Hot Penny Stocks: OXBT, NYNY, IDSA

It’s an exciting time for penny stocks, especially Chinese penny stocks like Oxygen Biotherapeutics (OXBT), Empire Resorts (NYNY), and Industrial Services of America (IDSA). Lets take a closer look at these three big movers

It’s an exciting time for penny stocks, especially Chinese penny stocks like Oxygen Biotherapeutics (OXBT), Empire Resorts (NYNY), and Industrial Services of America (IDSA). Lets take a closer look at these three big movers

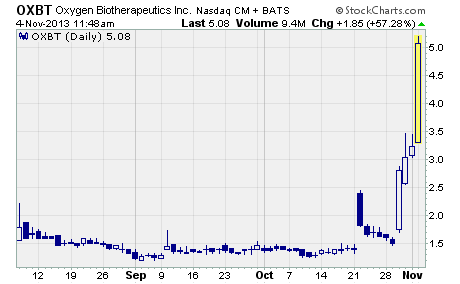

Oxygen Biotherapeutics (NASDAQ: OXBT)

OXBT’s on fire!

Shares of this development-stage biotech penny stock soared 98% last week. The stock took off on exciting news for a new drug soon to be acquired by the company.

The drug is called levosimendan. It’s a calcium sensitizer developed for intra-venous use in hospitalized patients with acutely decompensated heart failure.

So, what’s the exciting news?

Last Wednesday, researchers at the Duke Clinical Research Institute (DCRI) reported findings from a meta-analysis of 14 independent clinical trials of levosimendan. The aggregate results showed that the drug may reduce mortality and other adverse outcomes, including heart attacks, in patients undergoing heart surgery.

In fact, DCRI’s Director of Cardiovascular Research, John Alexander, M.D., said levosimendan, “may reduce mortality and other adverse outcomes by as much as 50%.”

Here’s the thing…

Oxygen Biotherapeutics has an agreement to acquire the rights to develop and commercialize levosimendan in the US and Canada from Phyxius Pharma. Phyxius has licensed these rights from Finland’s Orion Pharma.

Levosimendan has been approved in 53 countries, but is not yet available in the US. However, the drug has received Fast Track status from the FDA, and is about to begin a phase 3 trial.

OXBT is continuing its meteoric rise today. As I write, the stock is up more than 57% intra-day.

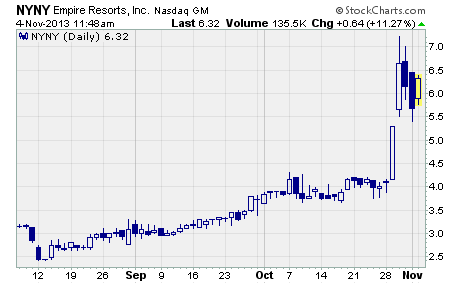

Empire Resorts (NASDAQ: NYNY)

This surging penny stock could be poised for more huge gains.

Empire Resorts engages in the hospitality and gaming industries in New York. The company owns and operates Monticello Casino and Raceway, a video gaming machine and harness horseracing facility in Monticello, and is an agent for the New York Lottery.

Now, here’s the key…

Voters in New York will head to the polls tomorrow to determine the fate of a casino gambling referendum. Passage of the referendum would legalize non-Indian gaming throughout the state.

And if that happens, it could mean big bucks for Empire Resorts.

You see, the company has submitted a proposal to build a massive casino resort at the former Concord Hotel in the Catskills. If the referendum passes and Empire receives one of the coveted licenses to operate a casino in the region, NYNY will likely soar.

In fact, investors are already driving the stock higher in anticipation of a positive outcome on both fronts.

As you can see, NYNY jumped from $4.00 to a high of $7.21 before finishing the week at $5.68 per share. That’s an 80% rise to the high and a 42% gain for the week. Not too shabby.

While several groups are vying for a license to operate a casino in the Catskills, Empire Resorts is the lone publicly traded company among them. As such, it’s the only way ordinary investors can possibly profit from this event.

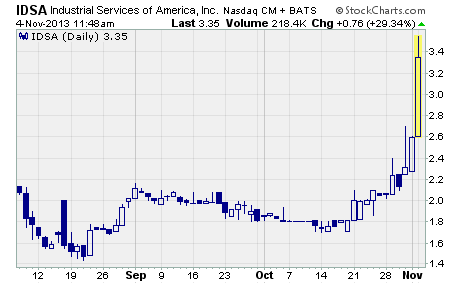

Industrial Services of America (NASDAQ: IDSA)

IDSA is making a strong upside move…

The stock climbed from $2.10 to a high of $2.70 before closing out the week at $2.59 per share. The move was good for a 26% gain on the week.

And it put the stock up more than 43% over the past two weeks.

Industrial Services of America is in the business of buying, processing, and marketing scrap metals and recyclable materials for domestic users and export markets. The company also offers customers a variety of programs and equipment to manage waste.

Why’s the stock jumping?

The shares took off after the company recently announced a new $4 million credit facility from The Bank of Kentucky. The funds provide the company with additional liquidity. And a good portion will be used to promote the growth of IDSA’s Waste Equipment Sales and Services subsidiary (WESSCO).

Management says WESSCO offers stable, recurring revenue and cash flow which complements the parent company’s metals recycling business. And now that funding has been secured for WESSCO, the company is free to reinvest its free cash flow into the metals recycling business.

It certainly looks like the new credit facility will help IDSA grow its businesses going forward.

Clearly, a number of investors believe this will be the case.

After the stock’s slow but steady upward climb over the past two weeks, they’ve sent it surging more than 23% in today’s trade as I write. IDSA is now closing in on its 52-week high of $3.99.

Profitably Yours,

Robert Morris

Category: Hot Penny Stocks