Go Long Value, Rotate Out Of Growth Stocks

“Low interest rates have made it very cheap for companies to grow. Higher ROI will outperform when capital becomes more expensive.”

David Poppe, Sequoia Fund’s CEO, on why value stocks have underperformed growth stocks.

According to Renaissance Capital, there were 192 biotech IPOs in the past 5 years, raising more than $14.7 billion. Most of these companies are development stage businesses, have never earned money and most never will. Despite that, these companies have lofty market valuations as investors bet on the next blockbuster drug.

Technology is also trading at bloated valuations with the “FANGs” (Facebook, Amazon, Netflix, Alphabet) up an average of 83% in 2015. These stocks are trading at 25x, 73x, 110x and 19x earnings, respectively.

Growth style investing has outperformed Value in recent years. This isn’t surprising given that Growth has historically outperformed in environments where earnings growth is weak and interest rates are low and stable.

Since 2009, the market environment has favored Growth investing. Interest rates have remained at historically low levels since the Global Financial Crisis (GFC). At the same time, S&P 500 earnings have been anemic, particularly since 2014 growing at less than 1% per year.

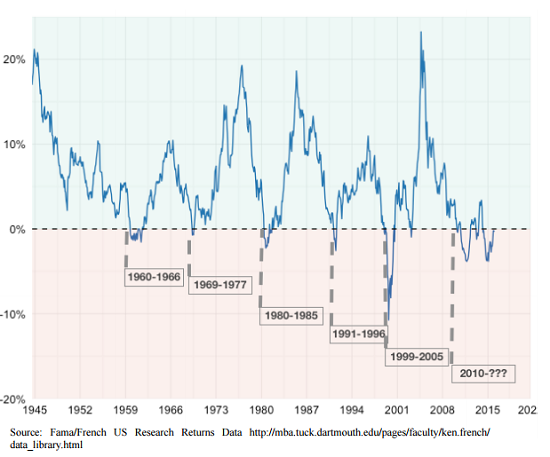

The chart below plots the outperformance of Value investing (the shaded green zone) vs. Growth (in the shaded red zone) going back to 1945. This is the 6th period since Growth has outperformed Value and the first period of Growth’s outperformance since the internet bubble.

Value’s Resurgence?

Due to an extended period of low interest rates combined with a weak recovery, this Growth cycle has lasted longer than previous cycles. There are, however, reasons to believe that this is changing now.

The 2nd half of 2016 and 2017 should mark an important turning point post the GFC.

With US employment near the FED’s goal, inflation is the factor to watch that will spur rates on a slow and steady climb higher. US inflation has reached 2.0% recently and is expected to move higher over the next year.

At the same time, earnings which have been flat for the past 2 years, are expected to grow in H2’16 by 4.2% and in 2017 by more than 13.5%.

Value’s outperformance during periods when interest rates rise and importantly when earnings are growing, intuitively makes sense. Value investors discount cash flows to determine their enterprise value of a company. When earnings are falling, uncertainty around future cash flows rise and the present value of the business will adjust lower. As long as interest rates rise in a lagged manner to growth (which is the norm), then rising interest rates signal a solid economy which should more than offset the effect on discount rates adjustments.

Looking at prior periods where Growth has outperformed, Value has subsequently recovered and outperformed Growth by roughly 5% per year for 5 years . The strength and length of the recovery explains why Value investing has 1 outperformed Growth over time.

Some investors express concern about the overall market valuation as a potential reason why we may not experience Value’s recovery. Consider this fact -On January 1, 2000 at the height of the tech bubble, the S&P500 began the year trading at a PE of 29x. Technology stocks cratered thereafter. Between 2000 and 2006, the Growth declined 34.7% (-6.9% per year) and over the same time, Value was up 2 3 98.4% (19.7% per year).

The economy is set to pick up after a period of weak GDP and earnings. At the same time, interest rates should rise, albeit at a gradual pace. The time to buy Value is now.

Note: The author of this article is Anthony Fogler. He is a contributor to ValueWalk.com.

Category: Investing in Penny Stocks