Hot Penny Stocks: CECO, OPTT, ZGNX

It’s an exciting time for penny stocks, especially Career Education (CECO), Ocean Power Technologies (OPTT), and Zogenix (ZGNX). Lets take a closer look at these three hot penny stocks

It’s an exciting time for penny stocks, especially Career Education (CECO), Ocean Power Technologies (OPTT), and Zogenix (ZGNX). Lets take a closer look at these three hot penny stocks

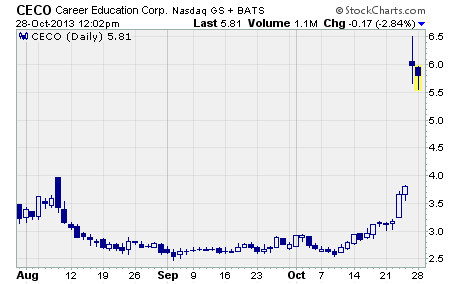

Career Education (NASDAQ: CECO)

CECO soared last week!

Shares of the for-profit education stock jumped more than 57% on Friday after the company released exciting news earlier in the week. On Tuesday, CECO announced that it will sell its European education division to private-equity firm Apax Partners for $305 million.

Here’s the thing…

The purchase price for this one unit is about $50 million higher than the company’s market cap prior to the announcement. It’s a classic case of the parts being more valuable individually than the company as a whole.

The amount Apax is willing to pay clearly shocked investors.

CECO finished the prior week at just $3.13 per share and with a market cap of about $221 million. One week later, the shares were a whopping 91% higher, and the company’s market cap had nearly doubled to $400 million.

So, is it time to buy CECO?

While the company’s still dealing with a decline in enrollments due to new federal regulations, at least one major Wall Street analyst upgraded the stock on Friday. Wells Fargo raised CECO from “Market Perform” to “Outperform” and increased its price range target from $2.50-$4.80 to $5.00-$7.00.

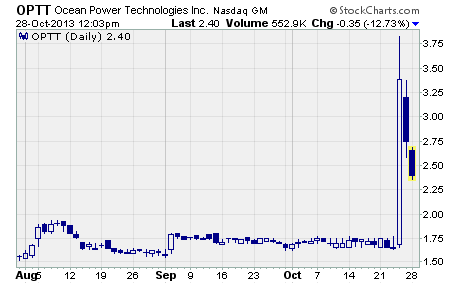

Ocean Power Technologies (NASDAQ: OPTT)

This surging penny stock could be poised for more huge gains.

Ocean Power Technologies is a tiny alternative energy company that specializes in harnessing the renewable energy of ocean waves. Capitalizing on its 15 years of in-ocean experience, Ocean Power has developed the revolutionary PowerBuoy system.

This aptly-named system uses ocean-going buoys to capture predictable ocean wave energy and convert it into clean electricity. And it has captured the attention of electric utilities all over the world.

Now, here’s the key…

The Pennington, New Jersey company announced huge news last week. It has signed a major agreement with Japan’s Mitsui Engineering & Shipbuilding to commercialize the PowerBuoy system.

Under the agreement, Mitsui has purchased a license to sell PowerBuoy systems in Japan as well as several countries in Southeast Asia and Africa. Ocean Power will receive royalties on any sales Mitsui makes in its territory.

In addition, Mitsui will purchase Power Take-Off systems from Ocean and integrate them into all PowerBuoys it sells.

While the agreement didn’t provide any specific numbers, investors clearly believe it’s a huge win for Ocean Power Technologies. Just take a look at the company’s stock chart…

As you can see, OPTT more than doubled in value on the day the deal was announced. And although the stock succumbed to profit taking on Friday, OPTT still gained a hefty 63% for the week.

While OPTT is declining further today, the pullback may provide a good entry point for investors who missed the initial move.

The lone analyst covering OPTT has a “Strong Buy” rating on the stock. And with a price target of $5.00 per share, the analyst clearly sees huge upside potential for OPTT.

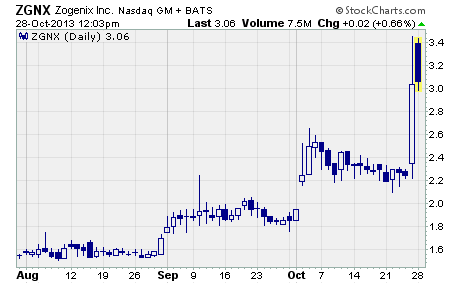

Zogenix (NASDAQ: ZGNX)

ZGNX is a penny biotech stock that just hit the big time!

On Friday, the FDA approved the company’s novel extended release painkiller, Zohydro ER. The drug is designed for people who need daily, around-the-clock treatment and cannot be treated with other drugs.

As you might expect, ZGNX skyrocketed on the news…

The shares jumped from $2.24 to an intra-day high of $3.45 before finishing the day and the week at $3.04. That move was good for an outstanding single-day gain of 36%. And it helped the stock register an impressive 32% rise for the week.

But here’s the really interesting thing… the FDA approval came as a big shock to investors.

Just last year an FDA advisory panel recommended the drug not be approved for sale in the US market. The panel was concerned Zohydro, which contains the prescription painkiller hydrocodone, could be too easily abused by patients.

Hydrocodone is already one of the most widely-abused prescription drugs in the US.

However, the advisory panel’s recommendation was not binding on the FDA. A point the FDA drove home with its surprise approval of Zohydro.

So, is ZGNX a good buy?

It certainly is according to global asset manager William Blair. The firm maintained its “Outperform” rating on the stock and raised its price target from $3.00 to $6.00 per share.

Zogenix is currently changing hands at $3.06. As such, it has upside potential of 90% to the analyst’s price target.

Profitably Yours,

Robert Morris

Category: Hot Penny Stocks