. Indeed, responses to the survey revealed that following Augusts bond market rally, the share of both high grade and high yield investors finding spreads overvalued jumped to the highest level since the market peak in June of 2014. But technical remain (remained) strong, and therefore, respondents indicated they expected technicals to win the day over the next few months. Both high grade and high yield investors are (were) very bullish on spreads over the next three months. Longer term (12 months), however, the tradeoff between valuations and technicals turns bearish and investors expect wider spreads. Finally, regarding positioning HG investors remain predominately overweight, but continue to reduce gradually.

After the market action of the past few days, it will be interesting to see how the responses to BoA’s credit survey for next month differ from the August results.

Note: The author of this article is Rupert Hargreaves. He is a contributor to ValueWalk.com.

Category: Breaking News