Buy This Safe $10 Stock Yielding 20%

Tired of settling for 3%, 4%, or even 5% yields? While those might be good for some stocks, the stock featured today manages to pay an eye-popping 20% yield like clockwork to investors. Tim Plaehn reveals all the secrets of how this stock manages to pay such a high-yield and explains why you haven’t heard about.

Tired of settling for 3%, 4%, or even 5% yields? While those might be good for some stocks, the stock featured today manages to pay an eye-popping 20% yield like clockwork to investors. Tim Plaehn reveals all the secrets of how this stock manages to pay such a high-yield and explains why you haven’t heard about.

Out of the first quarter earnings reports from the largest MLPs, I see a picture of stability, but a sector that has not yet returned to meaningful and accretive EBITDA and distributable cash flow growth. Management teams expressed several times during their earnings call a belief that business could turn more strongly positive in the second half of 2017.

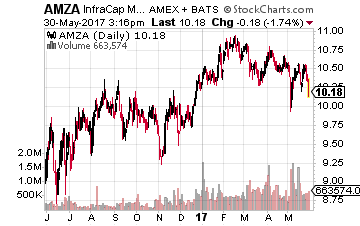

I recommend an investment in the high-yield InfraCap MLP ETF (NYSE:AMZA) to earn an attractive income while waiting for the MLP sector to move higher.

Master limited partnership (MLP) is the business structure used by the majority of public companies providing energy infrastructure assets and services. Some of the typical services include crude oil and natural gas gathering, transport of energy commodities by pipeline or other means, processing of energy commodities, storage of energy commodities and terminal facilities.

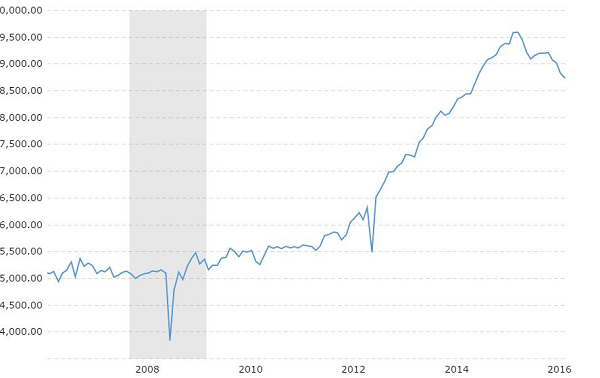

These businesses require significant capital investments. Revenues are mostly fee-based, paid by energy producers, buyers or refiners for use of the assets and services. The development of horizontal drilling and hydraulic fracturing techniques in the late 1990’s and early 2000’s by oil and gas producers started an energy production boom in North America.

In Fall 2014, crude oil prices started an 18-month collapse, which triggered a swing from strong production growth to a decline. This chart shows the rapid rise and fall of crude production over the last decade.

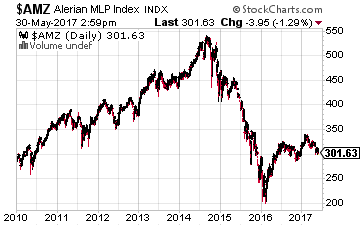

The MLP sector rode the wave of higher production, building out the infrastructure required by the increasing oil production. The drop in crude prices led to an energy sector bear market and the MLPs were not immune. From its September 2014 peak to the February 2016 bottom, the Alerian MLP Infrastructure Index (AMZI) lost 62% of its value.

MLPs were forced to change their business growth plans, shore up balance sheets, and many MLPs stopped growing or even reduced the distributions paid to limited partner unit holders. Since the early 2016 bottom, the AMZI index value has stabilized with a modest flat to upward trend.

MLPs were forced to change their business growth plans, shore up balance sheets, and many MLPs stopped growing or even reduced the distributions paid to limited partner unit holders. Since the early 2016 bottom, the AMZI index value has stabilized with a modest flat to upward trend.

