The High-Yield Stock That Can Sink Your Portfolio

Tim Plaehn loves to share his analysis on high-yield dividend stocks that he invests in because of their secure dividend payments, but for every one stock he recommends there are four or five that he passes over. See the kind of high-yield stock that an income expert would never invest money into.

Tim Plaehn loves to share his analysis on high-yield dividend stocks that he invests in because of their secure dividend payments, but for every one stock he recommends there are four or five that he passes over. See the kind of high-yield stock that an income expert would never invest money into.

Today I saw the term “reflation trade” as the current excuse why investors think they need to sell out of the higher yield dividend stock sectors and reinvest into something else. The result of the uncertainties in investors’ minds has been a lot of volatility and share price declines in the higher yield stock groups like REITs, utility, and telecom stocks.

I constantly discuss with my newsletter subscribers that one major reason why we invest in dividend stocks is to be able to stay invested through market declines and continue to earn nice dividend yields. As a dividend-focused investor, I get paid to wait out market downturns.

The one event that as high-yield investors we want to avoid, is to have one or more of our dividend stocks reduce or suspend dividend payments. That will produce a wound to a portfolio that will take a significant amount of time from which to recover.

While we can’t always accurately predict a dividend cut, in this article I’ll show you a former high-yield stock that had huge warning signs that caused me to reject the stock as a recommendation. This window into my analysis on the safety of dividend payments for high-yield stocks should give you techniques on what to look for in order to see if a dividend is in danger of reduction.

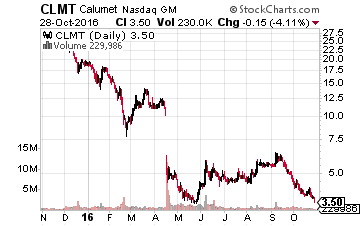

Calumet Specialty Products Partners LP (Nasdaq: CLMT) is a leading independent producer of high-quality, specialty hydrocarbon products. The company owns several refineries which process crude oil into the traditional fuels and asphalt as well as high value specialty petroleum based products such as paraffinic oils, synthetic lubricants, mineral oils, waxes and personal care products.

Calumet Specialty Products Partners LP (Nasdaq: CLMT) is a leading independent producer of high-quality, specialty hydrocarbon products. The company owns several refineries which process crude oil into the traditional fuels and asphalt as well as high value specialty petroleum based products such as paraffinic oils, synthetic lubricants, mineral oils, waxes and personal care products.

The specialty products side of the company’s business has always been very profitable and served as the primary attraction for investors. From its 2006 IPO, Calumet was able to pay attractive dividends and from early 2008 until mid-2013, the quarterly distribution showed steady growth. Through that same period, the CLMT shares carried an attractive 8% to 9% yield.

Then, in the latter months of 2013 and 2014, the dividend rate stopped growing. This was the first danger signal. At that point, investors should have taken a look at what was going on with the company’s cash flow. In early 2014, a look back at the 2013 results showed that Calumet had paid dividends of $202 million in that year, but had only generated $18.5 million in free cash flow, an $183 million shortfall.

In the first half of 2014, the company came up $81 million short of the cash distributions it paid to investors. Anyone looking at these numbers would say a dividend cut was inevitable. Yet, Calumet continued to pay its big dividend for almost two more years. What happened?

First, management launched $750 million of growth projects, which they promised would be profitable enough to cover the cash flow shortage and allow the dividend to again start growing. They paid for these projects with borrowed money and borrowed more to keep paying the distributions.

Second, the steep decline in the price of oil that started in late summer 2014 resulted in well above average profit margins for refining companies. The non-typical large profitability lasted through the 2015 third quarter and allowed Calumet to cover its dividend payments with free cash flow for several quarters. Then both positive factors reversed.

The new projects started coming on line and were losing money instead of producing free cash flow. Refining margins collapsed and Calumet was losing money on every barrel it refined into fuels and asphalt. Cash flow at Calumet actually turned negative.

It all had to end, and in early 2016 Calumet fired its CEO, brought in new leadership and suspended the distribution payments. From October 2015 until May 2016, the CLMT share price dropped by 85%. I wrote several articles starting in early 2014 that this was a company in danger of slashing its dividend. It took almost two years, but the fact that this high-yield company could not generate enough free cash flow to cover its dividend payments eventually cost a lot of trusting investors a load of money.

What Kind Of High Yield Stocks Should You Own?

The moral of the story is, as a high yield investor, you must make sure the companies that are paying you those big dividends are generating enough free cash flow to cover the payouts to investors. If a company misses on cash flow coverage for more than a couple of quarters, don’t listen to management promises. Sell the shares and find a better home for your money.

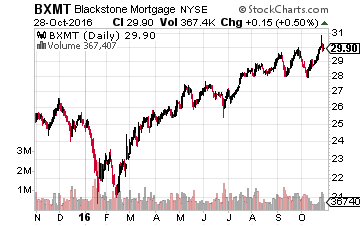

One stock that just reported earnings with the right kind of news is Blackstone Mortgage Trust Inc. (NYSE: BXMT). Net income and cash flow per share continue to grow and handily cover the dividend payments. When asked by a Wall Street analyst whether the company was considering a dividend increase, company Treasurer, Doug Armer, stated that management’s focus is on the stability of the dividend. Excess cash flow will be reinvested to make sure the dividend is secure. That’s the kind of high-yield stock I recommend and want to own.

One stock that just reported earnings with the right kind of news is Blackstone Mortgage Trust Inc. (NYSE: BXMT). Net income and cash flow per share continue to grow and handily cover the dividend payments. When asked by a Wall Street analyst whether the company was considering a dividend increase, company Treasurer, Doug Armer, stated that management’s focus is on the stability of the dividend. Excess cash flow will be reinvested to make sure the dividend is secure. That’s the kind of high-yield stock I recommend and want to own.

A stock like Blackstone that won’t cut its dividend, pays a high current yield, and has the potential for dividend growth is an integral part of the income strategy for my newsletter, The Dividend Hunter. BXMT is a strong, stable dividend payer just like the 20 other high-yield stocks currently available through my Monthly Dividend Paycheck Calendar system for generating a high monthly income stream from the market’s most stable high-yield stocks.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 5 paychecks every month and in some months up to 12 paychecks from reliable high-yield stocks built to last a lifetime.

The next critical date is Wednesday, November 2nd (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $2,609 in payouts by November, but only if you’re on the list before November 2nd. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: Penny Stock Tips