Energy Stocks Are A Screaming Buy

I may sound like a broken record, but energy stocks are the place to be right now

I may sound like a broken record, but energy stocks are the place to be right now

Just last month, I was pounding the table for natural gas stocks, and sure enough, natural gas has done nothing but climb since it traded briefly below $2.

Even after an almost 20% climb off decade lows, natural gas and now the entire energy sector are a screaming buy. Next Ill tell you why energy looks so good and how you can use penny stocks to play energy for big gains.

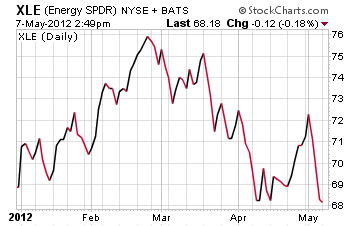

First, looking at the overall energy sector, you can see its down over 4% year-to date. Take a look at the Select Sector SPDR Energy Fund (XLE) chart below

Right now, energy stocks are trading at a low for 2012. And thats saying something for a market thats up over 7.5%, even after last weeks big selloff.

Why are energy stocks lagging the overall market?

There are quite a few factors that influence energy trading, but two of the biggest have to be supply and demand factors, and trader rationale

As far as supply and demand goes, the biggest catalyst affecting prices this year has been the lack of demand for oil and natural gas. With one of the warmest winters on record, consumers in most parts of the country avoided paying huge energy bills to heat their homes.

Making matters worse, the active production of natural gas has been documented at record levels. Natural gas storage levels have been well above five year averages as reported by the US Energy Information Administration (EIA). When you combine less demand with more supply, sit back and watch prices plummet.

As bad as its been for natural gas, oil has seen a very different set of trading catalysts. For much of this year, oil has avoided the ill-fated overproduction issue of natural gas.

In addition, political tensions in the Middle East over the Iranian oil embargo have kept crude prices elevated over $100 for much of the year. As more countries signed on to protest importing Iranian oil, the leadership in Tehran ratcheted up their aggressive rhetoric, causing a spike in oil prices.

After finally coming to their senses, leaders in Iran decided it wasnt in their best interest to threaten to blow up the world. As such, oil prices have gradually declined that is up until last week.

Suddenly, oil prices have fallen to lows for the year, and even traded under $95 a barrel! Whats happened is overall global growth forecasts seem to be cooling off a bit. And without Middle East tensions, traders have turned their attention back to sluggish global growth.

The real problem has been traders in energy markets

Their overall philosophy is to shoot first and ask questions later. Theyll buy, buy, buy in excess and then turn around and sell, sell, sell until the floor falls out beneath them.

In my opinion, the aggressive selling has put oil prices in oversold territory. Better still, natural gas producers have been shutting down production until prices come back up to a profitable level.

But prices arent there yet

So with natural gas on the rise (even as oil has been falling) and oil prices in oversold territory were looking at a great overall buying opportunity in energy stocks.

Heres the deal

Even if various countries report GDP growth less than forecast, most of the world is still growing. And that includes the two largest economies in the world, the United States and China.

With energy prices trading just off the lows for the year, nows a great time to buy energy stocks. Penny stocks historically move much faster than the market, so youll be able to capture even bigger percentage gains as the energy sector recovers this years losses.

For those of us in the penny stock world, there are dozens of solid energy exploration, production, and service providers. Take a look at buying small cap energy stocks now to capture the coming move higher in the energy sector.

Editors Note: If you want to find winning penny stock trades both in and out of the energy space, Gordon Lewis, has the answer! Discover his secret to finding winning penny stocks

Until next time,

Brian Walker

Category: Energy Stocks, Natural Gas Stocks