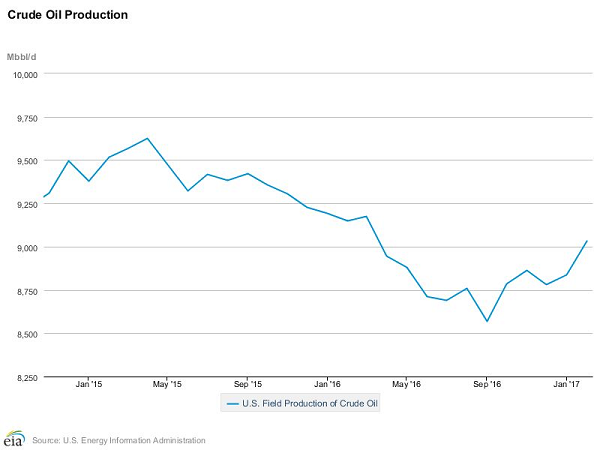

U.S. based crude oil production rates bottomed last Fall. This chart shows that production is again rising.

As a result of the crude production downturn that started in 2014, MLPs have plenty of already built-in capacity to absorb higher production. As production continues to grow, pipelines will fill and terminals will become more active. This means greater revenues for MLPs without needing to add more, new, capital-intensive assets.

At some point in the near future, MLP results will start to come with positive surprises including a resumption of more typical levels of distribution growth. According to the MLP management teams, that time could start in the second half of 2017.

My recommendation to participate in these gains is the InfraCap MLP ETF (NYSE:AMZA). This fund launched in October 2014, and as a result dropped with the sector bear market. However, as an actively managed ETF, AMZA was able to sustain its dividend rate and the fund currently yields almost 20%.

My recommendation to participate in these gains is the InfraCap MLP ETF (NYSE:AMZA). This fund launched in October 2014, and as a result dropped with the sector bear market. However, as an actively managed ETF, AMZA was able to sustain its dividend rate and the fund currently yields almost 20%.

Here is how the InfraCap MLP ETF is designed to operate. The fund owns the same MLPs as the ones tracked by the Alerian MLP Infrastructure Index, with the following possible enhancements to the index:

- The fund manager can weight individual MLPs holdings different than the index. The AMZI is strictly market cap weighted, tracking the 25 largest midstream MLPs, with bigger MLPs having a greater weight on fund performance.

- AMZA will weight these same MLPs based on the return potential from the management team’s proprietary algorithm.

- The fund can own the publicly traded general partner companies of the index component MLPs. The general partner of an MLP can generate an accelerated level of cash flow growth compared to the limited partnership it manages. The GP companies can produce extra capital gains for the fund and a faster growing distribution cash flow stream.

- The fund can sell call options (covered call strategy) to generate extra cash income from the portfolio.

- Fund managers can use a moderate amount of leverage (up to 33% of the portfolio). Leverage in an MLP fund helps offset a portion of the corporate income tax drag.

These strategies have allowed AMZA to sustain its dividend rate even as MLP values fell. I am in regular contact with the fund managers and they believe the distribution rate is sustainable. It is a comfort to earn those big dividend checks every quarter while waiting for the MLP sector to start its next leg higher. I recommend that investors reinvest at least a portion of the dividend payment into more shares each quarter.

I have strict requirements that every high-yield stock must meet before I recommend it to my Dividend Hunter newsletter subscribers and the general public. Every high-yield stock that I recommend must have a high potential for dividend growth and a huge margin of safety in their cash flows.

In my Dividend Hunter newsletter, I recommend the market’s strongest, most stable high-yield dividend payers, and there are over 20 high-yield stocks currently available through my Monthly Dividend Paycheck Calendar, a system for generating a recurring monthly income stream using my Dividend Hunter recommendations.

The Monthly Dividend Paycheck Calendar is set up to make sure you receive a minimum of 6 paychecks every month and in some months up to 14 paychecks from reliable high-yield stocks built to last a lifetime.

The Calendar tells you when you need to own the stock, when to expect your next payout, and how much you can make from these low-risk, buy and hold stocks paying upwards of 12%, 13%, even 18%. I’ve done all the research and hard work, you just have to pick the stocks and how much you want to get paid.

The next critical date is Tuesday, June 6th (it’s closer than you think), so you’ll want to take action before that date to make sure you don’t miss out. This time, we’re gearing up for an extra $4,723 in payouts by June 28th, but only if you’re on the list before June 6th. Click here to find out more about this unique, easy way of collecting monthly dividends.

Category: Cheap Stocks